By Srivathsan Karanai Margan

The first generation (1G) of wireless network technology began the dissemination of mobile phones in the 1980s with analog voice calling. The second (2G) and third generation (3G) came in the next decades, introducing the age of multimedia messaging and mobile internet respectively. The fourth generation (4G) that is currently prevalent has changed the scope of how people use their mobile phones. It charted a new era of digital connectedness with high-definition streaming. These technologies have progressively spearheaded a multi-sided data-driven economy by exponentially increasing the surge in data traffic among industries and consumers. Over the years, the way people communicate, connect, transact, and consume has changed drastically.

The fifth generation (5G) is the latest edition currently being rolled out across the world. It promises to provide superfast broadband, high capacity to handle mass connections, extreme reliability, and ultra-low latency. 5G is expected to revolutionize the connectivity paradigm and redraw the contours of productivity, efficiency, utility, and experience. This article discusses the scope of 5G, its likely impact on industries including insurance, and what to expect.

The promise of 5G

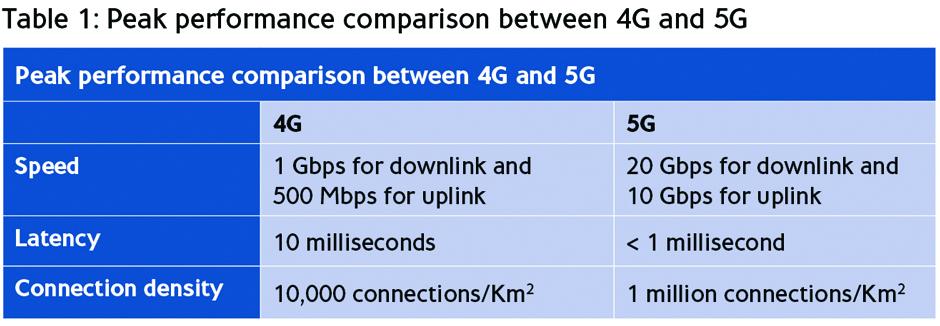

At the peak of its capacity, 5G promises a speed of 10 gigabits per second, latency of less than 1 millisecond, and connection density supporting 1 million devices per square kilometer. With such incredible performance benchmarks, 5G is expected to deliver user experiences vastly superior to 4G. (See Table 1)

This outperformance is possible because the way in which 5G operates is radically different from the earlier network generations. 5G uses higher-frequency radio waves that have a shorter physical range. This requires communication service providers (CSP) to make huge upfront investments to build a dense physical infrastructure comprising smaller geographic cells. A very niche feature of 5G is “network slicing,” which is the capability to create logical segments of network that offer tailored and guaranteed services to specific needs of users.

4IR and the confluence of 5G

The fourth industrial revolution (4IR), which is characterized by the merger of digital, biological, and physical world, is in the early stages of evolution. Evinced by the concurrent evolution of several technologies such as additive manufacturing, artificial intelligence (AI), autonomous vehicles, big data, blockchain, cloud computing, edge computing, extended reality (XR), and IOT, it is set to change the way we live, work, travel, purchase, consume, and interact. The foundational paradigm of these emerging technologies is the connectedness that redefines the way data are generated, stored, analyzed, consumed, and acted upon. With a surge in the number of connected devices and solutions, an “everything-is-connected” environment will manifest in which data is the underpinning driving force. The phenomenal surge in the data traffic will necessitate a much abler network. Appositely catering to this need, 5G is expected to act as a lubricant in accelerating the transition to 4IR.

The power of 5G when fully unleashed will result in the compression of time and distance constraints related to communication between source and destination. This could unravel a new revolution in the hardware and software landscape where solutions at the user end could become less complicated as the core processing functions are shifted to the edge of the network. 5G is touted to be not just an access technology, but a transforming general-purpose technology (GPT) because of its potential to handle a wide range of products and distinct applications, the capability to improve itself over a period, and the capacity to trigger improvement and innovation in other 4IR technologies.

