By Kenneth A. Kent

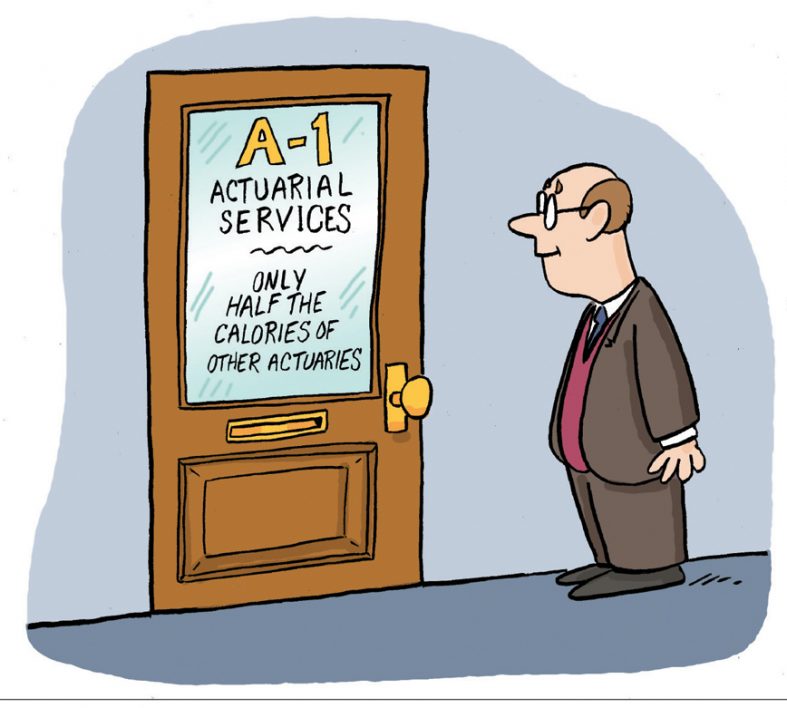

Every Precept of the Code of Professional Conduct (the Code) is considered essential in meeting our responsibility to the public in support of our profession. We rarely highlight Precept 11, Advertising. While infrequent, complaints alleging violations of Precept 11 usually present challenging issues for consideration.

Precept 11 provides that:

An Actuary shall not engage in any advertising or business solicitation activities with respect to Actuarial Services that the Actuary knows or should know are false or misleading.

Annotation 11-1. Advertising and business solicitation activities encompass all communications by whatever medium, including oral communications, that may directly or indirectly influence any person or organization in deciding whether there is a need for Actuarial Services or in selecting a specific Actuary or firm to perform Actuarial Services.

As with most of the other Precepts, the advertisement of an actuary’s capabilities must also conform to Precept 1, which requires that:

An Actuary shall act honestly, with integrity and competence, and in a manner to fulfill the profession’s responsibility to the public and to uphold the reputation of the actuarial profession.

The connection between these two Precepts hinges on honesty and integrity, which appear to be straightforward concepts. However, in the process of business solicitation, our perception of our personal and our firm’s market advantages in quality of service and capabilities may color what we say and communicate.

For many of us, the selling of our services (which can be essential in building and growing an actuarial practice) is based on an underlying belief that we offer distinct advantages, and that we can provide additional value to a prospective client beyond what they are receiving from their current actuarial service provider. For some practice areas, advertising of actuarial services extends to industries that don’t regularly engage actuaries, where we market our expertise to enhance their financial and risk-management capabilities. We may also face circumstances wherein an industry is looking at other service providers like data management companies or financial engineers to meet needs we actuaries believe we are better equipped to provide.

These competitive environments, coupled with the pressure to acquire new clients and expand into new areas of practice, can sometimes lead to presenting our services in a false, misleading, and/or deceptive manner.

False and Misleading Statements

Actuaries involved in business development have to firmly believe that they and their companies have a better or unique value proposition to offer. We do it better, we have better tools, we have more expertise, we are the preferred provider in the industry. In our minds, most actuaries believe these statements. However, can we substantiate them before the engagement of our services? Any statement of capabilities beyond what our potential competitors can provide should have a basis in fact to allow for substantiation; otherwise such statement can fall within the terms of false or misleading statements.

Examples of such statements might include:

“We can reduce your financial risk”;

“Our methods and approaches will reduce your cost”; or

“The experience we deliver will improve your balance sheet.”

The integrity of these representations is important—can the actuary support them if challenged? In part, this evaluation is what Precept 11 may be intended to force us to consider, because Precept 11 provides guidance for actuaries who advertise. When combined with Precept 1, Precept 11 essentially says that thou shall not engage directly or indirectly in any advertising or other activity that can reasonably be regarded as being likely to attract professional work in a deceptive manner, or where the content is false, fraudulent or misleading. That means our solicitations as actuaries and members of a profession should make claims that are objectively truthful or that are supported by evidence and do not mislead.

That also means that marketing strategies based on research results must avoid making unqualified claims based on qualified results. In other words, when soliciting clients based on targeted research results, we must keep in mind the assumptions we make to support our advertised claims and make sure we do not mislead by omitting information or factors that may qualify or limit our claims. Actuaries may want to make broad, strong claims in their solicitations, but we must resist the temptation to remove the qualifiers that are needed to prevent claims from being deceptive.

When drafting marketing material, actuaries will want to determine whether each claim in the solicitation can stand alone as a truthful, verifiable statement—and also whether the claims in the entire solicitation, when put together, continue to be truthful and not misleading. If the solicitation fails either of these tests, it should be reworked.

Actuarial Judgment

Another area that can influence the representation of our capabilities is in our actuarial judgment. If we represent that we can, through appropriate actuarial practice, arrive at a better outcome by the use of different assumptions or methods to achieve better financial results than our competitors, do we risk misleading the public—in this case, prospective clients? Does the approach, when advertising, of representing the ability of using alternative assumptions to produce potentially better results create an adverse impression with the public of the underlying honesty and integrity of our profession? Can we imply that we can refine best estimates beyond what the current actuary has done while still working as a professional within the bounds of actuarial judgment?

Precept 11 dictates that Actuaries must only make truthful statements that are not misleading in their advertisements, and that these statements cannot create an unjustified expectation about the results that the Actuary can achieve for a prospective client.

Resolution

When actuaries become credentialed, they are agreeing to be bound by the Code.

The Actuarial Board for Counseling and Discipline is at times asked to consider whether there is a risk to the public (and the profession) when actuaries make misleading advertisements and business solicitations based on unsubstantiated claims of superior capabilities.

For the actuary, this all leads back to what we often conclude in situations involving compliance with the Code: “An Actuary shall not engage in any advertising or business solicitation activities with respect to Actuarial Services that the Actuary knows or should know are false or misleading.” If you find yourself making representations that are not honest, impinge on your integrity, or risk eroding the trust of the public, then you have a responsibility to make changes to ensure that public statements of your abilities and those of your company are accurate, can be substantiated, and do not mislead.

KENNETH A. KENT, MAAA, FSA, FCA, EA, is a member of the Actuarial Board for Counseling and Discipline.