By Debbie Hoffer and Mark Troutman

Today’s managed care reinsurance market is characterized by both consolidation and expansion. The merger and acquisition activity of the major chains is shrinking the size of the available reinsurance market. Notwithstanding the rejection of several large mergers and acquisitions among major market players such as Blue Cross, United, Cigna, and Aetna, these acquisitions occur in waves, and the wave is cresting again as insurers seek economies of scale, market penetration in new areas, and increased profit and revenue. Anthem has purchased HealthSun, a 40,000-member Medicare Advantage plan in Florida, and Centene is buying Fidelis, a 1.6 million-member, primarily Medicaid plan in New York.

Counteracting this market contraction due to mergers and acquisitions is the expansion of accountable care organizations (ACOs), which are groups of doctors, hospitals, and other providers who form networks to coordinate care and deliver it more efficiently. Payment reform driven by the Affordable Care Act (ACA) and the Medicare Access and CHIP Reauthorization Act of 2015 (MACRA) continues to be a catalyst for change as the volume-based reimbursement system shifts to a value-based reimbursement system. As providers assume more risk through the development of ACOs, there is strong interest in population health management to keep patients out of the hospital. This is accomplished through the increased use of technology and data analytics (including predictive modeling, wellness, risk assessment, and disease management programs), as well as electronic health records and better coordinated patient care. This increased focus on improving wellness and quality of care should reduce all claims, including catastrophic claims.

New ACOs continue to grow at a rapid pace. There are now more than 925 ACOs representing 32.4 million covered lives.[1] Approximately 30 percent of these ACOs involve providers who are already participating in various value-based initiatives (e.g., pay for performance, episode-based payments, global payments, bundled payments, capitation, and/or salary), while 20 percent plan to participate in such initiatives, and 50 percent have not indicated any plans to participate. As a result of providers assuming more risk under ACOs, the market for provider excess insurance is predicted to increase five- to ten-fold in the next five to 10 years.

The predicted wave of such health care cost-controlling initiatives, however, is still in the future. According to one survey,[2] there are a number of impediments to successfully engaging in ACO arrangements, including:

- finding willing providers;

- cultural compatibility with value-based care;

- difficulty securing financial resources necessary for risk assumption;

- lack of technology to support value-based care;

- inadequate clinical integration;

- inadequate accounting or financial tracking; and

- misaligned quality requirements.

The Role of Captives

Regional hospital chains are developing new networks and contracting with local health plans and employers to assume medical risk for additional populations. Many of these entities assume some form of financial risk either directly or through reinsurance and captive utilization. According to a study,[3] increased use of captives occurs for a number of reasons, including to:

- enhance understanding of fundamental risks and exposures;

- provide a consolidated repository of retained risk;

- allocate retentions across multiple subsidiaries;

- draft customized policy terms and conditions;

- provide a vehicle to centralize insurance procurement;

- access strategic partners to help manage risks; and

- improve capital management and provide smoother earnings patterns.

Employee Retirement Income Security Act Plans

Health plans increasingly are looking to grow and retain membership by developing employer stop-loss capabilities for self-funded health plans. Insurers and reinsurers can be consultative partners for pricing and operational management of this business and provide value-added services such as catastrophic claim management programs and access to centers of excellence for transplants.

