By Mark Kinzer

Life in the trenches at Warren Buffett’s Berkshire Hathaway

I’ve just recently retired, so my story can now be told.

For the last 10 years, when I went to actuarial meetings anyway, I described myself as a garbage collector. (This did not, however, work very well at high school reunions!) I would typically get a quizzical look, then a smile, as I elaborated: “We take on other companies’ garbage—closed blocks of bad business—and get paid to do so.”

I would go on to say that we’re “product-agnostic”—we don’t really care what type of business we get. If there is good cash flow for us, and crappy accounting for you, let’s talk! As many of you know, there is lots of long-tailed business out there that companies want to lay off, including variable annuities, universal life with secondary guarantees, long-term care, and even deferred pensions and payout annuities.

How can this work, you may ask? What sort of economics occur that allow one company to take on another’s garbage? Doesn’t the acquiring company have the same issues?

I’m going to answer the above questions by asking a few more: What would your pricing algorithms look like if you could ignore reserves and capital? Suppose your CEO decided your company had virtually unlimited access to capital, and told you that henceforth, you really only cared about cash flow. Suppose you didn’t have to hedge for equity risk, interest rate risk, or currency risk. Better yet, suppose you had no pressure from above to do any marginal deals. How simple your life would be!

By now you are thinking, “This guy worked in Fantasy Land.”

Either that, or he worked for Warren Buffett and Ajit Jain. You see, during my tenure, Berkshire Hathaway actuaries were instructed to treat these garbage collection deals as long-term loans. We looked at cash flow, and that’s it. Reserves affect taxes and thus have a small impact on timing of cash flows, but capital has no impact, so it is not even used in pricing. Furthermore, if variable annuity reserves and required capital spike upward in a terrible quarter, due to adverse equity markets, so what? It would matter if capital was tight, but if you have to set aside a few million dollars out of $100 billion, then that really isn’t a big deal. And why would you hedge for a risk that might cost you, at worst, less than 1% of your capital in a bad quarter?

This is the world I worked in from 2011 to 2020. Those “long-term loans” had a cost to borrow that was unknown at inception, but if that “cost to borrow” fell within a reasonable range across a bunch of adverse scenarios, then we could do the deal. It turns out that our well-known CEO really liked to receive big chunks of cash, and planned to hold onto that cash for a long time, so he could buy businesses like railroads and ketchup companies. He could then move that cash over to his property/casualty company, which isn’t as constrained as a life company in how it invests. With “unlimited” capital, he could invest in long-term businesses, rather than corporate bonds, because quarterly changes in required capital don’t actually jeopardize Berkshire’s solvency ratios.

It wasn’t Fantasy Land, but it sure was a fun ride!

Into the Weeds

If you prefer to get more into the weeds, follow with me as I elaborate on single deal, in which an insurer paid $2.2 billion of premium (that’s with a “B”) to Berkshire to offload its assumed variable annuity block, back in January 2013.

Throughout 2011 and 2012, our team had learned about the types of closed blocks that were available in the life & annuity industry. While we were a seasoned team, we were only two people, and we didn’t have much direct experience with any of the types of available business. For every deal we saw, we relied on the selling company to provide projections and assumptions, and we asked their actuaries to convince us why the cash flows and the underlying assumptions were correct. It was telling that very often, the experience studies showed results that didn’t really line up with the assumptions used to project the business. Sometimes the misalignment was due to standard “thumb on the scale” seller appraisals, and sometimes due to simplification of the experience study process, such as measuring lapses using policy count rather than exposure amount. Many of the blocks would have generated hundreds of millions of dollars of premium. But with no pressure from our leadership to do a transaction, it was easy to make sure we got it right—especially for our first deal.

The more blocks we saw, and the more selling teams we met, the easier it was to know that by the second half of 2012, we had encountered a large ($1.3 billion reserves) block of reinsured variable annuities from a motivated seller, along with an honest, knowledgeable, and experienced team of actuaries. The team shared with us their full suite of experience studies, and patiently educated (and re-educated) us on the finer points of their business, including my favorite concept, called “gamers.”

