By Steve Malerich

Our assumptions about the future of retirement security are on shaky ground

“In this scenario, the foundation beneath our retirement system has crumbled. Our stool cannot stand, because it has nothing to stand on.”

When I wrote those words for Contingencies,[1] 28 years ago, this was just one scenario about a future when my generation—the baby boom—retired from active employment.

At the time, there was much discussion about the funding of retirement for this large generation. Projections estimated that the Old-Age, Survivors, and Disability Insurance (OASDI) trust fund would be exhausted in 2029 and that Social Security taxes would be sufficient to continue benefits at just 75% of the amounts promised in law.[2]

Yet, in all the discussion and debate and innovation aimed at keeping retirement promises alive, our focus stayed on the stool. Whether the stool would have a foundation to stand on was largely absent. (See the sidebar, “The Foundation Beneath the Stool.”) We did have assumptions about the foundation, but they were implicit and often varied depending on whether we were proposing a solution or highlighting a problem.

Since 1995, Social Security has remained unchanged and private pensions guaranteeing a lifetime income have been largely replaced by tax-qualified retirement saving plans.

Annual OASDI cost has surpassed non-interest income every year since 2010. Beginning in 2021, cost exceeded all income. Trust fund reserves are now declining and expected to last until 2034. Once exhausted, payable benefits are expected to be just 80% of scheduled benefits.[4]

Many private pensions have been frozen and transferred to insurance companies. Other private-sector offerings to maintain income for life have expanded.

Yet, solutions offered for strengthening our retirement income stool still assume that it will have a foundation to stand on.

Before turning to that foundation, let’s consider economic policy.

Economic Policy

After World War II, federal fiscal policy helped to keep our economy strong and to limit inflation until the late 1960s. Inflationary pressures generally worsened through the 1970s. That inflation was blamed on fiscal policy and external shocks.

About 1980, the Federal Reserve Board began using interest rates to gain control of inflation and then to sustain an active economy. To a great extent, that worked well until the 2008 financial crisis, when quantitative easing was added to their toolbox. Recently, their efforts in response to surging inflation have had limited success and some unpleasant side effects, felt most notably by some banks. Again, inflation is being blamed on fiscal policy and external shocks.

I can’t argue with those as triggering events, but I wonder whether changing demographic forces have also contributed, and will continue to do so. (See sidebar, “A Boomer Economy.”)

As troubling as inflation might be, my concern for retirement funding is more fundamental. To understand this concern, we turn now to the foundation beneath our retirement income stool.

Productivity

In the coming years, will our working population be able to satisfy their own needs and those of the growing retirement population?

In 1995, I introduced a simple measure of productivity specific to the context of the retirement income stool and its foundation. While traditional productivity measures focus on output per worker, this measure focuses on the ability of workers to satisfy demand. “The working population is able to produce and deliver the exact amount of goods and services needed by the entire population to maintain a generally accepted standard of living.” [7] In that context, “generally accepted” can be understood in relation to times and places where living standards were not generally accepted. In extreme cases, consider the Soviet Union in 1991, Germany in 1933, and France in 1789. In the U.S., recent signs of declining acceptance include Occupy Wall Street in 2011 and (by some accounts) the election of Donald Trump in 2016.

With that definition, productivity of one is a range of relationships between productive capacity and consumer demand. As numerous recessions have shown over the past hundred years, we can adjust our standards of living for periods of time without being driven to revolution or another form of major political upheaval.

Arguably, most of the general economic distress in the past hundred years has been related to excess capacity—our ability to produce has exceeded demand. Most dramatically, the Great Depression followed rapid growth in productivity. By the late 1920s, excess productivity and debt-fueled buying created a severe imbalance in the economy. That imbalance wasn’t resolved until the federal government dramatically increased demand to fight World War II. Later, memory of the pre-war imbalance preserved the increased government role in the economic affairs of the country.

Given that history, there has been little reason to doubt the ability of our working population to produce enough to satisfy the needs of our entire population. The challenges for policymakers have centered mostly on managing the level of demand. Our ability to produce has largely been taken for granted.

In contrast, productivity of less than one would mean that our working population is unable to satisfy demand. On a large scale, that hasn’t happened here yet, though there have been shortages in specific locations, products and services. But just because it hasn’t happened doesn’t mean that it can’t. To envision the possibility, we return to demographics.