Physician Medical Group Consolidation

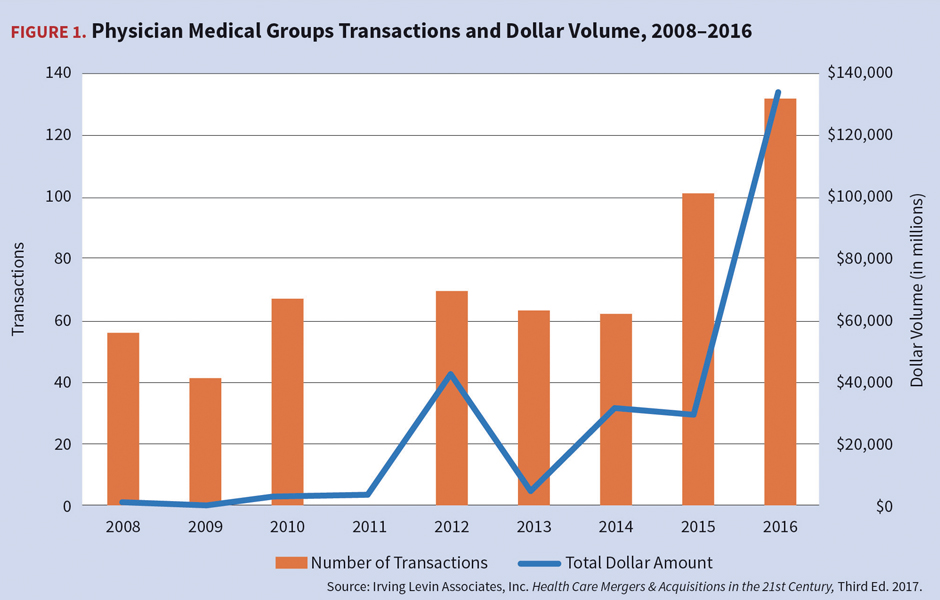

Provider merger and acquisition activity increased in 2015–2016 and is expected to continue to increase in 2018. ACA and MACRA are contributing factors to more physicians seeking employment with large providers such as hospital systems and practice management companies. Consolidating hospital systems often acquire physician groups to foster clinically integrated networks in an attempt to raise reimbursement rates and increase patient volume.

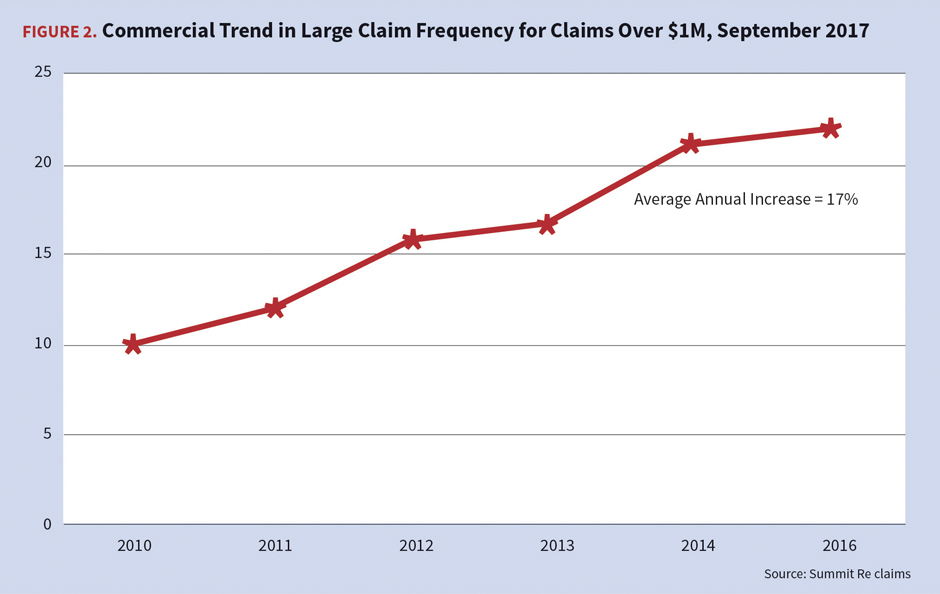

Catastrophic Medical Claims

The higher frequency of large medical claims continues to challenge the market. Claims in excess of $1 million increased an average of 17 percent annually between 2010 and 2015. As a result, reinsurers in this market who rely primarily upon experience rating and underwriting practices may be surprised by the increase in risk exposures for catastrophic medical claims, as a focus on past experience will be inadequate to project future losses.

The reinsurance market is rife with examples of individual claims exceeding $10 million on a paid basis, causing more and more of the largest insurers and reinsurers to purchase excess-of-loss protections—so-called sleep insurance—at $2 million to $5 million in deductibles. Most of these jumbo claims come from specialty drugs, often for hemophilia and often for situations in which the dosages are exceptionally high (e.g., five to 10 times higher than what is typical).

These large claims can be particularly difficult to current and future underwriting results if the reinsurer has offered a no-new-laser product that allows the claim to continue for additional years.

A secondary area of these jumbo claims not related to hemophilia are large claims in commercial groups, particularly exchange populations, for transplant, newborn, congenital, or cancer care, which often correlate to complications and comorbidities.

