By Michael G. Malloy

It’s been hard to turn on the news this year and not see prominent stories about extreme weather and climate-change issues. Intense heat blanketed much of the South for most of the summer, with heat indexes holding near or above 100° F in many states. Phoenix had the highest temperature on record for any U.S. city in July, averaging 102.7° F.[1] In the same month, torrential rains in Vermont and New York’s Hudson Valley led to widespread flooding that rivaled the damage from Hurricane Irene, which drenched the area in 2011. Extreme weather in other parts of the world—including India, Japan, and China—were part of a pattern in which scientists cited an atmosphere that’s becoming warmer and wetter.[2]

And it wasn’t just the heat, or the humidity. Much of the U.S. was blanketed this spring and early summer with smoke from Canadian wildfires drifting down over the border. Heading into the heart of hurricane season, an enormous mid-August wildfire devastated the town of Lahaina on the Hawaiian island of Maui, with a mix of man-made electrical wires and high winds from an offshore hurricane fanning the flames that killed more than 90 people[3] The cause of the deadliest U.S. wildfire in more than a century was still under debate as of late September, with experts saying live power lines that came down in high winds may have sparked the fires—Maui County officials and residents filed lawsuits against utility company Hawaiian Electric claiming as such.[4]

As extreme events occur with the backdrop of a warmer and wetter atmosphere, actuaries and insurers alike are recalculating their business models to insure homes and businesses in light of bigger and stronger storms, more prevalent wildfires, and other weather-related natural disasters.

“What we are seeing is entirely consistent with what the scientific community has been warning about for decades regarding climate change,” said Rade Musulin, principal with Finity Consulting, a strategic analytics firm in Australia and New Zealand, former Casualty vice president for the American Academy of Actuaries, and a joint winner of the 2023 Actuary of the Year Award, presented by the Actuaries Institute of Australia.

“No one who’s been following the IPCC [Intergovernmental Panel on Climate Change] or the scientific community should be surprised by this, and as rational actuaries who look at facts instead of emotions, it is becoming almost impossible to deny that this is human-caused—it’s the result of greenhouse gas emissions, which are affecting the climate,” he said. “Climate change is effectively loading the dice, and making [chances of] extreme weather—or in the case of sea-level rise, coastal flooding—more likely.”

Noting that climate change is a global issue, “You have to be concerned about communities and people,” Musulin said. “This isn’t just a mathematical problem; it’s a people problem. [So] it’s clear why climate risk is going to cause problems for the insurance industry—the risk is going to change faster than the defenses, therefore cost goes up, the regulatory system is going to make it difficult to pass that cost on to consumers, or affordability pressure will make it difficult, and then you’ve got an insurance market problem,” he said.

Some insurers are frustrated that California regulators require them to set home-insurance rates based on their historical loss experience—and not projections of future losses that are determined by catastrophe modeling.

In May, State Farm General Insurance Company, State Farm’s homeowners insurance operation in California, announced it had stopped accepting new applications of business and personal P/C lines of insurance, citing “historic increases in construction costs outpacing inflation, rapidly growing catastrophe exposure, and a challenging reinsurance market.”[5]

Allstate, another large national insurance company, also announced it had stopped new P/C coverage in California, citing expenses due to extreme events. The company was the fourth-largest insurer in California, according to 2021 state figures, earning $4.3 billion in premiums that year, with $2.6 billion in losses.[6]