Gamers

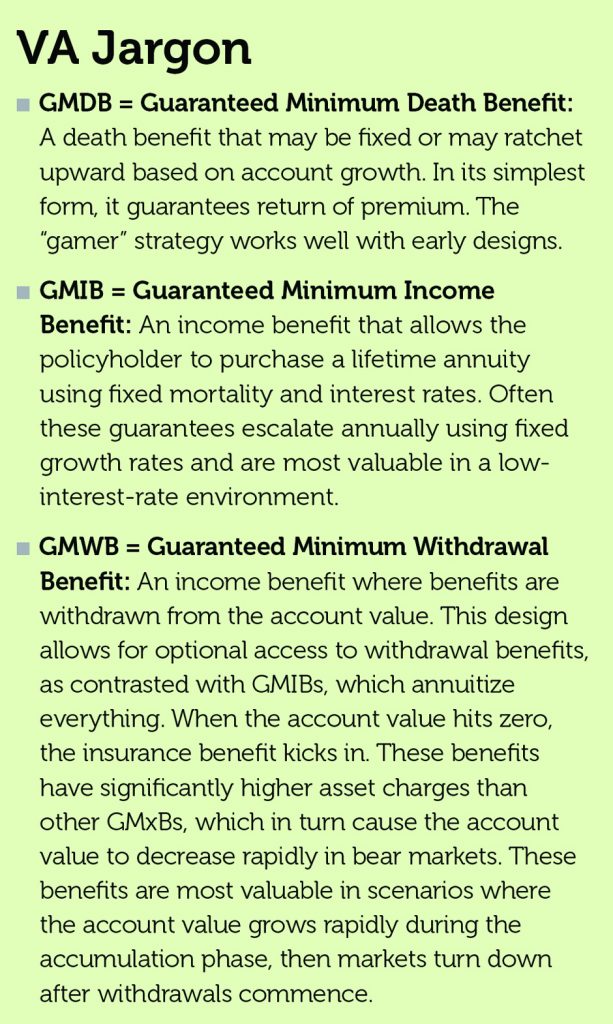

I’ll detour a bit to define the group of gamers. Back in the late 1990s, when the market was booming and variable annuities (VAs) were first being sold in large quantities, the product’s designers had inadvertently included a provision that was potentially quite lucrative to a savvy policyholder. The provision is now called dollar-for-dollar partial withdrawals, often abbreviated as “$4$”. The mechanics were easy to understand, and thus frequently executed. A simple example is when the policy provided a return-of-premium guarantee—that is, if the policyholder died when the account value was below the premium paid, the heirs would get at least the full premium back, regardless of the level of the account value. This provision is called a Guaranteed Minimum Death Benefit, and abbreviated as GMDB. And if some of the account value was withdrawn along the way, the GMDB was adjusted downward, dollar for dollar, by the amount withdrawn.

On Dec. 6, 2002, when the S&P 500 was down 40% from its high in March 2000, The Wall Street Journal published a front-page article titled “How Annuity Holders Can Pull a Switcheroo” that was a kind of an instruction manual showing how policyholders could lock in their now in-the-money death benefit, by simply withdrawing all but a few dollars from their VA policy and reinvesting the proceeds into another policy via a “partial exchange” so they would not lose out on future gains. Quite a few savvy investors took advantage of this free life insurance, and the “gamer” was born.

The insurer lost out on future asset fees, but often they had purchased reinsurance to cover the GMDB. The reinsurers, however, now were on the hook for many paid-up life insurance policies, which would have future lapse rates of < 0.5%. Their premiums had been expressed as a few basis points times the account value, so were basically $0 once a policy was gamed. Reserves on gamed policies shot up as more and more policyholders, often assisted by helpful agents, rolled most of their money into new VA policies.