The initial happening zone of 5G, however, is expected to be focused on exploiting the benefits of hyper-connectivity, improved data ingestion, higher connection density, and quicker feedbacks for providing a better customer experience to access multimedia content and digital services. The majority of the early use cases will be derivatives of the experiments that were initiated with 4IR and 4G, now being reinvigorated with 5G.

Impact of 5G on other industries

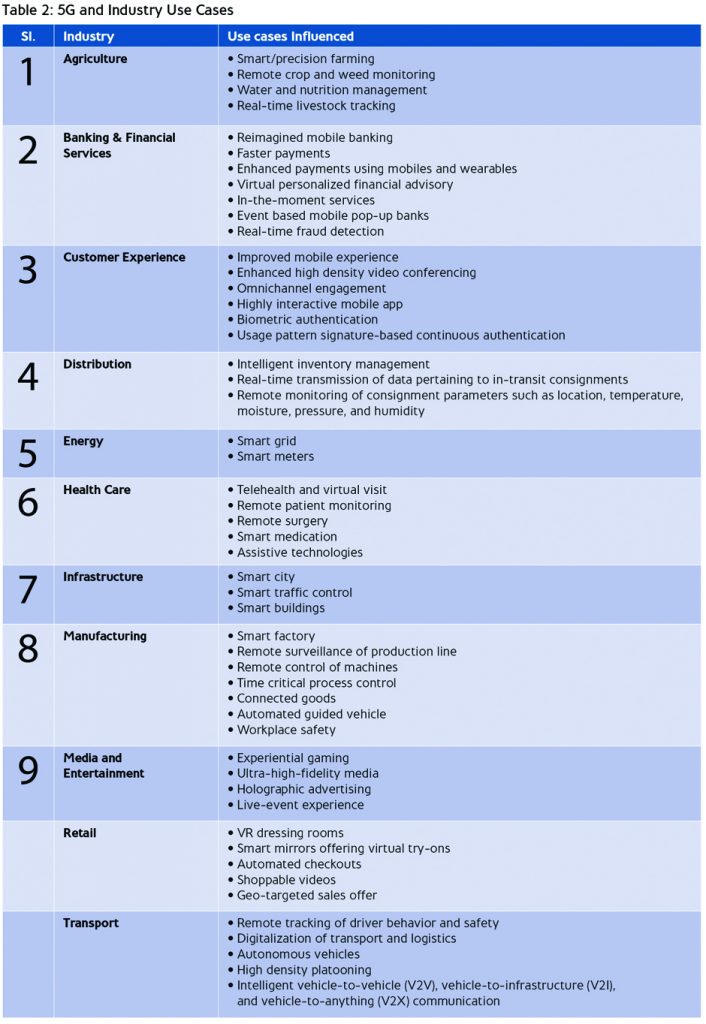

Over the last several decades, the evolution and adoption of new technologies, including the two most important game-changing pivots—internet and smartphone—have resulted in a continuous reinvention of the relationship between industries and their customers. In this process, several business models, products and services got altered, became redundant or new ones emerged. As regards the core impact of 5G on industries, it will be felt only by the way it integrates with other 4IR technologies. Due to their confluence, the very purpose of the industries could get redefined as they lead together into uncharted territories. The paradigm shift that industries have started toward building digitally connected ecosystem-based business models will get rejuvenated with 5G. An indicative list of the widely articulated 5G-driven industry use cases is mentioned in Table 2.

While superior experience is the broader theme of all the non-core use cases, the dominant potential benefit from the core use cases is the efficient management of risk and continuation of safety by controlling activities that are prone to human error and risk. Remote and continuous monitoring, outlier prediction, autonomous or human intervened preventive response, and deriving prescriptive insights are set to become a new standard activity across the industries. This will immensely help industries to reduce the risk frequency and severity for many of the known and controllable risk events and the resulting financial loss.

