By John T. Stokesbury

So, there I was. I remember it like it was yesterday. I was reading my prior year memo to get up to speed for this year’s project. And one sentence caught my attention. I kept reading it over and over again. Something tickled the back of my brain.

And then I remembered.

The sentence said the assumption was “not unreasonable.” But that wasn’t what I had written. I clearly recalled the issue now; I had spent days struggling with the topic and finally concluded that the assumption was “unreasonable.”

What happened?

It took some research, but I got to the bottom of the matter. A junior staffer had inserted the word “not” in that sentence after I had delivered my memo. He had thought that subsequent discussions had resolved the question, and rather than circling back to me, he simply “updated” my memo.

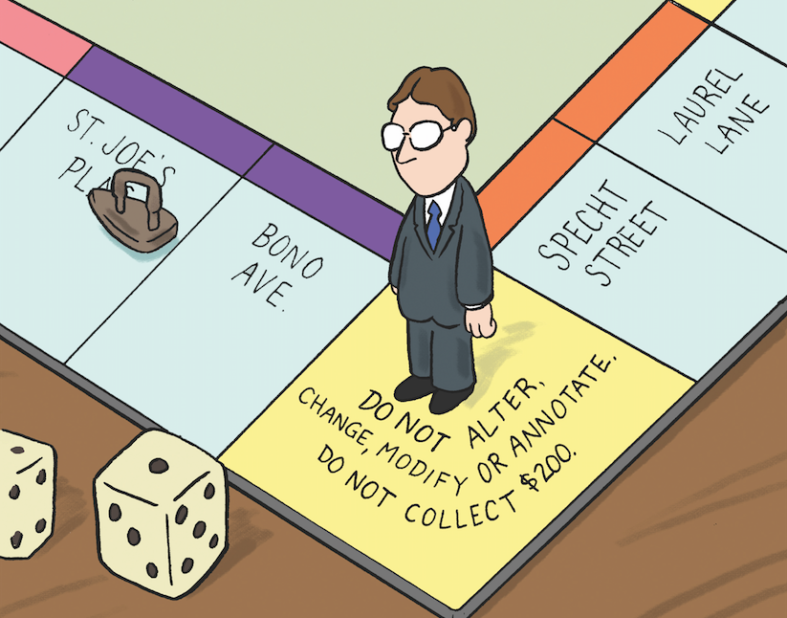

After cleaning up the documentation, I did some thinking about what I could have done differently to prevent—or at least reduce the likelihood of—a similar occurrence in the future. So, I dusted off my copy of our Code of Professional Conduct and read Precept 8:

Control of Work Product

PRECEPT 8. An Actuary who performs Actuarial Services shall take reasonable steps to ensure that such services are not used to mislead other parties.

ANNOTATION 8-1. An Actuarial Communication prepared by an Actuary may be used by another party in a way that may influence the actions of a third party. The Actuary should recognize the risks of misquotation, misinterpretation, or other misuse of the Actuarial Communication and should therefore take reasonable steps to present the Actuarial Communication clearly and fairly and to include, as appropriate, limitations on the distribution and utilization of the Actuarial Communication.

What would have been a “reasonable step” I could have taken in this situation? A first step would be to reach agreement that any updates to my memo would need to be cleared by me. While reasonable, that didn’t seem to be enough for me. In this case, using a password or some other protection to prevent someone else from updating my memo seemed like a better solution.

And then I got thinking. What are other situations where a reader might be misled by (or simply misinterpret) an Actuarial Communication—and what are reasonable steps an Actuary can take to mitigate that risk? I came up with some plausible situations—certainly not an exhaustive list—and approaches that I might consider to mitigate the risk. (Of course, other actuaries might well come up with other reasonable steps to address these or similar situations.)

One situation that I can imagine is a Principal[1] sharing only extracts and pieces of an Actuarial Communication. This situation could be perfectly innocent—for example, distributing summary sections in order not to overwhelm an audience—or less innocent—for example, providing only those examples that favor the Principal’s point of view. In any case, there is a risk that the subsequent audience would not appreciate the full extent and context of the Actuarial Communication and would be misinformed or misled. At a minimum, the audience would be at risk of making a decision with less-than-complete information.

For me, I can see a couple of approaches to mitigate this risk. One, the Actuary could proactively inform the Principal that only the complete Actuarial Communication could be shared with others. Or, that the Actuary would be entitled to review (and approve) any summary or extraction of the Actuarial Communication before it is shared. Or perhaps place a footer on each page alerting the reader that the entire document is needed to have proper context.

Another situation could arise in which the Principal is not happy with a recommendation made by the Actuary or the results of some actuarial analysis. In this situation, the Actuary and the Principal are not in perfect alignment. Certainly, there is often room for different points of view and different interpretations of data. And the Principal’s view might well be reasonable—but it is different from the Actuary’s view. As Actuarial Standard of Practice No. 41, Actuarial Communications, discusses in Section 3.4.4, unless the Principal’s view significantly conflicts with the Actuary’s view, the Actuary may not have a disclosure requirement.

However, I think Precept 8 is a little more subtle—is there a risk that another party might be misled if the Actuary does not take some action? In other words, is there a risk of omission? For example, consider the situation where the Actuary provides the Principal with an analysis that supports a particular assumption. The Principal has access to other analyses and considers those in the ultimate selection of the assumption (which may not be consistent with the Actuary’s analysis). Would it be misleading for the Actuary to write that the Principal considered the actuarial analysis, and leave it at that? Or would it be better for the Actuary to mention that the Principal considered the actuarial analysis as well as other information? How much detail would the Actuary want to provide regarding the “other information”? Would the Actuary want to provide any assessment of the “other information” and how it might support or conflict with the actuarial analysis? How much is enough? How much is too much?

In this situation, the sophistication of the potential “other parties” may be a factor to consider. For example, if the Principal is expected to share the Actuarial Communication only with senior management or within the C-suite, and there have been other recent Actuarial Communications to provide context, then the Actuary may conclude that little or no additional information/discussion is appropriate. On the other hand, if the Actuarial Communication has the potential to be shared more broadly within the Principal’s organization—or even with the public at large—then the Actuary may conclude that additional discussion or information is warranted.

And certainly there is no one right answer; the Actuary would need to consider the specific facts and circumstances. In fact, the Principal might be very sensitive to any hint of differing points of view and extensive discussion that might highlight an issue. Nonetheless, our Code of Professional Conduct requires that the Actuary be aware of the potential for an Actuarial Communication to be used to mislead others—and to take reasonable steps to address that risk.

JOHN T. STOKESBURY is a managing director at Deloitte Consulting LLP and a member of the Actuarial Board for Counseling and Discipline.

About Deloitte

Deloitte refers to one or more of Deloitte Touche Tohmatsu Limited, a UK private company limited by guarantee, and its network of member firms, each of which is a legally separate and independent entity. Please see www.deloitte.com/about for a detailed description of the legal structure of Deloitte Touche Tohmatsu Limited and its member firms. Please see www.deloitte.com/us/about for a detailed description of the legal structure of Deloitte LLP and its subsidiaries. Certain services may not be available to attest clients under the rules and regulations of public accounting.

This communication contains general information only, and none of Deloitte Touche Tohmatsu Limited, its member firms, or their related entities (collectively, the “Deloitte Network) is, by means of this communication, rendering professional advice or services. Before making any decision or taking any action that may affect your finances or business, you should consult a qualified professional adviser.

No entity in the Deloitte Network shall be responsible for any loss whatsoever sustained by any person who relies on this communication.