By Alice Rosenblatt

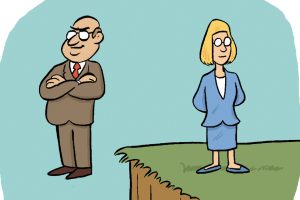

Internal or external users of actuarial services—should there be a difference in the work? Not much; actuarial work should be done in a similar fashion, and the substance of communication to internal and external “customers” should be very similar.

I recently was asked to participate in a career symposium for high school students who currently attend my high school (held by Zoom). It was my objective to pass on information about the actuarial profession as well as my own pathway from high school to becoming an actuary, and later an executive for a large health insurance company.

Because my own background as an actuary includes both consulting work and employment with several types of insurance companies (multi-line mutual company, not-for-profit Blue Cross/Blue Shield plans, publicly traded health insurance company), I started thinking about the differences in actuarial practice in those different environments. As a member of the Actuarial Board for Counseling and Discipline (ABCD), I also responded to a recent Request for Guidance (RFG) that involved thinking about the differences between having “internal” versus “external” principals, as principals are defined in the Code of Professional Conduct—namely as a client or employer of the actuary.

The Code and our actuarial standards of practice (ASOPs) tell the actuary what to consider, disclose, and document, but do not prescribe strict methods, assumptions, or wording for actuaries to use when performing actuarial services. In fact, ASOP No. 41, Actuarial Communications, which applies to all of our practice areas, describes how to deviate from the guidance in an ASOP while still complying with the ASOP. It provides information on how to communicate to principals when one encounters such a situation.

The combination of the career symposium and the RFG had me thinking about whether, in fact, there should be differences in how actuarial work is performed within an insurance company versus within a consulting firm. I came to the conclusion that there should not be much of a difference.

What came immediately to my mind was a situation where a small health insurance company (providing products only to group customers) outsourced all of its actuarial work to an actuarial consulting firm. The actuarial work would fall into five broad functions with the following primary audiences:

- Rate filings, which have to be filed with (and in some cases approved by) the regulator

- Valuations to be used for financial statement blanks

- Trend analysis for management to understand cost and utilization

- Development of the experience-rating formula for management that will be used by the underwriters to set premiums (see item 5)

- Development of spreadsheets or other tools for the company’s underwriters to determine premiums for specific groups

The consulting actuary would determine the ASOPs that could potentially assist with each of these functions. For starters, the consulting actuary would review the four ASOPs that apply to all Statements of Actuarial Opinion (SAOs), namely:

- ASOP No. 1, Introductory Actuarial Standard of Practice

- ASOP No. 23, Data Quality

- ASOP No. 41, Actuarial Communications

- ASOP No. 56, Modeling

Then the consulting actuary would do the following to carry out these functions:

1. For rate filings—the consulting actuary would provide the necessary calculations and other material required by the regulator in that state, usually including a signed actuarial memorandum. The actuary would need to meet the General Qualification standards and to comply with the following ASOPs and potentially others:

- ASOP No. 5, Incurred Health and Disability Claims

- ASOP No. 8, Regulatory Filings for Health Benefits, Accident and Health Insurance, and Entities Providing Health Benefits

- ASOP No. 25, Credibility Procedures

The actuary would include a reliance statement concerning the data (assuming the insurance company data was used).

2. For valuations—the consulting actuary would provide the necessary calculations and other material needed to complete the A&H statement. This work would also include a formal actuarial opinion letter and as in the rate filing example, a statement of reliance on the company’s data. The actuary would need to meet the Specific Qualification standards and comply with the following ASOPs and potentially others:

- ASOP No. 5, Incurred Health and Disability Claims

- ASOP No. 7, Analysis of Life, Health or Property/Casualty Cash Flows

- ASOP No. 22, Statements of Opinion Based on Asset Adequacy Analysis by Actuaries for Life or Health Insurers

- ASOP No. 28, Statement of Actuarial Opinion Regarding Health Insurance Liabilities and Assets.

3. For trend analyses—the consulting actuary would collect cost and utilization information from the company and prepare an analysis and an accompanying actuarial memorandum. As in the above examples, there would be a statement of reliance on the company’s data. The actuary would need to meet the General Qualification standards and comply with ASOP No. 5 and potentially others.

4. Experience-rating formula—the consulting actuary would develop a formula that would take into account the data available, credibility issues, trend projections, products, company expenses, and profit objectives. The actuary would need to meet the General Qualification Standards and comply with ASOP No 5 and No. 25 and potentially others:

5. Spreadsheets for experience-rating a specific case—the consulting actuary would most likely develop a spreadsheet that could be used by each individual underwriter. The consulting actuary would document how to use the model and would probably provide the underwriting area with training aids and other material. The actuary would need to meet the General Qualification standards and comply with ASOP No. 5. The actuary would most likely state reliance on others who were responsible for the technical details involved in building such a spreadsheet.

Now let’s make the health insurance company bigger so that there is an internal actuarial department that performs the same five functions. Should there be any difference in how the results get accomplished or communicated? There should be no difference in how these tasks are done, but there might be a difference in the way the results are communicated. There is a statement in section 3.3 of ASOP No. 41 that allows for some communication differences. The head of the Actuarial Department could consult this section and determine that some of the content that would be necessary in a document coming from an external actuary might not be needed each and every time repetitive work is done for an internal principal. The wording used in section 3.3 of ASOP No. 41 is:

“3.3 SPECIFIC CIRCUMSTANCES

The content of an actuarial report may be constrained by circumstances. The actuary should follow the guidance of this standard to the extent reasonably possible within such constraints. When those constraints exist, it may be appropriate not to include some of the otherwise required content in the actuarial report. However, limiting the content of an actuarial report may not be appropriate if that report or the findings in that report may receive broad distribution.

If the actuary believes circumstances are such that including certain content is not necessary or appropriate, the actuary must be prepared to identify such circumstances and justify limiting the content of the actuarial report.”

There is another point to note regarding the fifth item above—the experience-rating tool. Section D of the Qualification Standards provides examples of SAOs. In Section D, experience studies and personal computer programs are listed as communications that “are not SAOs when used alone without an opinion as to what the results suggest.”

My personal experience of having worked for both insurance companies and actuarial consulting firms would lead me to give advice that the actuarial work should be done and communicated in a similar fashion. While working for the insurance company, I often used to think of the actuarial department as providing consulting advice to the internal “customers.” And some of the best practices of consulting, such as adequate documentation and peer review, should apply in providing actuarial services within an insurance company. If my staff pushed back at me when I spoke about this, I would have them consider a situation where an internal actuarial report was reported to the ABCD. As a member of that body now, I would certainly advise that peer review and good documentation help an actuary make a stronger case than if those two are not present.

ALICE ROSENBLATT, MAAA, FSA, CERA, is a member of the Actuarial Board for Counseling and Discipline.