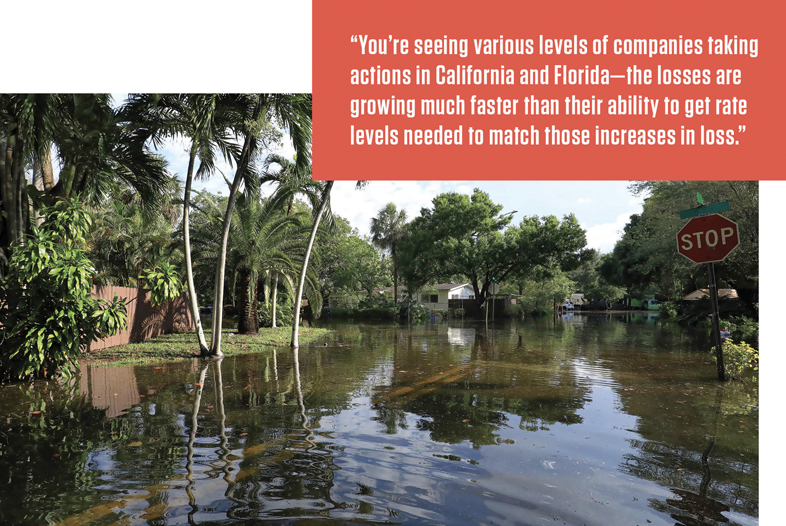

“You’re seeing various levels of companies taking actions in California and Florida—the losses are growing much faster than their ability to get rate levels needed to match those increases in loss,” said Howard Kunst, chief actuary, science & analytics at CoreLogic and a member of the American Academy of Actuaries’ P/C Extreme Events and Property Lines Committee.

“[Catastrophe] models can help with that by providing a longer-term, more stable base than a 20-year look back if you haven’t had a whole lot of loss,” said Kunst, who has been active in the committee’s modeling efforts and contributed to its 2022 wildfire issue paper, which updated a 2019 paper.[7]

“Hurricanes and earthquakes are probably the most mature catastrophe models that are out there,” Kunst said. “The Florida Hurricane Commission reviews and certifies North Atlantic hurricane models every two years so they stay up to date. The majority of events in most catastrophe models are really simulated events based on knowledge of meteorology and how hurricanes form and move, along with the historical probabilities of how they’ll grow and move in certain directions,” he said.[8]

“What you’re seeing in California is just the pointy end of the stick,” Musulin said. “That’s just the beginning of the problem you’re going to see in the U.S. and lots of places around the world, for that matter. We’re seeing that in Australia right now; we’re having problems with flood insurance and bushfire [wildfire] insurance. … We just don’t have a rate regulatory system in the middle, and consumers pay the price.”

He added that “in fairness, those costs can be unbearable to consumers and it’s not right for the system to just tell a consumer who bought a house 15 years ago that their premium went from $500 or $800 up to $8,000 or $10,000 and they can’t afford coverage just because we have better risk models,” and their home is at risk without insurance.

Insurer Concerns

In California, insurers have concerns about everything from rates to reinsurance, said Seren Taylor, vice president of the Personal Insurance Federation of California (PIFC), which represents P/C insurance companies on issues of homeowners, automobile, earthquake, flood, and wildfire insurance in California.

“With the reinsurance market tightening, and prices increasing as much as they have been, the inability of insurers to include the net costs in their rates becomes a significant variable that reduces the ability to bring more capital into California, and companies can’t grow,” he said.

Since the state’s historic wildfires in 2017 and 2018, State Farm had continued to take new business in many wildfire-exposed communities—and absorbed a tremendous number of customers who were non-renewed by other insurers, Taylor said, estimating the company’s homeowners’ insurance market share grew from 17.6% at the end of 2017 to just over 21% at the end of 2022. State Farm was picking up slack in the market but basically couldn’t grow anymore, he said, adding that California’s “outdated regulatory system” does not allow insurers to include the net costs of reinsurance in their rate filings.

Now that reinsurers are analyzing California wildfire risk more like a primary (and not a secondary) risk—as outlined in a 2022 AM Best presentation to the Casualty Actuarial Society[9]—it is increasingly difficult for insurers to serve as many customers, Taylor said.

“With the reinsurance market tightening, and increasing prices as much as they have been, the inability of insurers to include the net costs in their rates becomes a significant variable that reduces the ability to bring more capital into California, and companies can’t grow,” Taylor said.

Allstate told California regulators in 2021 it planned to expand its homeowners’ coverage throughout the state—taking on new customers for the first time in nearly 15 years—if they could get a modest rate increase of about 4.5% approved, Taylor said. But due to intervenors and regulatory delays, it took more than two years to get the rate filing approved—and in that time inflation pushed up residential construction and labor costs by more than 30%.

“So, over the course of that period they went from saying, ‘We’re going to open up for business in every area of California’ to ‘We’re not going to be able to expand at all,’” he said.