These large claim trends indicate that leveraged trend has accelerated even as the underlying, from the ground-up loss trends were decreasing. One notable change from historic trends is the increased prevalence of recurring large claims from the same member. Usually claimants had a large claim in one year and then not in subsequent years, due to either recovery or death. Now more and more claimants become chronic catastrophic claimants over multiple years. This is a function of the increased ability to treat complex conditions, the rising cost of treatment, and increased survival rates. It demonstrates that a small number of claimants still drives a large proportion of total health care costs, and managing them effectively from the ground-up and at the catastrophic claim level pays significant dividends to risk takers.

Catastrophic Claim Trends by Type of Claim

Historically, transplants were the primary cost driver for most payers. Although transplant claims remain significant, they no longer are the main driver of catastrophic claims. Key catastrophic claim drivers now are specialty drugs, dialysis, complex oncology, neonatal intensive care, and cardiac care.

Specialty Drugs

Specialty pharmacy has been a niche industry serving a limited number of patients with a small number of high-cost, low-volume conditions such as hemophilia and Gaucher’s disease. Specialty pharmacies first were developed in the 1970s to deliver temperature-controlled drugs to treat cancer, HIV, infertility, and hemophilia. In the mid-1990s, there were fewer than 30 specialty drugs, but by 2008, this number had increased to 200, and today that number is approaching 400, as new drugs and biological products offer often significant advances in health care for patients. There now are close to 400 pharmacies with specialty pharmacy accreditation, according to the National Association of Specialty Pharmacy (NASP).

While “specialty drug” is a specific drug classification, there is no universally accepted definition of a specialty drug. The Centers for Medicare & Medicaid Services defines a specialty drug as one costing more than $670 per month. The National Association of Chain Drug Stores defines specialty medications as products used to treat chronic, high-cost, or rare diseases that can be injectable, infusible, oral, or inhaled. Specialty pharmaceuticals tend to be more complex to maintain, administer, and monitor than traditional drugs; therefore, they require closer supervision and monitoring. According to NASP, “specialty drugs are more complex than most prescription medications and are used to treat patients with serious and often life-altering and sometimes life-threatening conditions.”

Another characteristic of specialty drugs is that they are expensive. While the use of specialty prescriptions occurs in less than 2 percent of the U.S. population, specialty drugs accounted for 24 percent of U.S. drug spending in 2010 and 37 percent of drug spending in 2015 and is projected by NASP to reach 50 percent by 2020. The average monthly cost of a specialty drug is $2,500–$3,500 per patient.

Today, 47 percent of specialty medications, such as those administered in a doctor’s office, are billed through the medical benefit, which lacks effective cost controls. The responsibility for prior authorization has migrated from the medical management area to the pharmacy.[4]

A new era of designer drug development was ushered in with the Food and Drug Administration’s (FDA’s) approval of Kymriah, the first gene therapy treatment in the United States. Kymriah (tisagenlecleucel) is used to treat a form of acute lymphoblastic leukemia (ALL) in children and young adults by genetically modifying their own white blood cells to find and kill the leukemia cells. The drug demonstrated the ability to bring ALL into remission when other treatments have failed; the overall remission rate after three months of treatment was 83 percent.[5] Novartis, which manufactures Kymriah, is also seeking approval from the FDA for its use in adults with relapsed or refractory diffuse large B-cell lymphoma. The price tag for Kymriah, which is given as a single treatment, is $475,000.[6]

And Kymriah is only the beginning. There are 34 additional gene therapies in the final stages of testing and another 470 in initial clinical trials, according to the Alliance for Regenerative Medicine. Some therapies are expected to have prices of up to $900,000.[7] Given the newness of the therapies and the projected high cost, some drug manufacturers are developing pricing strategies that would not charge patients who did not respond to the treatment.

Kidney Dialysis

Dialysis is another contributor to the growth of catastrophic claims. The incidence of chronic kidney disease is on the rise and now affects more than one out of 10 adults, largely due to the increasing prevalence of obesity and diabetes. Today, the national cost for end-stage renal disease (ESRD) including dialysis, transplantation, inpatient care, pharmacy, and laboratory costs, is approaching $50 billion.[8]

