By Venkat Seshadri and Suresh Aranala Krishnamurthy

Continuous innovation is fast becoming a business necessity in the insurance industry. Innovation is imperative to meet the needs of demanding customers, stay ahead in a hyper-competitive environment, contend with disruption from insurtech players, and wrestle with volatility in the macro-economic environment.

While insurers recognize the urgent need for innovation, their attention is often completely taken up with ensuring business as usual in a challenging environment. Consequently, innovation does not receive the attention it deserves from all the stakeholders—more specifically, the business teams. Innovation efforts are mainly led by IT teams or a disparate department within the organization, with limited participation from business teams. The result is that innovation efforts produce small successes but fail to consistently deliver business value.

This article highlights how involving business teams in the ideation phase can help insurers take their innovation efforts to the next level and lead to exponential business value creation.

Introduction

The insurance industry, like any other, is continuously challenged by the emergence of new technologies. The strategic and tactical adoption of technologies in business operations and risk equations, as well as catering to a better customer experience, necessitates insurance companies’ continuing to innovate. Most importantly, technology is the mainstay of continuous innovation.

In the recent past, several startups and insurtechs have roared ahead in innovation to disrupt the industry across the value chain and win customers. To survive and grow, the incumbent insurers are compelled to create an innovation engine that catapults the company into the future. Insurers are quite aware of this fact and have already embarked on this journey. However, the initiatives are either owned and delivered by the IT team or by a separate innovation team that is not closely integrated with the rest.

The journey of the insurers in creating the innovation engine is generally challenged due to a lack of wholehearted participation from business teams. Due to this, most of these efforts result either in isolated successes or fail to take off and produce the right business value. This article proposes ideas for motivating and engaging business teams in the innovation engine. The ideas address three aspects of the problem: a lack of motivation for the business teams to innovate, less support from the organization during the ideation phase, and a lack of interest in converting the ideas into business proposals.

Current innovation efforts have low impact

While insurers do understand that innovation is important to keep up their competitiveness and do have focused innovation efforts, the impact of these efforts is mostly small, not felt across key stakeholders, and eventually ends up being a market news item.

We believe the key reason was the non-involvement of business teams in the innovation engine and efforts driven by the following:

- Establishing a separate innovation team sends the message that “innovation” is not everyone’s responsibility.

- Ideas from business teams—which many times look small, here and now—are ignored by the innovation team because they are not flashy enough, even though they might be impactful, and distances business further.

- Business teams on the ground are always neck-deep in operations, chasing metrics, and do not feel inspired to step out for innovation.

The cascading effect of nonparticipation by business teams results in issuessuch as:

- The innovation team is composed of IT or successful innovators recruited from outside, lacking critical on-ground experience.

- The new ideas end up being too futuristic or overly technology-driven with almost no connection to the current business horizon.

- Innovation seems intermittent (more reactive than proactive), driven more by the competition’s market announcements and technology hype and less by empathizing with business teams, customers, and partners.

For the reasons listed above, innovation efforts produce results that are not appreciated by the stakeholders and are not adopted by both business and customers. Given the current scenario in the innovation space across insurance companies, innovation has become less attractive, less useful, and uninspiring to business stakeholders.

Inspiring business to participate in innovation

If business teams participate enthusiastically in the innovation process, the innovation will have a greater impact. The insurers must motivate and ensure the participation of the business teams. Insurers might implement the following ideas to encourage business teams to participate in the journey and add value:

Encouraging to innovate

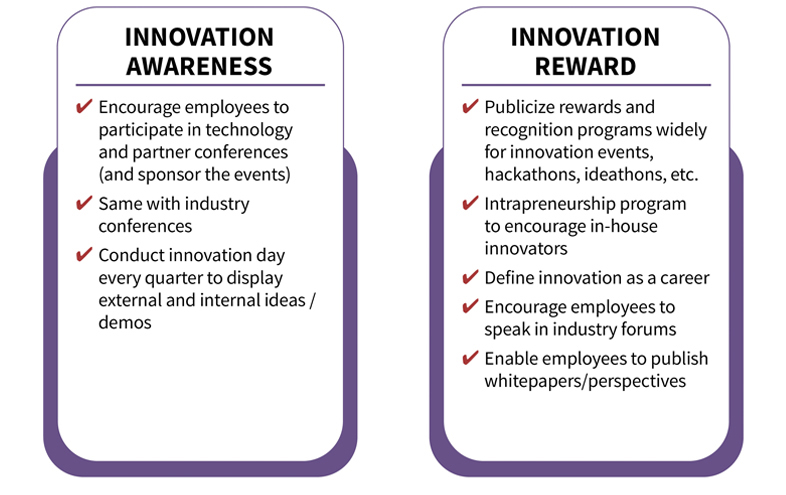

The key to encouraging business teams to innovate is to build and maintain awareness around innovation, reward innovative behavior, and continuously have a dialogue around stories of innovation. Figure 1 has some pointers on what insurers can do to motivate their business teams.