Musulin, who has worked in several countries in addition to the U.S., said that insurance rate-regulation is not the norm around the world. “Regulating rates is a foreign concept in most places. Prices in insurance outside the United States are basically set on supply and demand,” in the same way as other commodities. California’s ban of catastrophe modeling is an anomaly in this global context, he said.

“What you’ve got is a fast-changing view of risk on the actuarial side, and it’s largely enabled by technology,” Musulin said.

In comparison to rate-setting several decades ago in the 1980s and 1990s that were largely set by ZIP codes, “today you’ve got this tsunami of data, forensically telling you what a house is made out of—what kind of roofing materials it uses, the tree cover around the house from satellite imagery,” he said, which can feed into rates including wildfire coverage.

The result of this, with rate-setting practices, can lead to both good news and bad news for consumers, Musulin said. The good news is some level of stability in their insurance premiums that are not subject to sticker shock with prices going up—“the regulators do a good job of protecting people from radical change, and that’s not a bad thing,” he said. The bad news is that companies will either refuse to write policies or just leave markets—as State Farm and Allstate have done with their California wildfire coverage.

Something more subtle is encouragement of people not to get out of harm’s way—for example, excessive coastal development in hurricane zones, in part as a result of subsidized flood premiums under the National Flood Insurance Program (NFIP), Musulin said.

Reinsurance Perspective

Determining the most important perils is a complex question and will depend on whom you ask, said Peter Ott, senior pricing officer with reinsurance firm Swiss Re. “From a regulatory standpoint, the focus is a lot on solvency and capital events such as hurricanes and earthquakes, but I don’t think you can ignore what you might call secondary perils and what’s been happening with wildfires,” he said.

“You can clearly see this in the mandate that came out of California providing homeowners credits for their wildfire mitigation. Some of the recency of some of these perils, and their magnitude, is causing alarm from a regulatory standpoint,” he said. “From an industry perspective, concern still is around the adequacy of rates. Where I think there is a larger focus is the understanding about the level of certainty with these perils.

“Actuaries need to consider that thinking climate change and these risks is a nonstationary process,” he said. “We always say the past isn’t indicative of the future—that’s even more important as we think about climate change and our ability to cost that going forward.”

In the reinsurance market, “the movement from reinsurers is affecting the large primary insurers’ decisions to either pull out of certain regions or mitigate their new [under]writings, depending on the insurer” and the regulatory landscape in which insurers are operating, Ott said. “So the question of whether or not a primary insurer can pass on expenses that vary from the reinsurance perspective to customers is on a state-by-state basis, there’s a pricing and regulatory challenge there.

“From a reinsurer’s standpoint, as we look to mitigate against some of these risks, we can move a little bit faster based on position in the market, and there’s this inherent lag between us trying to price for the future of the changing landscape of these risks, and the ability of the primary insurer to react to change,” he said. “We’re trying to price for losses we expect in the near future, and it’s a more difficult problem for the primary insurer to then adjust accordingly with their premiums and also how they view their risks.”