The Foundation Beneath the Stool[3]

Social Security, pensions, and personal savings traditionally form what’s termed “the three-legged stool” of retirement income. More recently, we’ve added a fourth leg—earnings from continued employment. But what does our stool stand on? The entire concept of retirement rests on the assumption that working people, together with capital equipment, will produce sufficient goods and services to provide for both the working and the non-working populations. As long as this remains true, retirement will remain possible in some form.

Demographics

For much of the past century, we’ve had a steadily growing population of workers and increasing efficiency from technological developments and investments. From 1920 to the end of 2022, the civilian labor force in the United States grew from 42 million[8] to 166 million.[9]

To further enhance supply, other countries have supported our consumption in exchange for American dollars, as evidenced by nearly five decades of trade deficits.[10]

Of course, the growing population has also meant a growing retired population. And that growth has been enhanced by increasing lifespans. Still, productive capacity of the working population has largely kept pace with the demands of the total population.

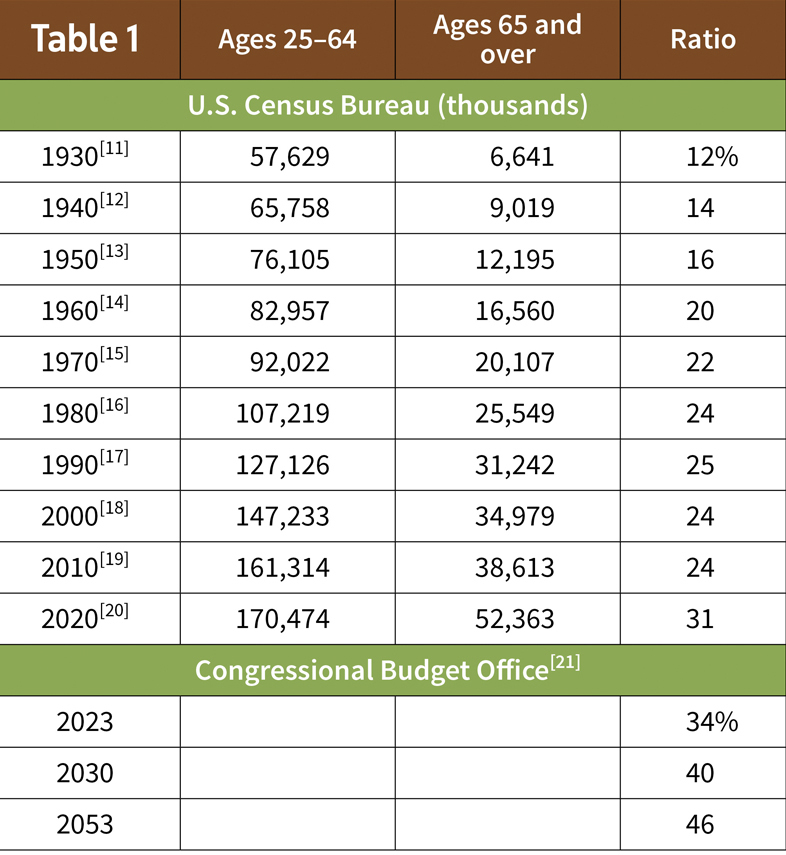

With the retirement of the baby boom generation, however, we’re experiencing rapid change in the relationship between the working and non-working populations. Beginning with the 1930 census, reports from the U.S. Census Bureau distinguish adult age groups below and above age 65. (See Table 1.)

The ratio of older to younger adults doubled between 1930 and 1980, a period characterized by steadily increasing manufacturing capabilities.

This ratio was fairly stable from 1980 to 2010, years when baby boomers were a large part of the younger adult age range. Greater efficiency and globalization during this time further increased manufacturing capacity and led to a shift of domestic labor into services.

Since 2010, the ratio has increased rapidly and will, according to the Congressional Budget Office, continue to do so until 2030, after which it will increase at a slower pace, nearly doubling from 2010 to 2053.

These general population patterns are also seen in the 2023 Social Security Trustees Report,[22] which shows a fairly stable ratio of about 30 beneficiaries per 100 covered workers from 1990 to 2008, when the Great Recession hit. After a recession surge, the ratio of beneficiaries to workers increased steadily to 36 per 100 in the 10 years before another recession surge. It is projected to continue rising for the next 15 years, to 44 per 100 in 2038.

