By Ankit Nanda

making the CASE

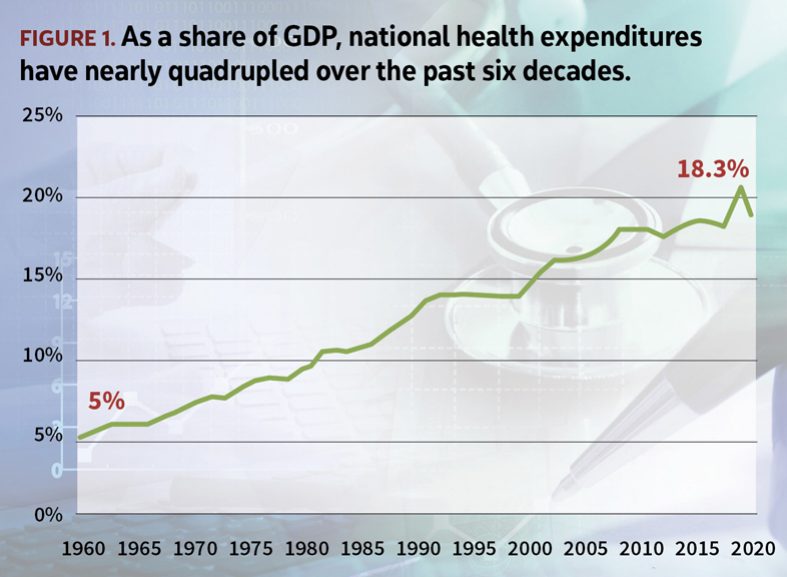

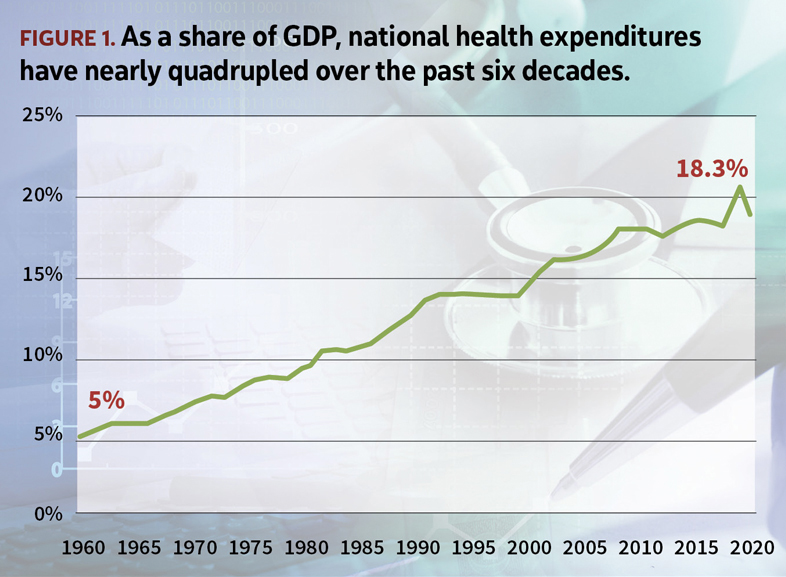

As far back as one can recall, health care costs in the U.S. have been steadily climbing, with inflation in medical products and services consistently outpacing general inflation in the economy. As a result, health consumption expenditures have now come to account for nearly a fifth of the country’s total gross domestic product (see Figure 1). Such consistent increases in public and private spending, however, have not necessarily translated to improved measures of morbidity and life expectancy.

Estimates compiled by Kaiser Family Foundation suggest that more than 150 million individuals are currently insured through employer-sponsored health coverage, with government programs such as Medicare and Medicaid accounting for the lion’s share of the remaining insured population. In reimbursement-related negotiations, government programs have tended to act as a unified front, carrying enormous leverage in order to wring the most favorable deal from provider systems.

Employers on the other hand have historically acted in a fragmented fashion, bringing significantly less influence to bear. As a result, the provider community has increasingly looked to make up the shortfall in reimbursements from government programs by shifting costs to the employer segment, where prices for similar services can run into many multiples of prices paid by the government.

The passage of federal Employee Retirement Income Security Act of 1974 (ERISA) heralded a new era in the world of employer-sponsored health coverage by restricting the ability of states to regulate self-insured benefits. Avoiding state-mandated benefits, employers were free (within reason) to tailor health benefits to the custom needs of their population. Alongside, tangible savings could be tapped by circumventing insurer profit margins that were baked into premium rates for fully insured benefits.

