By David L. Driscoll

What the hot new career choice can tell us

about our profession’s future

If you entered the actuarial profession back in the days when progress toward actuarial credentials could be pinpointed simply by asking a candidate what “part” he or she was working on, you may be aware that those entering the profession today often feel a sense of envy—or even resentment—toward those who preceded them 40 years or so earlier. Back in the early 1980s, successful completion of the first two “parts” generally meant that a candidate for entry-level actuarial jobs would have little trouble lining up interviews at multiple insurance companies and consulting firms. Absent troglodyte-level interpersonal skills, said candidate would probably come away from the interviews with multiple offers.

It was also in the 1980s that the actuarial profession lost a lot of the obscurity that had long been one of its defining characteristics. At a time when job security and employment prospects in many traditional white-collar occupations were shaken by economic and technological upheaval, the actuarial profession stood out as an oasis of safe, stable, well-paid employment. Awareness of this spread as such publications as The Jobs Rated Almanac reported that actuary was the “best” occupation.

The response was predictable: Students who previously had no idea what an actuary was decided to become one. The relatively small number of universities that had offered actuarial science majors were quickly joined by many others, and even universities that did not offer degrees in actuarial science began to emphasize the opportunities that their mathematics and statistics departments offered to those interested in preparing for actuarial exams. Enrollments in these programs rose rapidly, as did the number of actuarial candidates.

Perhaps predictably, the same forces that had driven people to the comparative safety of the actuarial profession began to be felt in the business settings in which actuaries were traditionally employed. Insurance enterprises consolidated and dropped unprofitable product lines. Companies that had offered defined-benefit pension plans froze them and terminated them. Insurance companies and actuarial consulting firms moved work overseas. And, of course, they all adopted technologies that significantly reduced the need for manpower in performing actuarial work. I recall boarding an airplane in the early 1990s and finding myself seated next to an actuary who, almost a decade earlier, had been one of my first managers after I entered the profession. He had recently moved to a new company in another part of the country, and I asked where that company generally recruited actuarial students. His response? Recruitment of actuarial students was a low priority for his new company, as spreadsheets had made them mostly obsolete. Later in the conversation, he acknowledged that he had made that remark half in jest—but only half. I did reflect that much of the work I had done under his supervision—in the days preceding the widespread availability of Excel spreadsheets—could be done in a fraction of the time it had taken in the early 1980s. In any case, in recent years, entry-level employment opportunities for actuaries have not grown as quickly as the number of people pursuing them, leading a recent candidate for the Board of Governors of the Society of Actuaries—an actuary who teaches actuarial science in a West Coast university—to observe that the “actuarial job market for students is difficult, with the number of candidates significantly outstripping available jobs.”

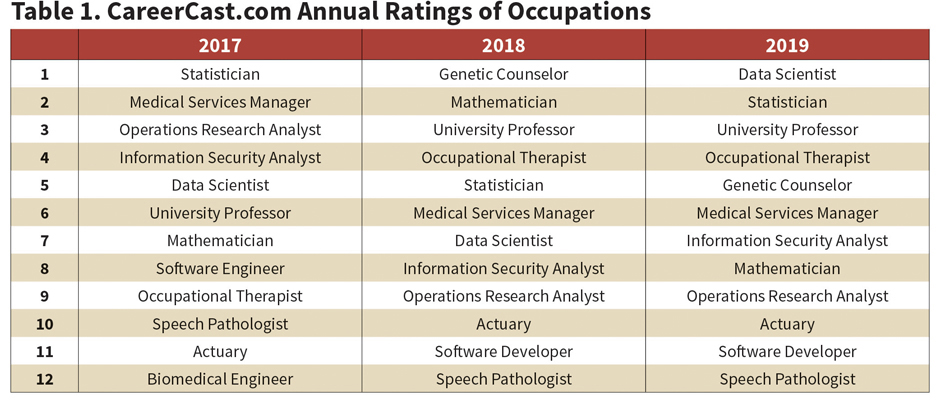

As this has happened, the ranking of actuary relative to other occupations has fallen. Our profession is viewed as offering a good career, but it is no longer viewed as the best. Over the past three years, CareerCast.com’s annual ratings of 200 occupations (based on data published by the Bureau of Labor Statistics on the environment, income, outlook, and stress associated with each) have identified the professions in Table 1 as the top 12.

Being ranked 10th or 11th on a list of 200 professions is certainly a respectable outcome, but the thought of being dethroned is still troubling to some of us. What seems especially disturbing to some is the movement in 2019 to the top of the list of “data scientist”—an occupation that has been regarded as something of an existential threat by some actuaries.

What, exactly, is data science or a data scientist? This is a notably harder question to answer than, for example, “what is an actuary,” as the term has not been around all that long, and its meaning has been the subject of some debate. Historically, “data science” effectively served as a synonym for computer science or statistics, or a combination of these disciplines. In recent years, a consensus meaning seems to have emerged, which is that data science involves the application of statistical and computational techniques to the analysis of “big” data sets.

If you sense that this is rather similar to what actuaries do in, say, analyzing claims data or formulating mortality tables, you are right. It is also rather similar to what biostatisticians and epidemiologists do. The exact distinction between what data scientists do and what other, longer-established professions that deal with the analysis of data do is an elusive one. The absence of specificity on this issue has allowed some writers on career matters to stake a claim for data scientists to some of the sexiest activity being undertaken these days by statisticians. The prospect of using “big data” to drive “machine learning,” and thereby to improve the functioning of an interactive website or identify patterns of behavior that suggest a threat of terrorist activity, can lead a prospective future actuary to imagine that a career as a data scientist offers more fulfillment than one spent setting reserves for an insurance company or determining contributions to be made to a pension plan. Whether or not these exploits are a fair representation of what a typical data scientist does, however, is not clear.