A Boomer Economy

The history of economic policy since World War II might also be seen in relation to my generation, the baby boom.

After the war, as fiscal policy aimed to keep the economy active, Americans had babies at rates much higher than the preceding 20 years.[5] Increased birth rates, and lower infant mortality rates,[6] created us—a massive generation in need of food, clothing, and shelter. In an increasingly specialized economy, we also needed an education.

Booming demand kept our parents and grandparents employed. Productive capacity, redirected from the war effort, and increasing productivity, allowed demand to grow without fueling inflation.

By the late 1960s, we began to enter the workforce, to marry, and to have children (at much lower rates than our parents). Again, our numbers had economic effects. Even with fewer children, we still wanted homes and cars and other things that come with adult life. Productivity continued to increase, but not as fast as demand, and inflation ensued.

By the mid-1980s, substantially all of us were productive members of the labor force. We started saving for retirement. Though much commentary said that we weren’t saving enough, our numbers drove demand for investments higher. As savings increased, interest rates declined and the price of investments rose.

Coincident with the 2008 financial crisis, we started to retire. Near-zero interest rates couldn’t restore a dynamic economy, in part because they limited our income from savings.

These numbers alone suggest that the load we place on our foundation is increasing rapidly and will continue to do so for several years. If those numbers aren’t sobering enough, consider the particular needs of an elderly population.

Job-related expenses generally decline after retirement, but the need for food, clothing and shelter do not diminish. Even if per-person demand for these doesn’t increase, sheer numbers suggest that retirees will put increasing demand on workers to supply these needs.

Of greater concern is health care. In monetary terms, mean personal expenditures for health care in 2021 varied from $1,367 under age 25, to $3,404 at ages 25-34, to $5,142 at ages 35-44, to $5,656 at ages 45-54, to $6,093 at ages 55-64, to $6,966 at ages 65-74, and to $7,123 at ages 75 and older. [23] Multiply those increasing expenditures by the projected population numbers and we find a rapidly growing demand for health care. Further, though the growth in personal expenditures slows after age 65, Medicare and Medicaid pick up continually increasing costs. According to the Congressional Budget Office, federal expenditures for health care are expected to change little over the next five years, at 5% below payroll taxes. Thereafter, they are expected to grow rapidly, surpassing payroll taxes by 8% in 2029–2033, by 27% in 2034–2043, and by 42% in 2044–2053.[24]

Those projections still assume that suppliers of medical care are available to meet the demand. Much of medical care, however, remains largely personal—people helping people, often one-on-one. If that remains true, demand is likely to outrun supply. In this respect, COVID-19 may have given us a preview of things to come. The increased stress on our health care system has already been felt by many. (See the sidebar, “One Family’s Experience.”)

Uncertainty

My 1995 article considered three scenarios.[25]

Of the three, inadequate productivity could be “the hardest to address once it becomes obvious, so it’s the one that will require the most careful preparation.”

Alternatively, technological advances could surpass the need, stressing the economy in much the same way as rapid advancement in the early 20th century. “Unless we recognize this possibility, we’re in danger of locking ourselves on a path that works to magnify the problems of this scenario.”

In the third scenario, advances make it possible for the working population to support this generation in retirement without overshooting on capacity.

Of course, reality is more complex than any model. It is possible for all three scenarios to occur simultaneously, with overcapacity in some sectors, stability in others, and deficiency in still others.

In this uncertainty lies risk. To manage the risk, we must see the possibilities, plan for alternatives, and adapt as we gain more information.

Cracks in the Foundation?

Though COVID-19 has undoubtedly contributed directly and indirectly to recent shortages and inflation, it came after a decade of rapid population aging. Demographic changes tell us that the load we place on the foundation is growing rapidly. At the same time, environmental stresses such as climate change and depleted or polluted freshwater supplies threaten to weaken the foundation, especially if they compound geopolitical tensions and shrink the support of foreign countries in meeting our consumer demands.

We need to consider the possibility that—if we continue to focus on managing our economy in the short term and strengthening our retirement income stool—the foundation will crack, or be crushed. In 1995, I considered possible consequences of this scenario.

