By Mark Shemtob

There are essentially two broad approaches to converting a retirement account into retirement income. One approach is based upon using investments, their dividends, interest, and hopefully growth in value where applicable. Investments are usually a combination of both equities and fixed income. The alternative approach is through the purchase of insurance products—annuities.

Traditional fixed-income annuities (what most people think of as pensions) can provide a fixed guaranteed lifetime income. However, they continue to be unpopular with retirees for reasons beyond the scope of this article. Other insurance solutions have been developed where a guaranteed income is coupled with an investment account. However, these products generally come with limitations on the investment options and on the annual permitted withdrawal level. They are often saddled with high fees and tend to be complicated and thus confusing to retirees.

The noninsurance approaches—withdrawals from investments—tend to be more popular but pose longevity and investment risks that can lead to running out of income. A recent study by Invesco (tantalizing named “Show Me the Income”) noted that 90% of surveyed retirement plan participants would prefer that their employer retirement plans offer both insured and investment-oriented retirement income options. Whether retirees want the choice to use either approach or are interested in using both simultaneously is unclear. That being said, the use of a combination approach offers potentially significant additional value over using either component part on its own.

Modeling options

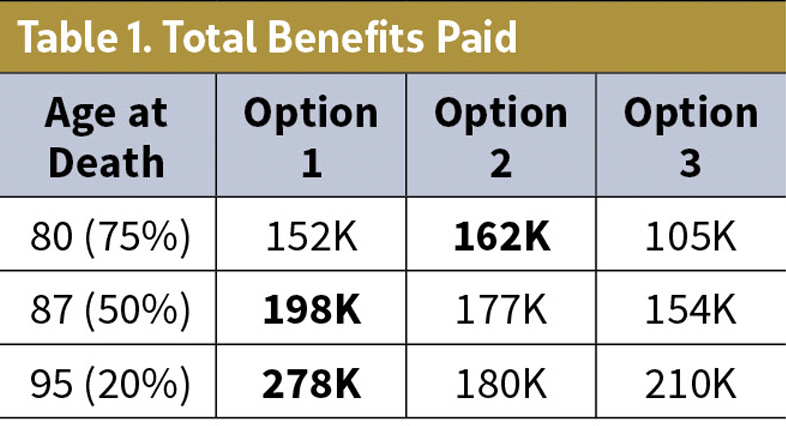

To illustrate the point above with respect to a combination approach, I modeled the three options as follows based upon employing $100,000 of retirement savings:

- Use 50% toward an annuity purchase and 50% toward equity investments

- Use 50% toward equity investments and 50% toward fixed-income investments

- Use 100% toward an annuity purchase

The following represent the primary assumptions used in the calculations:

- Retiree is an age 65 male in better-than-average (though not excellent) health

- Long-term annual return on equity investments: 7%

- Long-term annual return on fixed-income investments: 3.5%

The cost of a $7,000/year fixed-income annuity with a cash refund feature is $100,000. Note that the cash refund feature ensures that the retiree or beneficiary receives in total no less in benefits than the premium paid.

Table 1 illustrates the expected total benefits to be paid to the retiree and then the beneficiary (at the retiree’s death) based upon three alternative ages at death; 80, 87, and 95. The percentages noted after the age at death represent the estimated probability of living to that age or later. As noted above, the retirement sum used is $100,000. And the annual payout is set at $7,000 until the investment account runs out of funds (Option 1 and 2)

How long the retiree actually lives impacts the optimum choice of the three options. Based upon a life expectancy of 22 years or longer (50% likelihood) to age 87, Option 1—which is a combination of the annuity and equity investment—is the best choice. This becomes potentially even more valuable as lifespan increases. Option 2, which is strictly investments, provides a better outcome with shorter lifespans—though even at age of death at 80, there is not a significant advantage.

Considering volatility

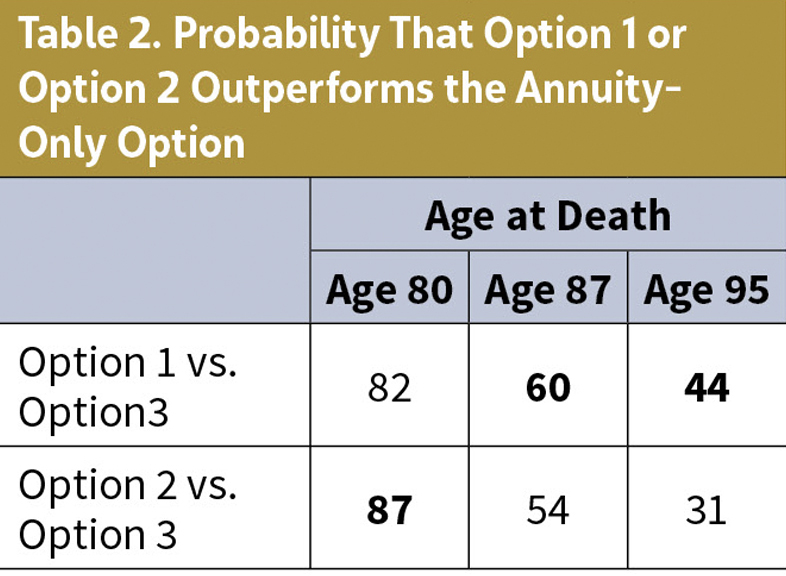

However, we should also consider the potential volatility of the three options. The advantage to using an annuity is the guaranteed nature of the payments. Equity investment returns are more uncertain than fixed-income investments, which are more uncertain than annuity payments. There are a variety of ways that we could measure the volatility of the options. We have done the following.

Option 3 is the safe alternative, where we know the total benefit payouts based upon the age at death. The below analysis compares Option 1 with Option 3 and Option 2 with Option 3. It illustrates the percentage of times that Option 1 or Option 2 provides better results than Option 3. The standard deviations assumed for Option 1 and Option 2 investments are 0.17 and 0.11 respectively.

Starting around age 84 (60% probability of living to or beyond this age), Option 1 outperforms Option 2. Combine this with the results from the prior section, we can conclude that Option 1 is, in the majority of circumstances, a better choice than Option 2. Option 3 is a good choice for the risk-adverse retiree with greatest concern of living well beyond life expectancy. The analysis in this article only compares three alternatives for simplicity purposes. Of course, there are many other combinations that can be tested. Using a greater percentage in equities and less in the annuity or fixed-income investment could also lead to better results but it would also increase volatility in the outcomes.

Takeaway

The main conclusion one will hopefully take away from this article is that using a fixed-income annuity along with equity investments will likely outperform an equity and fixed-income investment approach. The investment-only approach (which is the most common one currently used) is the better performer in situations where the retiree dies several years prior to life expectancy. That is not where risk lies. Risk lies in living beyond life expectancy.

I am not the first to arrive at this conclusion. So why hasn’t a combination approach of a traditional income annuity and equity portfolio become more popular? Here are some possible reasons.

- The potential value of this combination approach may not be known to retirees.

- Access to platforms that would make it easy to implement this combination approach are not readily available.

- There continues to be an aversion to traditional income annuities by retirees.

- Advisers do not promote the combination approach outlined above.

Overcoming the above impediments will require improved education of retirees as well as easy access to platforms that can help retirees implement combination approaches.

MARK SHEMTOB, MAAA, FSA, FCA, EA,