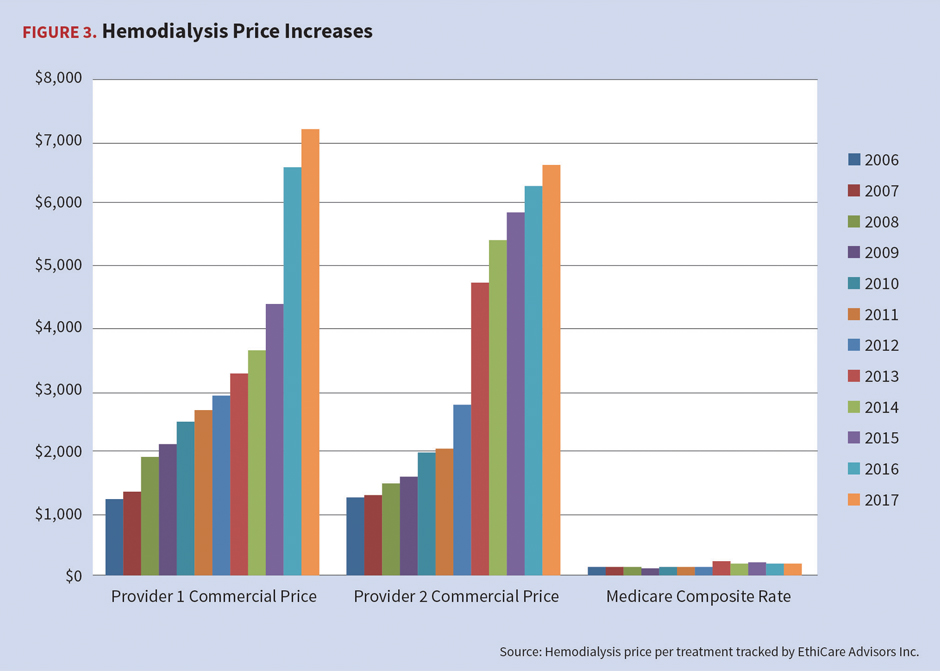

Dialysis continues to be a significant cost driver for commercial payers, who pay multiples of the Medicare base treatment rate of $250–$280 per treatment. There are additional charges for some drugs and blood products based on lab values, so reimbursement may vary from patient to patient, though the base treatment rate includes most drugs and labs. It is not unusual for commercial payers to receive billed charges for dialysis of $50,000–$120,000 per month. Discounts for contracted dialysis providers vary widely as noted in Figure 3. All-inclusive contracted rates are more favorable as the payer can more accurately budget for the treatment vs. a percentage off of billed charges.

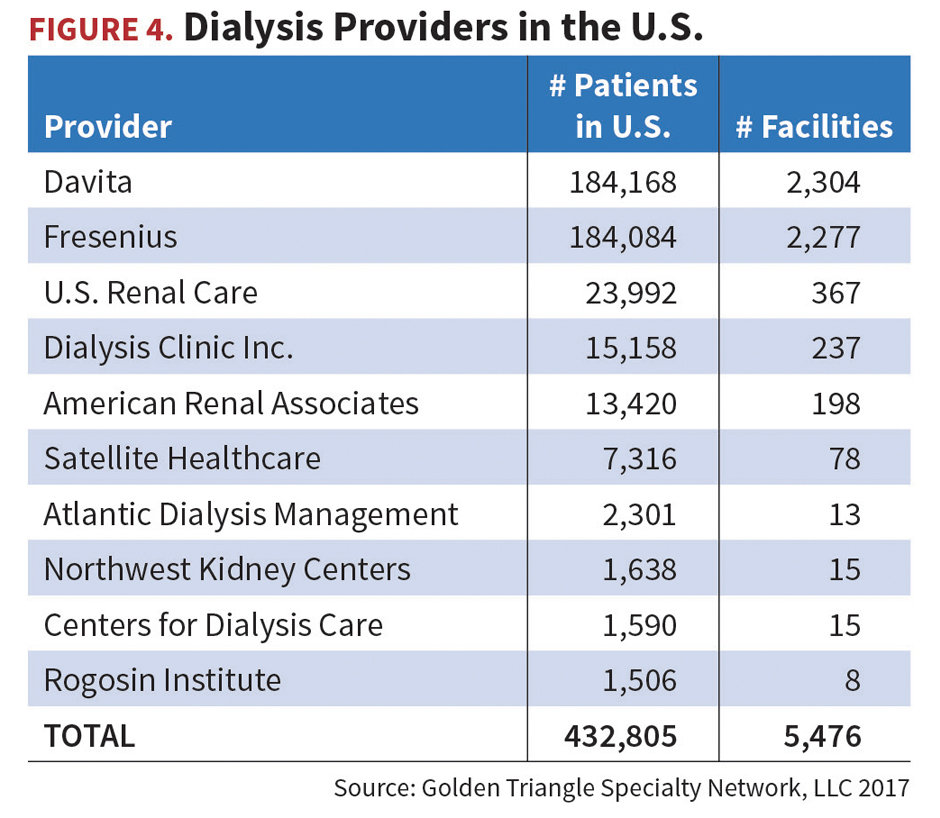

There is a heavy concentration of dialysis providers in the U.S. As indicated in Figure 4, the two major providers are Davita and Fresenius.

