Reviews by Daniel D. Skwire

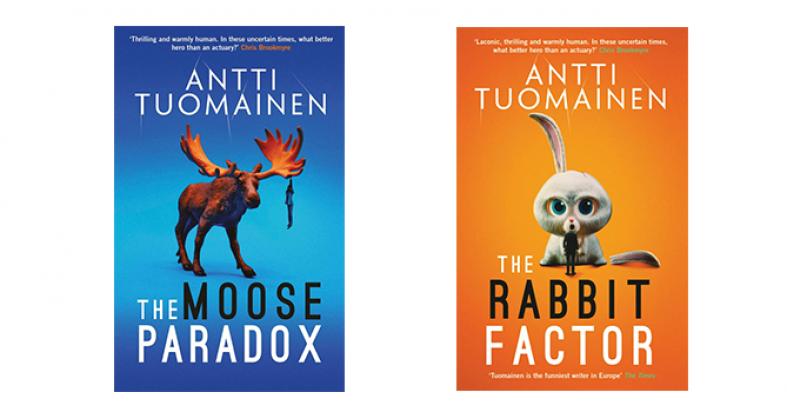

The Rabbit Factor (2020), by Antti Tuomainen

The Moose Paradox (2022), by Antti Tuomainen

Thank heavens for translators. When I learned that Finnish author Antti Tuomainen had published The Moose Paradox, the second volume in a planned comedy crime trilogy featuring a long-suffering actuary, I would, if necessary, have begun studying that notoriously challenging language immediately. Actuaries, after all, are nothing if not quick studies. Fortunately, both books are available in excellent translations by David Hackston, which simplified my task considerably.

The novels might best be described as a surprisingly successful ménage-à-trois among The Girl with the Dragon Tattoo, Charlie and the Chocolate Factory, and an actuarial mathematics textbook. In other words, they have a bit of everything. Especially for actuaries.

As The Rabbit Factor begins, Henri Koskinen has just lost his job as an actuary at an insurance company. It seems the new department manager (a former sales executive, of course) fails to appreciate his talents. Rather than work for “functionally innumerate psychobabblers”—I told you it was a good translation—Henri walks out the door. Shortly thereafter, he learns that his brother Juhani has died, leaving him—as his sole inheritance—a children’s adventure park called YouMeFun. Henri has found himself a new career.

He has also found himself a new set of problems. The adventure park had struggled financially under Juhani, who was driven to borrow a large sum of money from local loan sharks. Those same criminals now begin pursuing Henri for repayment. An early attempt to rough him up ends poorly for the thug, but Henri feels his orderly life is getting away from him.

“It’s hard to remember everything that has led to all this being my responsibility,” he reflects. “Everything is suddenly uncontrollable, unpredictable. I am an actuary. As a rule, I don’t run adventure parks, and I certainly don’t batter people to death with giant, plastic rabbit ears. But as I said, my life hasn’t been following the probability calculus for some time now.”

As the story proceeds, Henri masters the day-to-day challenges of running and maintaining the adventure park and managing its quirky staff, all while trying to balance the books and fend off the murderous loan sharks. Along the way, he gets lessons in romance and art appreciation from Laura Helanto, one of the park’s more competent employees.

In an effort to save both his life and the park, Henri reaches a temporary truce with the criminals by persuading them to partner with him in offering low-interest loans to the parents who bring their children to the park. “How do I know you’re good for it?” asks one of the mobsters when Henri offers a down payment to help fund the plan. “I am an actuary,” he responds. “I don’t make unfounded promises.”

Things get worse before they get better, of course, but the book is both a comedy and the first part of a trilogy, so I’m not giving away too much to say that Henri survives his many challenges. He survives them well enough, in fact, to face a whole new set of problems in the second installment, The Moose Paradox.

The first challenge Henri has, in this sequel, is the fact that he wishes to purchase a new ride, known as The Moose Chute, from Toy of Finland, a manufacturer the park has partnered with for many years. Under new ownership, however, the company refuses to sell him The Moose Chute and offers only the vastly inferior Crocodile Canyon, at a wildly inflated price. Will it surprise you to hear that the company’s new owners have the backing of criminal elements who once again use physical violence to try to persuade Henri to accept their terms?