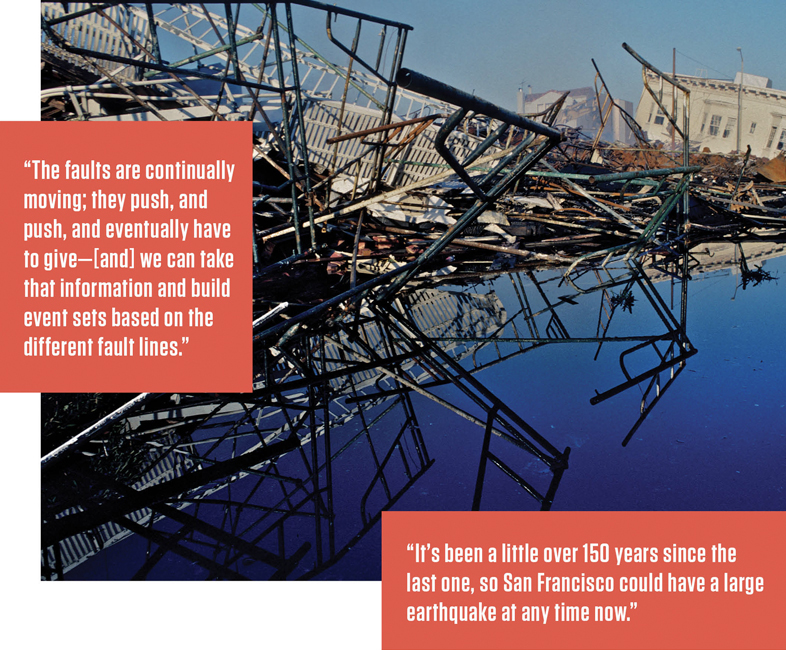

Earthquakes are “a little different in the modeling,” Kunst said, based in part on U.S. Geological Survey information on known faults and projected periods in which events could occur. “The faults are continually moving; they push, and push, and eventually have to give—[and] we can take that information and build event sets based on the different fault lines,” he said.

Kunst noted that historically, the Hayward Fault near San Francisco ruptures at a 6.5 magnitude or greater every about every 150 years. “It’s been a little over 150 years since the last one, so San Francisco could have a large earthquake at any time now,” he said. (The fault’s last earthquake of 6.5 magnitude or greater was in 1868.[10]) Everyone from scientists to architectural and structural engineers and other vulnerability specialists review the models to understand how different-magnitude events would affect different buildings and structures, he added.

Citizens Corp.

Ott called Florida’s Citizens Property Insurance Corporation—set up by that state’s legislature in 2002 as a means to address P/C and hurricane-related issues—“an interesting organization and idea. I would lump it in with any kind of structure or government organization that is looking to provide capacity and coverage for these types of perils.”

He noted, though, that the core principle of insurance—which is around aggregating risks and the associated resources to pay for them, “has to come back to the idea of can you set an actuarily sound price to cover those risks. Different government organizations have had different levels of success in their ability to do that, but I think that’s the fundamental question that has to be answered. Also, in order to mitigate risk—and help fund for these risks, which is what Citizens is doing—you can either transfer some of this risk in the form of reinsurance or just insurance … or you can avoid these risks altogether.”

Regarding Citizens and its potential applicability to other states, Musulin said the one thing governments can do that a private company can’t is impose assessments. So while a private company can’t compensate by such imposing assessments, governments—through programs like Citizens—can. California could have a similar program to Citizens, but the issue would be where the money would come from to fund losses. “That’s always the conundrum here,” he said.

If a company writes a policy and a state regulator won’t allow it to charge more when reinsurance costs go up, the company could go under, and those risks could fall to Citizens—and while this particular example is specific to Florida, similar issues exist in other states. “And now you’ve got billions of losses in Citizens partly because the NFIP incentivized people to move to the beach,” Musulin said. “It’s kind of a long-term story in the U.S., with governments warping risk incentives. … In the long run the losses get bigger, and consumers, or taxpayers, or society, have to pay more to fix it.”

He gave a hypothetical example of a Florida insurer with properties on one side of a ZIP code on the coast and the other on farmland 30 miles inland. If another competitor comes in and writes rates on the inland properties, then the insurer with the beachfront homes and businesses will end up holding just about all of the risk.

“So the problem is that even if an insurer wanted to try to defy reality and flatten prices across the ZIP codes or states, the competitive market won’t let it happen,” said Musulin, who was a senior executive for an insurance company in Florida for several decades.

“Insurers can continue to write business knowing that it’s costing them five dollars to issue a policy they’ll get three dollars in premiums for, and that’s a road to ruin—or they can just stop writing policies because they’re not getting enough to cover the risk,” he said.

Alluding to the California situation, Musulin said “this is particularly a problem for the AllStates and State Farms of the world that are national companies. They can’t afford to lose billions in California, because they’re going to have to take money away from their policyholders in Michigan or Montana … and regulators in those states are not going to let you raise rates in Michigan to pay for California.”

If they don’t charge enough money because they want to keep prices affordable for consumers, they have a mechanism to compel everyone in the state to pay for it, and that’s effectively how Citizens works, he said, adding that “some Florida legislators call them ‘hurricane taxes.’”

State, Regulatory Issues

Noting there has been a lot of conversation around how to support costs for, and consider mitigation and adaptation efforts by, insurers and policyholders, Ott said, “I think there needs to be a larger focus as well around what is the long-term solution for this. And, what happens if the actuarily sound price becomes untenable for policyholders.”