While such an arrangement offered several advantages around cost and flexibility, unsophisticated employers came to realize its accompanying potential to upend annual benefits-related budgets due to unforeseen volatility in the frequency and severity of large claims. This provided the impetus for the rapid and sustained growth in the market for medical stop loss, a form of coverage where an insurer steps in to provide protection to an employer for claims above a predetermined individual and/or aggregate attachment point.

The market for medical stop loss in the U.S. today is considered fairly mature, with several decades of credible experience backing rate indications. Nonetheless, several pitfalls await unsophisticated buyers, as well as sellers.

the story of a LARGE CLAIM

As in other forms of insurance, buyers and sellers of stop loss coverage are largely concerned with frequency and severity of claims. Large medical claims in particular can be notoriously difficult to predict with any degree of precision.

The concern is particularly acute for small to midsized employers insuring a few hundred lives with greater observed volatility in claims experience. This segment of the employer self-funded market is also most vulnerable to the impact of a few large claims on its budgeted benefit costs and, consequently, company’s bottom line. As a result, employers in this space tend to purchase stop loss cover at lower deductibles—an expensive proposition due to high rates of observed leveraged medical trend. Meanwhile, large employers tend to exhibit relative stability in claims experience and purchase coverage at higher deductibles due to their greater ability to withstand losses.

In both cases, however, historical experience can only offer so much assistance in accurately projecting future costs. For small employers, lack of credible experience due to fewer insured lives adds to the difficulty in estimating costs. For large employers, coverage is purchased at higher deductibles at which experience is generally scant and thus considered only partly credible.

A carrier must therefore exhibit a healthy degree of caution when using past experience to project future claim costs. Credibility (or weight) applied toward prior experience should ideally be supplemented with indications developed using a larger block of policies, with necessary adjustments that render the block comparable as it relates to characteristics such as demographics, geography, benefit plan design, etc.

Several large carriers with sizeable blocks of stop loss business produce annual reports detailing their observed experience around large claims. These reports typically include helpful guidance around evolving costs for conditions such as cancer, premature births, dialysis, etc., that have been found to be expensive to treat.

Alongside, novel treatments such as cell and gene therapies have newly emerged on the scene, combining strong curative potential with extremely high price tags, upwards of $1 million per treatment. With an ever-expanding set of conditions potentially within scope of treatment, they pose serious financial risk to the viability of employers, health (re)insurers, and the health system at large.

BENEFIT DESIGN makes all the difference

A carrier offering individual stop loss coverage is primarily concerned with costs above its attachment point. The underlying health plan design can yet exert considerable influence on its trajectory of costs.

An often-overlooked element in the equation is the presence of an out-of-pocket maximum, which caps maximum liability for individual plan participants. Without necessary safeguards and incentives, a patient is free to seek medical care from out-of-network providers once the annual cap is reached or anticipated to be reached. Such care is often associated with minimal discounts toward billed charges. The short-term nature of health insurance—lasting on average 12 months before an employer is free to shop for coverage during renewal—adds to the predicament, with little opportunity for the carrier to recoup costs in the short term.

A carrier must make efforts to include features in the underlying stop loss policy that provide the necessary impetus for an employer to make best efforts toward keeping a lid on costs. Such efforts can include:

- Significantly higher cost-sharing for out-of-network care through adjustments to underlying benefit design

- Strong encouragement for patients to use predetermined centers of excellence for expensive tertiary care

- Education around the dynamics of renewal pricing when the market will look to penalize poor historical experience through potentially significant rate hikes

NETWORK DISCOUNT or hardly a discount!

Provider groups have undergone significant consolidation in the past decade in an attempt to streamline operations, reduce costs, and drive greater innovation. This has been especially true for smaller physician practices and hospitals, many of which have come under tremendous cost concerns in an inflationary environment marked by a paucity of providers and steady upward pressure on wages—the dominant component of overall costs for a health system. As a result, several providers have either been purchased by private equity firms looking to enter this space or folded into larger health systems in order to stay solvent.

Although difficult to ascertain whether health system consolidation is necessarily linked to worse patient health outcomes over time, medical costs have in fact found to have increased in regions where such consolidation has occurred. These systems now bring great force to bear in negotiations, with large established insurance carriers enlisting them as part of their networks, driving higher overall reimbursements or threatening to opt out of network.