Back to Our Transaction…

Our client had not only identified and reserved for gamed policies, but they also were modeling and reserving for the possibility of future gaming. How refreshing that these folks actually knew what they were doing! Throughout the fall of 2012, we had the client run various sensitivity tests. We looked at both stochastic and deterministic scenarios, such as market returns remaining at 0% throughout the projection period, or even dropping 20% followed by 3% returns. Of course, our stochastic runs included risk-neutral scenario sets, but also sets with fixed return targets such as 0% mean, 20% volatility. We looked at simple modifications of lapse rates and mortality rates too, such as +/- 20%, just to better understand the sensitivities. I often observed that we really didn’t have to do much work, because we foisted it all on the client’s actuaries. (Sorry, Scott!)

The Cap and the Cost to Borrow

Two key elements to pricing were the “cost to borrow” and the “cap.” I mentioned the cost to borrow in my opening paragraphs—in essence we priced these transactions as if we were taking a loan (the premium), and paying it back over time via claims. The cost to borrow was simply the solved-for internal rate of return (IRR) that equated the initial premium to all future cash outflows. As we were looking at thousands of scenarios, we of course looked at thousands of IRRs. It was incredibly instructive to look at extremes. We always asked for the market scenarios that aligned with the cash flows, and seeing which stock return and interest rate patterns resulted in higher claims—and the timing of when cash flows reversed course—was useful both in this deal and in many others that we analyzed. (Guaranteed Minimum Withdrawal Benefits, which thankfully weren’t included in this block, are particularly sensitive to markets that go way up before coming down, for example.)

The cap was the other key component of our pricing algorithm. As I mentioned, we didn’t use required capital at all in our pricing. Rather, we fell back on a property/casualty risk management technique: When participating in, say, hurricane or earthquake insurance, Berkshire limits risk by taking tightly limited layers of bigger deals, such as taking a $10 million layer of coverage excess of $5 million. We used a similar approach for our variable annuity deals. In this VA transaction, we capped our maximum cash outflow at $4.3 billion in the initial pricing, which was lowered proportionally by market movements in January 2013. One significant advantage of having a “cap” is that it not only caps outflows, it also puts a lid on how big reserves can get in future quarters. Berkshire’s overall plan was to manage VA risk by adding up these caps for all similar VA deals and limiting the maximum exposure to this type of product.

EBIG Conference

My favorite memory from the fall of 2012 was when I attended my first Equity-Based Insurance Guarantees Conference in Chicago. I was sitting at a table with one of my counterparts from our client, and the conference chairman was up on stage stating how there had been no reinsurance market for years for these products. My counterpart and I, knowing a deal was a mere two months away, shared knowing grins.

The Price

When it came time to set the actual price, Ajit Jain took charge. He is currently vice chairman of Berkshire Hathaway, and on the short list of possible successors of Warren Buffett for close observers of BH. I’ll never know exactly how he determined the price, but once he decided on a premium of $2.3 billion with a cap of $4.3 billion, he never budged. Only in the final month—after we had set a formula for price moves as a function of interest and equity markets—did the price move down to its final level of ~$2.2 billion.

The Announcement

The transaction was announced by our client at close of business on Feb. 4, 2013. (It was too small for Berkshire to bother with, apparently.) While the client announced an $800 million pre-tax loss, their stock actually rose 3.5% the next day!

Ten days later, on Feb. 14, 2013, Berkshire Hathaway announced the purchase of Heinz Ketchup for $23.3 billion, and just like that, our huge deal was no longer news. But I like to think that our $2.2 billion helped just a little bit to fund that deal.

When I told my friends about the deal, they enthusiastically suggested, “Did you ask for a 1% bonus?” I just replied with a smile, “Nah, half a percent was good enough!”

MARK KINZER, MAAA, FSA, is a retired actuary, having most recently worked for Berkshire Hathaway Reinsurance Group. He can be reached at mark.kinzer@gmail.com.