The summer’s catastrophic floods in northern New England showed that extreme events can pop up anywhere around the country, and Ott noted the National Association of Insurance Commissioners (NAIC) “has a very important role. As we know, insurance is largely regulated on a state-by-state basis, but if you look at his climate and emerging events—and many events that haven’t been seen in certain regions of the United States—we have to recognize that these events don’t pay attention to state borders.”

Referencing a Federal Insurance Office (FIO) paper released in June around adaptation and regulatory supervision around climate events,[11] he said “a desire for the NAIC to identify what I would call best practices within states, and states who face similar perils. So for perils and events that are able to significantly impact large regions of the country at once, I think there needs to be an equally consistent and scale of a regulatory response as well, so the NAIC has clear role helping states identify who has had some of these best practices, and the extent they can, create consistency within those regions around how they want to respond as well.”

He noted that the two of the things FIO is looking for from both the NAIC and the industry is information on how climate change is affecting historically underserved communities and the additional constraint on the asset investment side, including ESG-related (environmental, social, and governance) topics.

Ott is also involved with both the Actuaries Climate Index (ACI) and the Actuaries Climate Risk Index (ACRI), serving as chairperson of the American Academy of Actuaries’ ACI/ACRI Work Group, part of the Extreme Events Committee. On the ACI/ACRI side, international groups “have reached out to see if they can mimic what we’re doing,” he said. “A lot of the work that we’re doing is also to extend access and understanding to actuaries to be able to leverage this underlying climate data to update the ACI, and eventually the ACRI.”

The ACI, which began is 2016, is sponsored by the Academy, the Casualty Actuarial Society, the Society of Actuaries, and the Canadian Institute of Actuaries.[12] The Academy unveiled the ACRI in 2020.[13]

“I think the timing of all this work is aptly timed right now, in terms of the needs that we’re seeing from the community,” Ott said. “I’m excited to see the updates coming from the ACI and the ACRI, and the Climate Change Joint Committee.”

States and the federal government have also taken action.

The White House in March 2023 earmarked $197 million to make communities more resilient to wildfires and strengthen federal, state, and local response, funded by the U.S. Department of Agriculture’s new $1 billion Community Wildfire Defense Grant program.[14]

In Colorado, Gov. Jared Polis signed two bills into law in May, one of which allows home- and business owners who cannot secure adequate property insurance because of wildfire risk to obtain an insurance plan of “last resort,” and sets up a board to run a quasi-state insurance plan for property owners who can prove they are unable to get insurance from a private company. The other creates a wildfire homes grant program that allows homeowners to apply to receive a grant for retrofitting or improving a homes to make them more resilient to wildfires—and increases the notice required by insurers canceling or refusing to renew homeowners’ policies from 30 to 60 days.

Looking Ahead

Asked what perils might be top-of-mind in the next decade, Ott said, “Actuaries will be spending a lot more time on these secondary perils and the events which historically not been captured in standard industry catastrophe models. That’s like derechos, and these one-off events, like Winter Storm Uri in Texas,” he said, referring to the unofficially named February 2021 winter storm that wreaked havoc on the Lone Star State’s power and water grid, causing an estimated $80 billion to $130 billion in damages.[15]

“I think we haven’t been to wrap our mind around the full space of what is possible, and as that changes, we will become more and more surprised over the years,” Ott said. “So I don’t know if I would say there’s a specific event, because I think what it is going to be is how can we broaden our perspective about what events are possible and spending a lot more time trying to understand is that even conceived and thought about in the standard models, and how do we price for those things.

“We need to start thinking about this as a non-stationary process, and ask ourselves, how is this going to change, because we know things are changing—and we keep being surprised year after year—and so, how do we cost for and think about things rigorously, when those events have never been seen historically. So that’s where I think we’ll be in 10 years,” he said.

Warming Seas

Warmer water temperatures feed larger hurricanes, leading to more severe wind and flood damage. This summer, as the 2023 hurricane season was readying for its September peak, water temperatures in South Florida were recorded at more than 100° F, near the highest on record for the planet.[16]

“All bets are off this year, because the water’s plenty warm,” said Brian Haus, professor and chair in the Department of Ocean Science at the University of Miami’s Rosenstiel School of Marine and Atmospheric Science, said in a late-July interview. “Temperatures are pushing 100° [Fahrenheit] in the middle of the [Florida] Keys,” and even near Miami are close to 90° F, he said, adding that “these are like late August temperatures about a month early,” when ocean water temperatures typically peak.