An employer that self-funds its health benefits will necessarily employ the services of a carrier or a third-party administrator (TPA) to tap into its proprietary provider network. Discounts offered on medical billed charges vary greatly depending on the strength, size, and breadth of the individual network. A stop loss carrier is primarily concerned with discounts on claims above the stop loss threshold, which may differ from discounts on first-dollar claims. Several hospital systems include unique accommodations in underlying contracts that peg allowed charges to a higher percentage of billed charges when claims exceed a certain “stop loss” threshold, instead of a customary higher network discount.

At the same time, case rates and diagnosis-related group reimbursement (DRG) arrangements may exist for neonatal care and inpatient stays, adding yet another layer of uncertainty in estimating appropriate levels of network discount. Similarly, distribution of total claims is known to vary among the three primary service categories—inpatient, outpatient, and physician—depending on the size of the deductible. Loosely speaking, the universe of medical care narrows to a smaller subset for high-dollar claims, with notable repeat categories such as transplants, burns, neonatal care, specialty drugs, and more.

A carrier must ensure that any network discount being estimated considers these peculiarities before adjusting a base rate, as developed rates can be highly sensitive to the assumption around network discounts, especially at higher attachment points. Furthermore, carriers will often employ a manual developed by a consulting firm to arrive at base rate indications while employing a table of discounts from a different firm for network discounts to use with such base rates. Applying network discounts from one to the other implicitly assumes that base rates in both cases are roughly comparable, which may not always be true.

Pharmacy-related costs for employers have risen sharply in recent years, partly due to a market-pricing approach adopted in the U.S. to recoup research and development costs, coupled with tremendous innovation around breakthrough drugs tackling previously untreatable disease conditions. A pharmacy benefit manager (PBM) is generally responsible for negotiating the cost of drugs with manufacturers on behalf of employers.

In exchange for preferred placement on a drug formulary, a manufacturer may offer rebates to a PBM, which may share them in part with an employer, effectively providing a discount toward list prices for drugs. The underlying arrangement between the PBM and the manufacturer is generally considered proprietary; as a result, discounts on pharmacy charges are not easy to determine. It is essential for an employer to initiate a dialogue with its PBM for guidance to arrive at a reasonable discount estimate to apply toward pharmacy portion of total rates to account for potential rebates.

LASER focus on high-cost claimants

Lasers are a popular technique used by stop loss carriers to avoid “known” risk within the insured population. When an individual claimant is considered highly likely to exceed a certain threshold of claims during a policy year, an insurer may decide to laser out—or exclude—the individual completely from underlying coverage, or, more popularly, apply a higher deductible for the individual compared to the remainder of the group.

A laser is considered a win-win situation for both parties—carrier and policyholder. By lasering an insured individual, the policyholder avoids having to pay a risk charge on their expected claims. Developed rates are as a whole lower, allowing for a lower starting point in future-year rate negotiations. The carrier in turn benefits by avoiding risk for that individual.

Lasers, however, are known to be only partly effective in avoiding risk, as patients are known to transition from one state of care to another over time. Moreover, studies have gone so far as to suggest that the odds of a medical professional correctly predicting a high-cost claimant in a policy year based on past experience is no better than 50-50, or the flip of a coin!

Employers have rightly raised concerns about the application of lasers, which allows carriers to avoid taking on risk that employers may be most concerned about. A request for no new lasers is among the top asks from an employer during renewal of a stop loss policy.

For a rate that includes the option of no new lasers, a carrier must estimate the likelihood and associated cost of claims for the individual(s) during one or more future contract years and build it into its underlying rate. When employed with a multiyear rate cap, they must be used with caution for the risk of misestimating future trend in costs. Finally, experience for lasered individuals may nor may not be excluded from historical experience when trending claims to a future rating period.

While imperfect, lasers are yet considered a valuable risk management tool for stop loss carriers in helping manage costs.

~ ~ ~ ~ ~

The market for stop loss coverage has grown at a rapid clip over the past decade, with continued growth seemingly on the horizon owing to high rates of leveraged trend and an acceleration of the shift away from fully insured coverage to self-funded benefits for small and midsized employers. This has invited interest—speculative and otherwise—from traditional and nontraditional players alike looking to capitalize on the potential for easy pickings. The volatile nature of the product, however, offers a cautionary tale for serious-minded participants aiming to build a sustainable business in proceeding with utmost care and caution.

ANKIT NANDA, MAAA, FSA, is a senior reinsurance actuary with Lockton Re, a reinsurance brokerage based in New York.