Impact on the insurance industry

The confluence of 5G and 4IR technologies will impact the insurance industry in two ways—first as a direct user of these technologies in their operations and second as a cascading effect due to overall risk compression of its customers. The impact could be further categorized based on whether the core or non-core business functions are impacted and if the period under consideration is near-, mid-, or long-term. While a reimagination of non-core business areas, services, and operating models will occur in the near- and mid-term, core business areas including products and business models will be reinvented in the long term. The narrowing of the connection gap among insurers, its partners, intermediaries, and customers, will lead to the when, what, where, and how aspects of access to insurance products and services being revisited to provide a richer experience. The digitalization initiatives that have been aggressively pursued by the industry in the year 2020 to face the COVID-19 pandemic-imposed restrictions, will scale many notches higher with 5G. The new avenues for intense virtual interactions with customers and other stakeholders will improve the effectiveness of engagement.

The opportunity to reduce the overall risk across industries will have a major impact on the insurance industry, which plays the most important role of a risk transferee in the risk management relationship. The core business expertise of insurers is to gather data related to risk, analyze it, discern causative associations, estimate the probability of the occurrence of a risk event, and calculate the premium to charge for the risk transfer. The democratization of risk management due to the hyper-connectivity between the source from where the risk-related data originates and the destination where it is consumed and acted upon will likely change the risk management landscape forever. The extensive flow of risk-related data in real time will enable insurers to have a deeper understanding of the covered risk and the various human, technology, and systemic factors that influence it. Insurers can analyze these constraints pragmatically to ascertain the extent to which risk could be controlled with the new technologies. Based on this, they will need to recalibrate their coverage proposition by quantifying those subjective parameters influencing risk to redesign and reprice the coverages.

Though insurers have traditionally operated in an ecosystem to manage risk, it has been siloed and disconnected. The concept of a digitally connected ecosystem emerged with 4IR and insurers started reinventing their purpose from remediation of risk to actively participate in the business of holistic risk management for continued safety. As it spreads vastly with 5G, new collaborative relationships, contractual obligations, and governing regulations will evolve to handle the risk-related fast-data flow. 5G will be an important ingredient for effecting a seamless data transmission between the orchestrator of such ecosystems and its several participants. The connected insurance ecosystems and real-time risk verification could make parametric insurance contracts more popular. Parametric products have been long stigmatized from broader application and acceptance due to the presence of “basis risk,” which is the difference between actual risk exposure and parametric payment. The higher connection density of 5G will narrow the displacement of exposure from measurement stations reducing the basis risk. Consequently, parametric contracts could be successfully implemented for many new risks.

The ubiquitous spread of connected devices and the improvised data transmission capabilities of 5G raises apprehensions regarding surveillance, which could increase litigation risk for insurers. The distributed software-defined digital routing envisaged by 5G increases the overall cyber-risk surface. Hackers could potentially exploit the vulnerabilities of expansive digital networks to launch faster cyberattacks. Insurers will have to analyze the dynamically evolving cyber risk landscape, to identify their soft spots as well as coverage gaps to redefine the terms of the contract and launch new coverages, respectively. Higher electromagnetic frequency (EMF) radiation caused by 5G is another challenge that is raising trepidation with respect to potential health effects. While the epidemiological studies conducted so far negate any potential risk, the problem is still intensely debated. There is an inherent fear that exposure to high EMF radiation could be more complex than the asbestos risk for it could impact every individual. This is quite unlike asbestos that had an impact only on the workers who were involved in its production and their family members. Insurers currently exclude coverage for any health, general liability, loss, damage, and legal expenses that result directly or indirectly from radiation. If the continuous exposure to the EMF from 5G triggers long latency period response ailments, it could manifest into an extreme risk scenario.

A reality check

5G is not a complementary technology that will be replacing all earlier generation networks immediately. It will co-exist with earlier generations for a considerable number of years. The rollout of 5G is currently embroiled in geopolitical and techno-nationalistic complications that could potentially derail or delay the launch plan in several geographies. As the rollout of 5G involves a trade-off between investment and performance, CSPs are also following different approaches to launch. Some CSPs are opting for the higher-frequency radio waves, which will provide the superlative experience, but launching it only in selected cities. Some on the other hand are opting for low- and mid-frequency radio waves that may involve lesser investments, but the performance is relatively toned down. These differential approaches will hamper the actual 5G experience, its consistency, or both. Even in the countries where 5G is already available, the performance benchmarks are markedly different.