Complex oncology

Complex oncology also is significantly adding to the cost of cancer care. Historically, the primary treatment options for cancer diagnoses included surgery, radiation, and/or chemotherapy. These options are now supported with new adjuvant therapies, immunotherapy, biologics, or combinations of these. Advances in oncology management are moving to individualized therapy with drugs specifically made for each patient. These drugs target the cancer cells more efficiently with less trauma to normal cells. In 2016 alone, the FDA approved immunotherapies for advanced forms of lung, kidney, bladder, and head and neck cancers, as well as Hodgkin lymphoma.

The costs, however, may be staggering, as there are more than 1,000 such drugs in the pipeline, each expected to cost in excess of $150,000. In 2017, an estimated 1,688,780 new cancer cases were diagnosed in the United States. The five-year cancer survival rate is improving, from 49 percent in 1975–1977 to 68 percent in 2006–2012. The American Cancer Society projects there will be 19 million cancer survivors by 2024 and survivors cost insurers two times more than decedents.[9]

Neonatal intensive care

Neonatal intensive care continues to be a significant driver of costs. The U.S. preterm birth rate is on the rise for a second year in a row after nearly a decade of decline, earning the nation a “C” on the latest March of Dimes Premature Birth Report Card. The U.S. preterm birth rate went from 9.6 percent of births in 2015 to 9.8 percent in 2016, and racial disparities persist, with black women 49 percent more likely than white women to deliver prematurely.[10]

More than 380,000 infants are born prematurely in the U.S. each year, and the increase in the preterm birth rate between 2015 and 2016 means an additional 8,000 babies were born prematurely in 2016. Premature birth (before 37 weeks of pregnancy) is the largest contributor to the death of infants in the U.S. Infants who survive an early birth often face serious and lifelong health problems, including breathing issues, vision loss, cerebral palsy, and developmental delays.

Preterm birth accounts for more than $26 billion annually in medical and societal costs, according to the National Academy of Medicine. The average cost for infants hospitalized in neonatal intensive care units is approximately $3,000 per day. The average cost of care for the first year of a preterm infant’s life is approximately $32,000 versus $3,000 for a full-term infant.[11]

Cardiac Care

The number of people diagnosed with heart failure is increasing and projected to rise by 46 percent by 2030, which will result in more than 8 million people with heart failure, up from about 6.5 million in 2014.[12] The increase in the number of people with heart failure can be attributed to medical advances, the aging of America, and other health problems, such as diabetes and obesity.