With a few hundred real-world examples, a hurricane model could have 50,000 simulated events that show impacts to U.S. coast, Kunst said. “When Hurricane Michael hit the Florida panhandle [in 2018], it was the first time in historical record that a hurricane of that magnitude impacted that part of the coastline, so that that event was put into the historical events set,” he said. “Also, as a result the models adjust for new information, updating to the current climatology … in addition, we can adjust the model parameters to whatever climate conditions we want to model,” such as the 30-year warming and cooling cycles of the Atlantic, or even various climate change projections.

Haus said that with only about a dozen named Atlantic hurricanes a year, there is a limited amount of data available on their tracks and progression, compared with previous years.

“It’s difficult to get really reliable statistics on these things when there’s such low numbers of occurrences,” he said, adding that “there has been demonstrated increase, on the order of something like 10% in storm intensity, over the last couple of decades. Storms are holding more moisture as air gets warmer, and that leads to the potential for more rainfall,” said Haus, who was featured working in his lab in the 2022 Netflix “Earthstorm” series episode on hurricanes.[17]

The result could mean slower-moving hurricanes—like Hurricane Harvey in 2017, which stalled over Texas, dumping catastrophic amounts of rain around Houston and causing more than $125 billion in damage, the state’s most costly natural disaster on record at the time.[18] Last year’s Hurricane Ian, which barreled in from Florida’s Gulf Coast through the state and into the Carolinas in late September, caused an estimated $47 billion in damages.[19]

“As air gets warmer, that decreases the vertical gradients in the upper atmosphere, which can cause storms to slow down,” he said. “They’re not super-dramatic numbers, but they can add up and mean the difference between a Category 3 or a Category 4 hurricane, and the potential to increase inland flooding.

“The conditions that lead to more storms forming in different locations on the Earth—that’s still relatively difficult to predict long term,” Haus said. “There’s been work that has suggested shifts from Atlantic storms to Pacific storms, or more storms overall, so we don’t know if we’ll get more storms, or the [hurricane] season will be extended,” he added, noting that in recent years storms have formed in June and even into December, after the end of the standard June 1-to-Nov. 30 Atlantic hurricane season.

(It’s been more than 35 years since a major hurricane has made U.S. landfall in June, although several tropical storms have hit the Gulf Coast in recent years, including Tropical Storm Cristobal in 2020.[20])

Hurricanes generally lose strength as they move north and encounter colder waters—“So while storms have encountered cooler water sooner in past years, warmer water may allow them to maintain their intensity,” Haus said.

Even Hurricane Katrina, which killed more than 1,000 people in and around Louisiana in 2005, weakened over the Gulf of Mexico from a Category 5 to a high-end Category 3 storm before slamming the Gulf Coast and causing catastrophic damage in three states. (Category 5 hurricanes, the strongest level, have sustained winds of 157 mph or greater.)

On “Earthstorm,” Haus showcased the lab’s 75-foot tank, which simulates wind and water impacts on structures, including bridges, homes, and other buildings. The scale models “provide more of the detailed quantification of what loads on structures would be in really intense conditions,” he said. “We can simulate winds up to Category 5 [and] can measure these things in conditions they’ve never been measured before, and get better formulations for models.”

The lab shares its data—some of which is federally funded by the National Science Foundation and the National Oceanic and Atmospheric Administration (NOAA)—which is “available for people to look at directly,” he said. There is a need for its energy-transfer and modeling work, and “we’re in regular communication with NOAA’s Hurricane Research Division, which is right across the street,” he said.[21]

“That can get into models, similar to climate models,” including information like heat-transfer and friction rates. “As the information gets into the literature it can be incorporated into building codes,” he said, adding that the lab has also done work with the insurance industry, which can run risk models based on the lab’s work on different types of buildings, “and they can use that as a basis for their rate-setting, demonstrating they have a basis for the rates they want to charge.”