What is clear is that who is a data scientist is at least as ill-defined as what data science is. As they did a generation earlier when actuarial science became a “hot” field, colleges and universities have moved quickly to capitalize on the emergence of data science as a celebrated occupation. In surveying the academic data science programs that have emerged in recent years, a stark contrast between actuarial science and data science becomes apparent. To be successful as an actuary, one really must pass a series of rather difficult examinations covering subjects related to the work of an actuary, and the curricula and admissions criteria for academic programs in actuarial science generally reflect that. Data science programs, on the other hand, seem to vary greatly in their academic rigor and admission criteria.

Consider, for example, the data science graduate program at Harvard University. It operates under the aegis of the university’s School of Engineering and Applied Sciences and utilizes coursework and faculty from its highly regarded departments of computer science and statistics. Admission to the program requires formal admission to the university as a graduate student, which in turn requires the submission of Graduate Record Examination (GRE) scores and an undergraduate transcript reflecting appropriate preparation for the required coursework. Further down the Charles River, MIT’s Institute for Data, Systems, and Society offers a Ph.D. program in Social and Engineering Systems, which also requires rigorous coursework in statistics and computer science. Candidates are also expected to analyze a problem of interest using data and, of course, to write and defend a dissertation. As at Harvard, the application process and admission requirements are designed to establish that a candidate is well prepared for the high-level study of the analysis of data.

At the same time, there are programs offering graduate degrees in data science that apparently require very little advance preparation. To illustrate the prevalence of such programs, I conducted a bit of informal data science of my own: I randomly surveyed 10 data science graduate programs at universities that are located in major metropolitan areas and highlight their opportunities for career-related part-time graduate study in promoting their curricular offerings. I must emphasize that these institutions are not diploma mills; they are accredited, respected universities that have produced many capable alumni in many fields of endeavor. Of their data science graduate programs, only four of the 10 required candidates for admission to have some level of quantitative coursework at the undergraduate level; these requirements ranged from some coursework (at an unspecified level of rigor) in probability, statistics, and programming to completion of a major in a STEM discipline followed by two years of related work experience. The other programs did not require any specific undergraduate major, and indeed one emphasized the absence of any such criteria. GRE scores, which could be viewed as a source of information about a candidate’s readiness for a graduate program whose demands on the quantitative skills of its enrollees is presumably not trivial, were not required by the programs, although in some cases they were “highly recommended” for candidates with low undergraduate GPAs or non-technical backgrounds. Is it possible for a part-time graduate program to take candidates with little or no mathematical preparation and transform them into practitioners whose statistical knowledge and programming skills make them ready to take on the interesting and sophisticated work that data scientists are commonly portrayed as doing? It is possible. But whether it is probable is another matter. It is not unreasonable to imagine that such programs have high attrition rates and/or produce graduates who are not competitive candidates for the jobs that have given data science its present cachet.

So, what can an actuary—or prospective actuary—make of the ascendancy of data science and its current “hotness” as a field? I think a few conclusions can be safely drawn:

Fundamentally, the emergence and success of data science as an occupational field and an academic discipline is good news for actuaries. There is little question that the skills one must acquire in statistics in qualifying as an actuary are in high demand. Practicing actuaries who are some years beyond completion of their exams sometimes make light of the limited degree to which they use their early statistical and mathematical training in their day-to-day work. Worse things could happen to us as a profession than to develop a renewed sense of appreciation for the value of the rigorous mathematical basis for our work in upholding our reputation as a profession—and in making possible the expansion of actuarial work into new areas.

The strong credentialing process for actuaries is a great strength of our profession. No one can become a member of the American Academy of Actuaries without having a basic education that includes a firm command of statistics and a knowledge of U.S. laws and practice, and good moral character and integrity. Further, actuarial education has expanded in recent years from a purely exam-based curriculum to one that allows candidates to demonstrate their skills in the hands-on analysis of data to solve important problems.

Awareness of the value of an exam-validated credential that is not easily earned seems to be on the rise among actuaries. A generation ago, there was concern among the profession’s leadership that travel time to fellowship in the Society of Actuaries or Casualty Actuarial Society was too long and was having the effect of driving good potential actuaries into MBA programs (this was in an era when MBA programs were proliferating in a manner similar to that seen currently in data science programs). Now, there is concern that travel time has been shortened excessively. I would argue that the amount of time it takes to earn a credential is less important than the criteria used to determine who will receive it.

Actuaries can learn a thing or two from data science about skills they can add that would enhance their usefulness in addressing problems of interest to our publics. Machine learning and data visualization are two examples. Fundamentally, what actuaries can take away from the example of data scientists is that the growth and long-term viability of our profession depend on our ability to break away from applying formulaic approaches to familiar tasks and develop solutions based on statistical principles to problems that actuaries of earlier eras could not even imagine.

As individuals, actuaries are almost certainly smart enough to achieve a mastery of the skills needed to survive and prosper in a labor market marked by constant changes in technology and culture. I believe the same can be said of us as a profession. The manner in which we respond to the rise of data science as a discipline and as a profession will tell us a lot about whether this is so.

DAVID L. DRISCOLL, MAAA, FSA, FCA, EA, is an Academy volunteer who serves on the Actuarial Board for Counseling and Discipline, and a principal and consulting actuary at Buck.