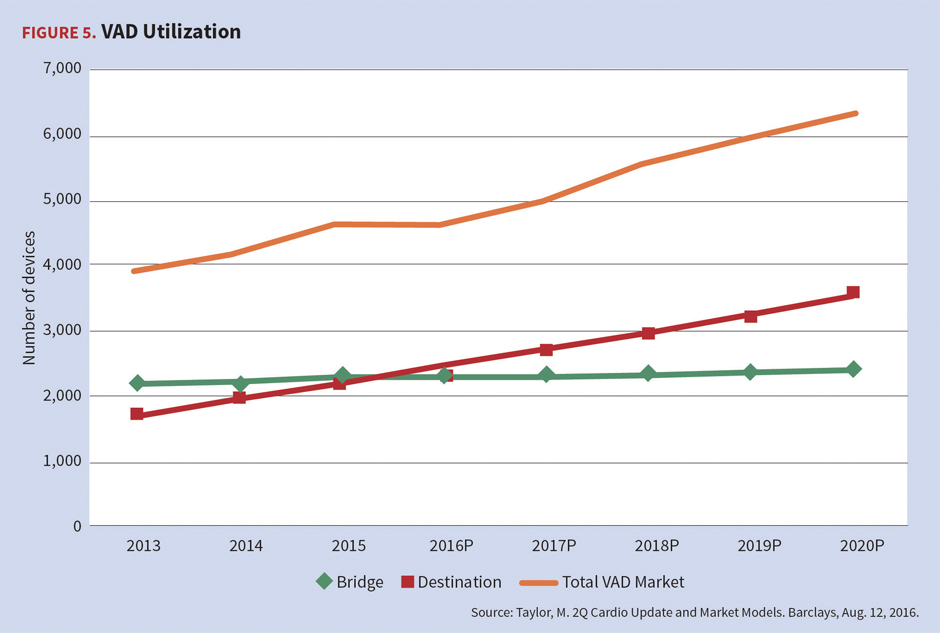

Since the approval of ventricular assist devices (VADs) by the FDA in the United States in 1994, their indications and prevalence have continued to expand. Initially, these support devices were approved to bridge end-stage heart failure patients awaiting transplant; however, utilization has expanded to include destination therapy. The FDA approved VADs for destination therapy only for patients who are classified as New York Heart Association Class IV end-stage ventricular heart failure and who are not candidates for heart transplantation, yet require permanent mechanical cardiac support.

Utilization of VADs continues to increase at a 7 percent compound annual growth rate. VAD technology comes at higher costs than a traditional heart transplant. A VAD patient surviving 10 years can cost three to five times more than a non-VAD heart transplant patient. Further, one-year average billed charges for a VAD implant ($1,056,000) versus heart transplant ($821,000) are 29 percent higher, on average. Post-implant charges due to complications can be as high as $1.5 million per year.[13]

Transplants

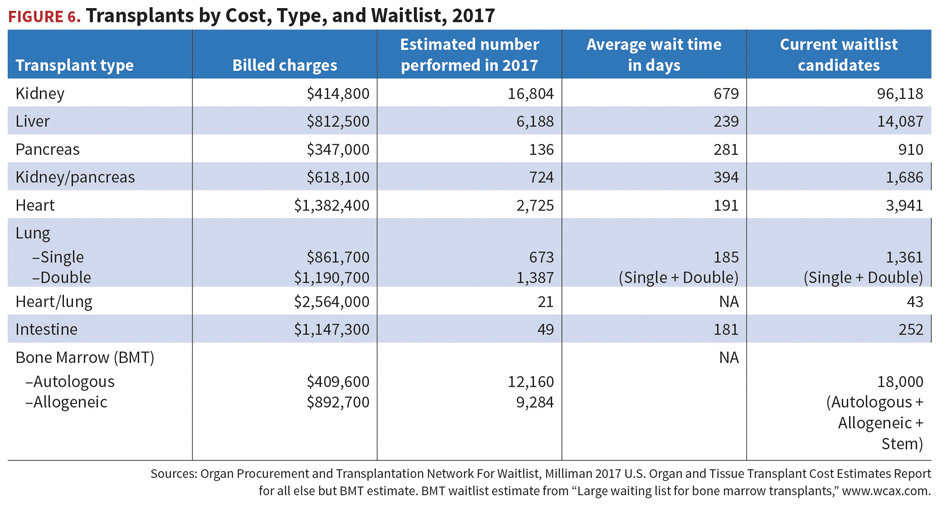

Although transplants may no longer be one of the top five key cost drivers for payers, they remain complex clinical challenges often requiring referrals to tertiary care facilities. As seen in Figure 6, billed charges for transplants range from $1.4 million for the approximately 2,700 heart transplants performed in 2017 to just under $350,000 for 136 pancreas transplants the same year.

The 2017 per-member-per-month cost for transplants is estimated to be $8.21 for members under age 65 and $12.23 for those over age 65. Most payers do not pay full billed charges due to discounts available through transplant networks and other discount arrangements. Survival rates generally increased slightly from 2014, except for pancreas.

Reinsurance Trends

A higher percentage of health care organizations now look to their reinsurance partners for catastrophic claim protection, capital solutions, and consultative support. These functions are all designed to support client risk tolerance, risk-based capital needs, and corporate growth initiatives. More involvement in strategic planning often includes merger and acquisition support, industry and vendor partnerships, product diversification, and captive utilization, as described above. Clients also look for consultative advice on best practices for operational and developmental efficiencies and enterprise risk management.