Henri’s new partner in managing the park also makes life more difficult for him, offering unrealistic and expensive commitments to the park’s employees, and working behind Henri’s back to address the park’s financial problems in the worst possible way. Meanwhile, ticket sales are down and his relationship with Laura requires increasing attention. “As I have been forced to accept several times already,” says Henri, “even actuarial mathematics doesn’t have an answer for everything.”

One of the great pleasures of these books (at least for those in a certain profession) is the seriousness with which they treat Henri’s career and resulting outlook on life. It would have been easy to make him a caricature, rather than a fully drawn character, but that is far from the case.

Henri’s repeated statement, “I am an actuary,” is a leitmotif throughout the books, and Tuomainen takes the time to explain the profession to readers in Henri’s voice: “Actuarial mathematics is a discipline that combines mathematics and statistical analysis to assess the likelihood—or risk—of any eventuality, in order to define an insurance premium that from the insurer’s perspective is financially viable.”

Henri also offers periodic digressions on mathematics, risk, and insurance that present a fair and entertaining view of the business for those readers who do not happen to be actuaries:

Insurance companies … know two things: one, that people essentially have to take out insurance policies; and two, that a certain number of people, despite advice to the contrary, will inevitably set themselves on fire. And it is between these two factors—shall we say, between the pen and the matchstick—that actuaries operate. Their job is to ensure that while the self-immolator will be reimbursed for his troubles, the insurance company still makes its predefined profit margin by insuring him and many others besides.

Initially, Henri tends to express frustration that the world around him doesn’t seem to follow mathematical logic. Later, however, he develops a realization that the randomness he observes in, say, criminal behavior and romantic relationships, is also present in the mathematical methods underlying his profession.

“I think of actuarial mathematics and how much it has taught me over the years about the stochastic nature of human behavior,” he says near the end of The Moose Paradox. The realization that human behavior is inherently stochastic rather than deterministic, and that actuarial mathematics must therefore be stochastic in nature, is an impressive insight in these entertaining novels that aren’t afraid to wrestle with larger philosophical issues. (Did I mention that Henri’s cat is named Schopenhauer?)

My only quibble with the depiction of Henri and his actuarial work is that, when pitching his loan scheme to the mobsters in The Rabbit Factor, he doesn’t seem to appreciate why high interest rates are required as a result of the repayment risk on unsecured loans. Not as high as what the loan sharks desire, perhaps, but surely higher than the “sensible” rates Henri proposes. Henri seems surprised when borrowers fail to repay their loans in timely fashion and he has to untangle the resulting chaos.

That aside, the books are great fun, and unexpected pleasures abound. I found myself treasuring offhand references to Henri’s actuarial projects—“shifts in interest frequency on payout optimization” or “pondering the difference between conditional probability and original probability”—in the same way that a committed Sherlockian obsesses over references to unwritten tales such as “The Giant Rat of Sumatra.”

Tuomainen is also effective at capturing the type of interior monologue that runs through actuaries’ heads in all sorts of random situations. Consider Henri’s description of the adventure park’s company van. “Its fuel consumption was reasonable and its appearance suitably unattractive, which lowered the risk of its being stolen, which in turn ensured that the vehicle’s insurance premium and excess remained untouched.” Or his observation that “the average height of our clients is around one metre, twenty centimetres, and the median is lower still.” Means versus medians? Yep, that’s us.

Lastly, as I turned the final page of the book, I was delighted to find a bibliography containing a unique combination of books on behavioral economics, the philosophy of Schopenhauer and—of course—actuarial mathematics. The list of sources helpfully notes that several of the actuarial texts are available only in Finnish.

Amazon Studios has announced that it is developing a forthcoming film version of The Rabbit Factor, starring Steve Carell as Henri. I can’t imagine anyone else playing the part. Also on the horizon is the third volume of Tuomainen’s trilogy, titled Majavateoria or, in English, The Beaver Theory. Release and publication dates have not yet been announced. Please consult your local actuary for estimates.

DAN SKWIRE, MAAA, FSA, is a principal and consulting actuary at Milliman. He has published numerous essays on insurance and literature for Contingencies, including articles on Charles Dickens, Franz Kafka, Wallace Stevens, and Harper Lee.