The value of savings, public or private, will be eroded rapidly by high inflation. If workers can’t produce enough for everybody, then no level of Social Security taxation will be sufficient to pay for the goods and services demanded by the retired population. Either the funding mechanisms of Social Security, pensions, and savings will collapse, and retirement as we know it will cease, or the whole economic system will collapse, followed by a new system after some indefinite period of turmoil.[26]

One Family’s Experience

Over the past 18 months, my stepfather, my father-in-law, and my father have all run into capacity problems with their health care needs.

My stepfather needed hospice care for some time before his death, but there was no space available close to home. To obtain the care he needed, he had to be moved from a northeast suburb to a southwest suburb of a large metropolitan area.

My father-in-law, after a modest stroke and a brief hospitalization, needed therapy and memory care. Unfortunately, the retirement community where he lived had no room in that wing. His daughters were looking frantically for another place until, shortly before his release from transition care, a space opened for him when another man died.

My father, suffering from chest pains, went to an urgent care center. From there, he was transported to an emergency room and was quickly admitted to the hospital. The hospital, however, had no immediately available rooms. He was kept in emergency for about a day before being moved to an inpatient room.

These are just three members of “the greatest generation” and “the silent generation”—the people who created the baby boom. If we can’t staff enough facilities for their needs, how will we manage when the survivors among their 16 children need such care?

In a country that has stood for almost 250 years, it’s hard to imagine such a dire scenario. I like to think that we can do better, but assuming it won’t happen could increase its likelihood. Still, assuming it will happen could lead to other problems. We need to consider possibilities. (See the sidebar, “Uncertainty.”) We need to broaden our focus—to understand our foundation as well as our stool.

As I said in 1995, “The future of our retirement income systems is inherently linked to the future of production.” Let’s pay attention to that foundation.

Steve Malerich is director of risk modeling services at PwC in Chicago.

References

[1] “The Foundation Beneath the Stool”; Steve Malerich; Contingencies; March/April 1995. [2] 1994 Annual Report of the Board of Trustees of the Federal Old-Age and Survivors Insurance and Disability Insurance Trust Funds; Social Security Administration; 1994. [3] “The Foundation Beneath the Stool,” Op. cit. [4] The 2023 Annual Report of the Board of Trustees of the Federal Old-Age and Survivors Insurance and Federal Disability Insurance Trust Funds; Social Security Administration; 2023. [5] “Natality Trends in the United States, 1909-2018”; National Center for Health Statistics. [6] Chapter 2: “Patterns of Childhood Death in America”, When Children Die, National Academies Press, 2003 [7] “The Foundation Beneath the Stool,” Op. cit. [8] “Labor Force and Employment, 1800-1960”; Stanley Lebergott; Output, Employment, and Productivity in the United States after 1800; National Bureau of Economic Research; 1966. [9] “Civilian Labor Force Level”; FRED Economic Data; St. Louis Fed. [10] “Net trade in goods and services”; The World Bank. [11] Table 1, “Persons in the Labor Force, 1940 and 1930, and Gainful Workers, 1930 and 1900, by Age and Sex, for the United States”; U.S. Census. [12] Ibid. [13] Current Population Reports: Population Estimates”; U.S. Census. [14] “Supplementary Reports, 1960 Census of Population”; U.S. Census. [15] “Resident Population plus Armed Forces Overseas—Estimates by Age, Sex, and Race: July 1, 1970”; U.S. Census. [16] Table 43, “Persons by Age, Race, Spanish Origin, and Sex: 1980”; U.S. Census. [17] Table 14, “Age and Sex: 1990”; U.S. Census. [18] ”Profile of General Demographic Characteristics: 2000”; U.S. Census. [19] Table 1, “Population”; U.S. Census. [20] ”AGE AND SEX”; U.S. Census. [21] “The Demographic Outlook: 2023 to 2053”; Congressional Budget Office. [22] Figure IV.B2, “Number of OASDI Beneficiaries Per 100 Covered Workers”, The 2023 Annual Report of the Board of Trustees of the Federal Old-Age and Survivors Insurance and Federal Disability Insurance Trust Funds; Social Security Administration. [23] Table 1300, “Age of reference person: Annual expenditure means, shares, standard errors, and coefficients of variation, Consumer Expenditure Surveys, 2021”; Bureau of Labor Statistics. [24] Table 1-8, “Key Projections in CBO’s Baseline, Adjusted to Exclude Effects of Timing Shifts”; Congressional Budget Office. [25] “The Foundation Beneath the Stool,” Op. cit. [26] Ibid.