A few insurance companies encourage innovation:

- A large U.S. insurer displays photos of the business team that is the winner of innovation contests and has monthly sessions to share the innovation stories.[1]

- Many insurers provide cash rewards to business teams for their ideas.[2]

Helping business in the ideation journey

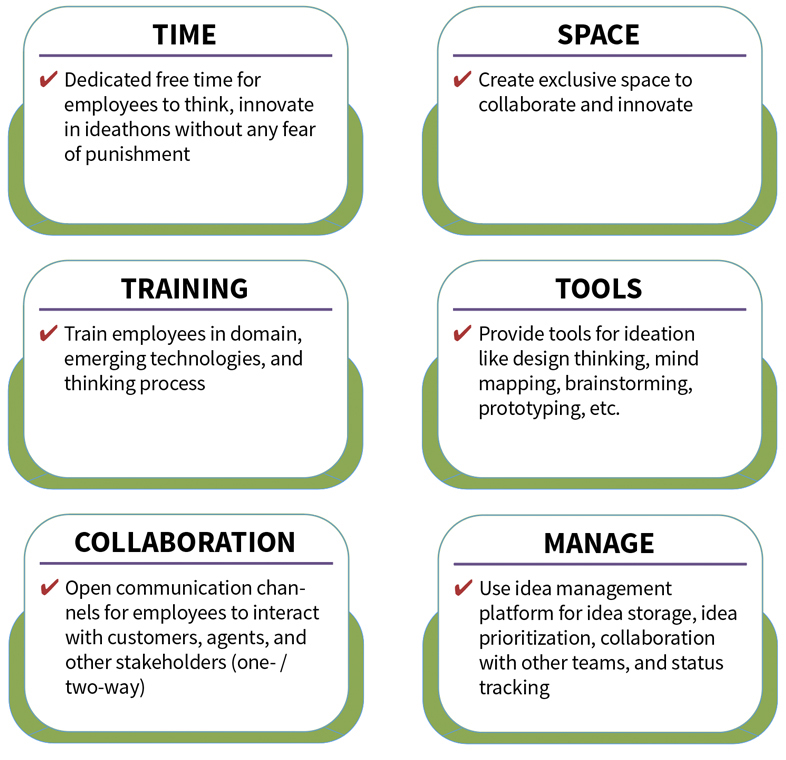

An inspired business team, which could suggest lots of ideas, needs the right infrastructure, framework, and guidance to maintain the momentum of ideation. Figure 2 has the details on what insurers could do to help business in the ideation journey.

Here are some interesting industry examples:

- One of the top personal lines insurers has allowed a dedicated half-day every week for freewheeling ideation discussion.[3]

- A few insurers have started annual hackathons, including business teams where they attack real issues.[4]

- Some insurers bring customers or partners regularly to office to let the business interact and bounce off ideas.[5]

- A Singapore life insurer has an exclusive space for experimentation and collaboration.[6]

- A large P&C insurer has created an innovation hub to enable collaboration of cross-functional teams.[7]

- A reinsurer is encouraging a culture of trying out-of-the-box / tough ideas without the fear of criticism or failure.

Reposition innovation CoEs as innovation enablers

Many times, ideas from business teams never see the light of day, and this causes significant discouragement. To send the right message to the business and other stakeholders, the innovation Center of Excellence (CoE) should not be responsible for delivering innovation but rather enable innovation by others. They should be sourcing ideas from the business team and not pushing their own agenda. This should have a balance of business talent, IT talent, and external hires for an outside-in view as well.