Political Concerns

Some of the challenges faced by insurance companies related to climate change can go well beyond the immediate concerns of a particular extreme event. In a June presentation to the Singapore Actuarial Society, “A Holistic View of Climate Risk: Extreme Weather, Rising Seas, Decarbonization, Economics, Politics, and How They Interact,” Musulin offered a (very) big-picture look at the global issues involved.

“If you look at the challenges the insurance industry faces from climate change, they go well beyond hurricanes, wildfires, tornadoes, and floods,” he said, and they can include everything from repairing electric vehicles coming on as the world moves away from carbon-based fuel to “Build Back Better” building codes in housing retrofits.

“There’s a whole range or risks—and opportunities, to be fair—which are not directly the result of direct climate impacts but decarbonization, which is going to create huge disruptions in every economy in the world. … Technology alone is going to drive that, regardless of what politicians do. That’s going to change the customer base for insurers, the investment portfolio; it’s going to affect the products insurers have to offer, and how things are repaired or rebuilt.”

He called it a “subtext” of the effects of climate risk, and in his presentation gave an example of “compound extreme events.” In December 2021, a tornado outbreak in Kentucky killed 74 people and caused widespread property losses in the Bluegrass State. One of the most severe December events on record, it reflected abnormally high temperatures and unusual jet-stream patterns.[22]

At the same time, the price of lumber—a key component in home construction and rebuilding—hit $1,700 per thousand board feet, well above its historical $300 to $400 range. That—as a January 2022 story in The Atlantic reported—pointed to climate-related drivers, including beetle infestations, wildfires, and floods in timber-producing regions in Canada.[23]

“That’s an example of where these climate effects can interact and create strange outcomes that you wouldn’t have seen,” Musulin said. “It’s really hard to predict things like that.”

MICHAEL G. MALLOY is managing editor for member content at the Academy.

Endnotes

[1] “Phoenix now has hottest month on record for a US city: July 2023, 102.7°F,” tweet, Arizona State University Climate Office, Aug. 1, 2023. [2] “Deadly flooding is hitting several countries at once. Scientists say this will only be more common,” Associated Press, July 10, 2023. [3] “How Fire Turned Lahaina Into a Death Trap,” The New York Times, Aug. 15, 2023. [4] “Maui Wildfires Latest: Lahaina Reopens to Residents,” New York Times, Sept. 29, 2023. [5] “State Farm General Insurance Company: California New Business Update,” May 26, 2023. [6] “Another major insurer is halting new policy sales in California,” CBS News Moneywatch, June 2, 2023. [7] Wildfire: An Issue Paper—Lessons Learned from the 2017 to 2021 Events,” American Academy of Actuaries, January 2022. [8] 2023 Hurricane Risk Report, CoreLogic, May 31, 2023. [9] “The Growing Impact of Secondary Perils,” AM Best, 2022 Casualty Actuarial Society Spring Meeting, May 17, 2022. [10] “Hayward Fault Zone,” Wikipedia. [11] “FIO Releases Report Assessing Climate-Related Risk, Gaps in Insurance Supervision,” Federal Insurance Office, June 27, 2023. [12] Actuaries Climate Index. [13] Actuaries Climate Risk Index, Preliminary Findings, January 2020. [14] “Biden-Harris Administration Provides Communities Resources to Bolster Resilience to Wildfires in Advance of 2023 Fire Season,” The White House, March 20, 2023. [15] “Winter Storm Uri 2021: The Economic Impact of the Storm,” Texas Comptroller, October 2021. [16] “South Florida may have set world record for warmest seawater,” Associated Press, July 24, 2023. [17] “Netflix: Earthstorm,” 2022. [18] “Hurricane Harvey,” Wikipedia. [19] “Hurricane Ian’s Path of Destruction,” NOAA, Oct. 4, 2022. [20] “The Last June U.S. Hurricane Landfall Was Decades Ago, But Tropical Storms Have Caused Serious Impacts,” Weather Underground, June 8, 2023. [21] NOAA, Hurricane Research Division. [22] “Tornado outbreak of December 10–11, 2021,” Wikipedia. [23] “Lumber Prices Are Off the Rails Again. Blame Climate Change,” The Atlantic, Jan. 19, 2022.