Industries are still trying to identify the most potent use cases of 4IR and 5G. Many of these core use cases are conceptual in nature, and the qualitative and quantitative analysis of the cost versus business value and adoption is yet to be performed. It could take several years for them to be implemented. Continuous risk monitoring is being prophesized as the killer use case across all industries. It cannot be ignored that the concept of the connected insurance business has been discussed for several years now, and even with 4G connectivity, the much-glamorized concept has not seen popular adoption. It has to be ascertained whether the limited adoption was just because of technological constraints related to connectivity for which 5G will be a panacea. If on the other hand, it was due to other technological compatibility issues, human concerns on cost and privacy, need for regulatory clarity on insurance contracts, lack of connected ecosystem governance principles or the role that insurers will play in such ecosystems, the mere availability of 5G may not improve the uptick.

Insurers have traditionally followed a post-risk remediation model and the concept of continuous tracking is relatively new. The initial experiment by insurers was to tweak the traditional products slightly in some lines to handle the new connectedness paradigm. The changes were more focused on rewarding customers for opening the risk data sharing window and proactively intervene in case of a risk event. These were revolutionary considering the conservative fortress within which the insurance industry operates. Given this scenario, how much of the existing contractual obligations of insurance desperately require the extraordinary 5G capabilities to execute is a point to ponder. The conundrum on which data to consume, how to consume, what to infer, or how to appropriately respond will remain until entirely new connected insurance products are introduced with an affirmative definition of terms and conditions for consuming continuous risk data.

The journey ahead

The retail, transport, manufacturing, and health care industries are the front-runners to experiment with use cases for exploiting the capabilities of 5G. The intense customer engagement in retail, the growth of associated technologies in transport, and the extreme criticality and time sensitivity in manufacturing and health care are the core drivers for this pursuit. Insurers will have to create a comprehensive 5G strategy enumerating the services, business processes, and products where they intend to incrementally implement it. Though insurers are not seen rushing to experiment with 5G use cases in their core operations, customer experience-oriented use cases are likely to spearhead the implementation in insurance. The increase in the magnitude of data traffic will require insurers to upgrade their applications to receive, store, analyze, and derive intelligence from the fast data and be quick in initiating the appropriate action.

SRIVATHSAN KARANAI MARGAN works as an insurance domain consultant at Tata Consultancy Services Limited.

References

[1] GSMA. (2019, April). The 5G Guide: A reference for operators. Retrieved from https://www.gsma.com/wp-content/uploads/2019/04/The-5G-Guide_GSMA_2019_04_29_compressed.pdf [2] Gartner. (2020, May 29). Market Trends: 5G for Banking. Retrieved from https://www.gartner.com/en/documents/3985823/market-trends-5g-for-banking [3] Huawei. (2017). 5G Unlocks a world of opportunities: Top ten 5G use cases. Retrieved from https://www-file.huawei.com/-/media/corporate/pdf/mbb/5g-unlocks-a-world-of-opportunities-v5.pdf?la=en [4] IHS Markit. (2019). The promise and potential of 5G: Evolution or revolution? Retrieved from https://assets.ctfassets.net/ob7bbcsqy5m2/3NJM5O4hDRcNeZB9ZVCms1/ecbc941cf206fec85dbf26031fce1a68/IHS-Markit-Technology-5G-The-Promise-Potential.pdf [5] Nokia. (2020). Unleash the value of 5G: Use cases to expand your business. Retrieved from https://pages.nokia.com/T00583-Unleash-the-value-of-5G-ebook.html?_ga=2.7028018.1015152771.1611138751-511704534.1611138751 [6] Nokia and Omdia. (2020). Beyond connectivity: CSP perspectives on higher-value 5G use cases. Retrieved from https://onestore.nokia.com/asset/207152 [7] World Economic Forum and PWC. (2020, January). The impact of 5G: Creating New Value across Industries and Society. Retrieved from http://www3.weforum.org/docs/WEF_The_Impact_of_5G_Report.pdf