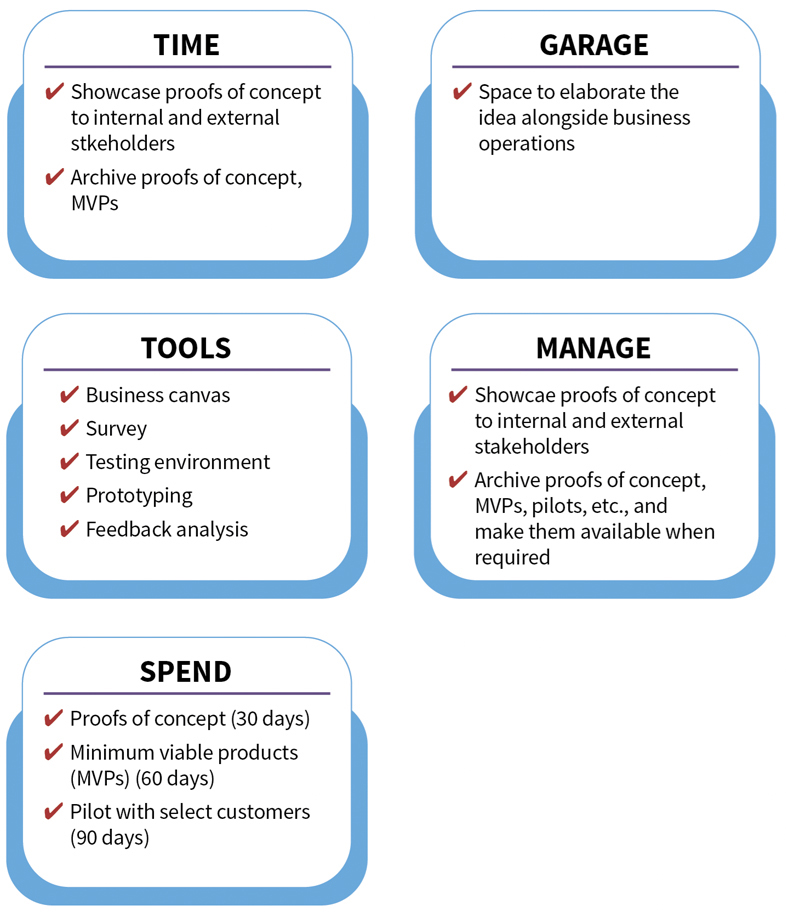

The innovation CoE’s priority should be to facilitate the business teams in pushing their ideas to the next level, qualifying them as valid business cases, setting up pilots, and finally scaling the ideas into implementation, which will give them a sense of accomplishment and increase their drive. Figure 3 details the infrastructure, framework, and guidance required for the same.

Here are some interesting industry examples:

- A commercial auto insurer has invested in virtual testing environment for the business team to ideate with partners.[8]

- A leading insurance and asset management group facilitates collaboration across group companies to push ideas around seamless customer journey.[9]

- A U.S. insurer has created space for business teams to bring their ideas to life—no matter which business area they belong to.[10]

- A large life, annuities, and employee benefit provider has a dedicated innovation fund for experimenting low-cost new ideas.[11]

Balancing innovation Ideas

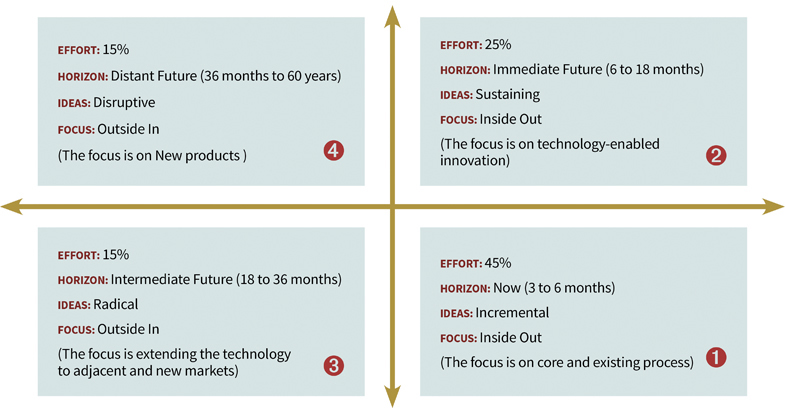

Innovation ideas must have a healthy mix of current business problems in Horizon One and future opportunities in Horizon Four. Finding new customer segments while expanding services to existing ones should be balanced. They should strike a balance between the selection of business processes and technology. Figure 4 depicts the balance that insurers can strive to cover different forms of innovation.

Conclusion

To deliver impactful innovation, the insurance company must create an environment of inclusivity and creativity in which various teams can participate and contribute to the innovation engine. Impactful innovation can be delivered by motivating and involving business teams in the innovation journey, having the right mix of business and technology resources, and being ably facilitated and enabled by the innovation CoE.

VENKAT SESHADRI is technology head for Insurance Research and Innovation for TCS’ Banking, Financial Services, and Insurance (BFSI) business unit. SURESH ARANALA KRISHNAMURTHY is a domain consultant in life insurance and pensions with TCS’ BFSI business unit.

References

[1] Gonzalez, I. (2017, March 6). Ideas Come to Life in USAA’s Innovation Lab. San Antonio Report. [2] Global insurer boosts innovation, simplifies operations and improves employee experience. Innovation program. (n.d.-b). DXC Technology. [3] Kaplan, S. (2017, August 15). How One Insurance Firm Learned to Create an Innovation Culture. Harvard Business (Half) Review. [4] Travelers Institute. (2021, July 14). Can You Innovate Like a Unicorn? Be aware that innovators are everywhere. [5] Ibid. [6] Living innovation at PRUWorkplayce. (n.d.). Prudential Singapore. [7] Kaplan, S. (2017b, August 15). How One Insurance Firm Learned to Create an Innovation Culture. Harvard Business Review. [8] The Digital Insurer. (2017b, August 16). Progressive’s Business Innovation Garage—The Digital Insurer. [9] Innovation to better protect our customers | AXA. (n.d.). AXA.com. [10] Gonzalez, I. (2017d, March 6). “Ideas Come to Life in USAA’s Innovation Lab.” San Antonio Report. [11] Innovation | MetLife. MetLife Experimentation Fund.