The nature of the reinsurance protection depends upon the underlying purpose or purposes. Quota share transactions are primarily capital-motivated. This proportionate transfer of premiums and claims gives corresponding reductions in risk-based capital requirements. The quota share reduces the revenue, claim, and profit or loss proportionally.

Excess-of-loss protection is a non-proportional coverage designed to protect against the severity and frequency of catastrophic medical claims. Most excess-of-loss coverages average only 1 to 5 percent of total premium, so they are ineffective risk-based capital relief solutions. They do, however, eliminate catastrophic claim volatility and protect balance sheets for a price. Aggregate stop-loss protections are designed to protect against over-utilization. They are primarily a mechanism to transfer risk for frequency volatility. A current example of increased interest in this area is an aggregate stop-loss coverage for entities assuming significant first-dollar risks (i.e., billions of dollars) for a new unknown population.[14] The cost varies based upon the attachment point and the reimbursement limits.

There is ample medical excess-of-loss reinsurance capacity from both traditional and non-traditional sources. In addition to the historic players, the total number of medical reinsurance providers increases as property and casualty companies and hedge funds put capital to work in these market segments.

Most established managed care organizations, i.e., health plans and provider organizations, continue to purchase higher deductibles and eliminate or reduce average daily maximum benefit limitations, which is a per diem limit on reinsurance claim reimbursement. Clients continue to purchase higher or unlimited maximum benefits given the unlimited nature of their liabilities and the ever-increasing severity and frequency of catastrophic claims. Some reinsurers now offer products with extended accumulation periods to better handle long hospital confinements and avoid multiple plan-year deductibles and lengthy specialty drug accumulations.

The health insurance market will continue to expand and contract in various areas, while health care reform and other developments will cause it to evolve and innovate. But it seems likely that catastrophic claims will continue their inexorable rise.

Debbie Hoffer, RN, MS, CCM, is vice president and managed care consultant of Summit Re. She can be reached at dhoffer@summit-re.com.

Mark Troutman is president of Summit Reinsurance Services, Inc. He can be reached at mtroutman@summit-re.com.

Located in Fort Wayne, Indiana, Summit Reinsurance Services, Inc. underwrites and administers medical stop loss insurance and reinsurance on behalf of Zurich American Insurance Company, Companion Life Insurance Company, and numerous health plans.

Endnotes

[1] Health Care Transformation Task Force; “Levers of Successful ACOs”; Nov. 8, 2017. [2] Presentation by Brett Graham, chief strategy officer with Leavitt Partners; Managed Care Risk Association Annual Meeting; Sept. 18-20, 2017. [3] “Captive and Reinsurance Strategy to Manage Risk in Changing Times”; Rob Fast; Willis Towers Watson 12th Annual MCO/PBM Roundtable; Sept. 12–13, 2017. [4] Express Scripts Drug Trend Report; 2013. [5] U.S. Food and Drug Administration; “FDA Approval Brings First Gene Therapy to the United States”; Aug. 30, 2012; https://www.fda.gov/NewsEvents/Newsroom/PressAnnouncements/ucm574058.htm. [6] Eric Sagonowsky; “At $475,000, is Novartis’ Kymriah a bargain—or another example of skyrocketing prices?” FiercePharma; Aug. 31, 2017. [7] Gina Kolata; “New Gene Therapy Treatments Will Carry Whopping Price Tags”; New York Times; Sept. 11, 2017. [8] U.S. Renal Data System; 2017 Annual Report; November 2017. [9] American Cancer Society; Cancer Facts and Figures 2017; 2017. [10] March of Dimes; “U.S. Preterm Birth Rate on Rise for Second Year in a Row”; Nov. 1, 2017; https://www.marchofdimes.org/news/u-s-preterm-birth-rate-on-the-rise-for-second-year-in-a-row.aspx. [11] Michael Kornhauser and Roy Scheiderman; “How Plans Can Improve Outcomes and Cut Costs for Preterm Infant Care”; Managed Care; Jan. 1, 2010. [12] Emelia J. Benjamin, et al.; Heart Disease and Stroke Statistics—2017 Update; American Heart Association; March 7, 2017. [13] Mark Troutman and Debbie Stubbs; “Catastrophic Medical Claims: Trends Impacting Managing Risk Associated With Value-Based Reimbursement”; Contingencies; January/February 2017. [14] See NextGen website, www.nextgen.com/, for more information.