By Carl Friedrich, Dan Nitz, Al Schmitz, and Deyu Zhou

The coming long-term care (LTC) crisis has been well documented. More and more Baby Boomers are turning 65 every day and the need for financial protection from an LTC event continues to grow. In our opinion, the good news is that today’s market offers a growing number of insurance solutions to meet the need.

While stand-alone LTC insurance has had its problems and has been in decline for many years, combination products that combine LTC coverage with either life insurance or an annuity are on the increase. Each solution to addressing LTC coverage needs has its own unique advantages and disadvantages. The array of options allows consumers to align the most appropriate insurance product to their unique needs.

This article will:

- Provide background on the combination product market and sales;

- Discuss how producers view and compare combination products with stand-alone products;

- Provide sample comparisons of combination products and stand-alone products; and

- Discuss early claims and persistency experience of combination products.

Background

Traditional stand-alone LTC insurance product sales have been in decline for several years and continue to face a number of challenges. The level premium structure of stand-alone LTC insurance, coupled with a steeply increasing claims cost curve by age, creates a lapse-supported and interest-sensitive product. In recent years, the very low lapse rates and low interest rates have created significant losses for LTC insurance writers. This has led to substantial rate increases, consumer disenchantment, and companies exiting the stand-alone LTC insurance market. Although the pricing for new business has stabilized, stand-alone LTC insurance is viewed as expensive to the average consumer.

At the same time, with the challenging economic climate for life insurers in the United States, more and more companies are seeking ways to enhance their life insurance offerings. One particular approach is through offering various forms of living benefits that are provided by the acceleration of life insurance death benefits under certain situations involving a chronic illness. Some of these plans include LTC accelerated death benefit (ADB) riders designed to comply with LTC insurance regulations. If designed properly, all of these amounts may be tax-free insurance benefits as described under the Internal Revenue Code (IRC) Section 7702(B).

Under these plans, some or all of the death benefit of the underlying base plan may be paid on a monthly basis to an insured when an LTC event occurs. Because these amounts come out of the base plan values (both the death benefits and cash value), the cost of the LTC coverage is reduced significantly. This also creates more alignment of interests between the insurance company and insureds, as the first layer of coverage requires accessing the client’s own assets (life insurance face amounts and cash values). Additionally, there are several offsetting risks to the insurance company between the base plan and riders under many combination products. For example, under many designs, higher mortality hurts life base plan profits but helps LTC rider profits.

Another product category builds on these designs, and continues the payment of monthly LTC insurance benefits after the entire death benefit has been accelerated, via an “Extension of Benefits” or EOB rider. These riders may result in total payments of two or three times the face amount. These “linked benefit plans” may also provide an inflation rider that increases both monthly maximum payouts and lifetime maximum payouts at a specified rate of increase each year, such as 3 percent.

One other category of products in this space is life policies that offer “chronic illness” ADB riders. These riders may have chronic illness triggers that are identical to LTC ADB riders, but they are governed under different regulations. IRC Section 101(g) defines their tax treatment as life insurance benefits that are tax-free within certain limits. These plans do not typically include many of the usual elements of LTC products; for example, they cannot provide benefits in excess of the underlying life face amount, and they do not include inflation protection. As a result, regulations specify that these chronic illness riders cannot be marketed as LTC insurance. Nonetheless, they have become quite popular in the market in the last several years.

National Association of Insurance Commissioners (NAIC) Model Regulation 620, which sets standards for chronic illness riders, prohibits restrictions on the use of proceeds. Thus, the administrative requirements of managing claims are reduced for chronic illness riders versus LTC riders that use an expense reimbursement structure, which caps benefits at LTC expense levels. The requirement of no restriction on use of proceeds means that benefits are locked in at predefined indemnity levels such as 2 percent of the face amount per month, regardless of the cost of LTC services. Further, if the benefit trigger requirement is met, most or all care can in some cases be provided by friends or family members, leading to insurance benefits well in excess of LTC expenses, which increases the costs over LTC riders that use expense reimbursement structures.

Finally, another variation of combination coverage is deferred annuities coupled with an LTC rider. These products typically first accelerate account values without the imposition of surrender charges for an LTC event, payable on a monthly basis, and then continue payouts for specified periods of time after account values are depleted. This may result in benefits that double or triple the account value under some plans.

Combination Plan Sales

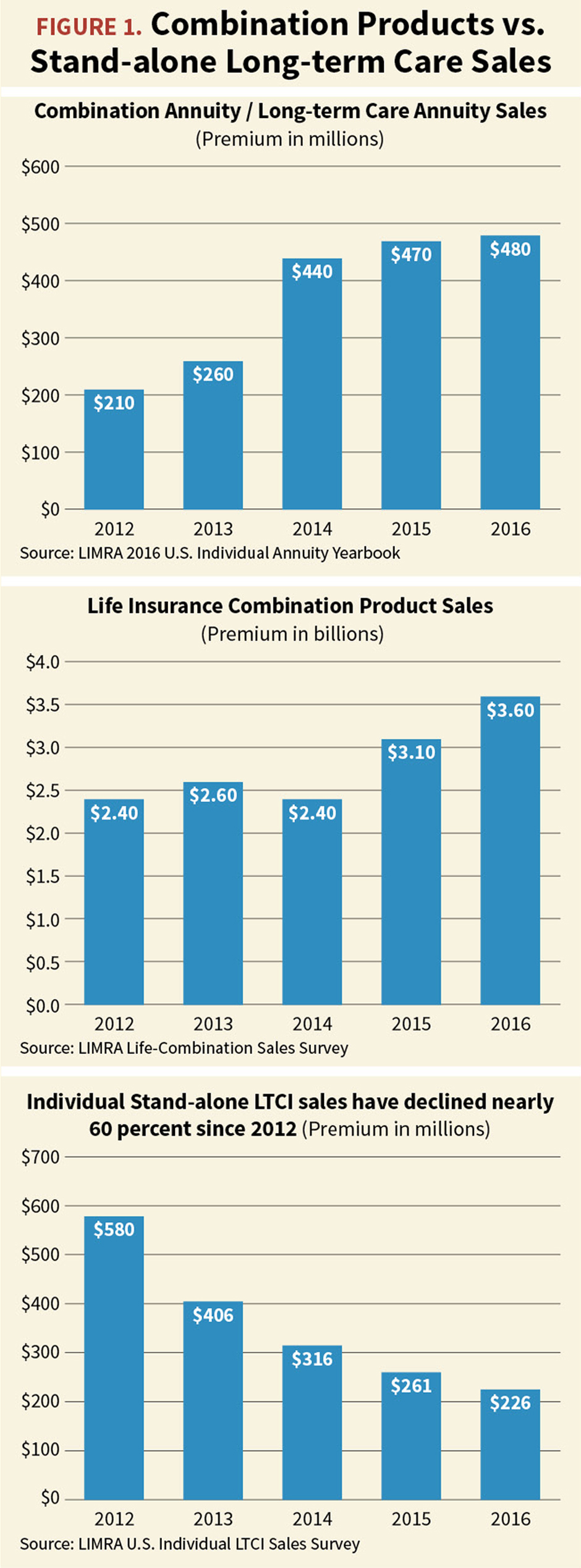

With that backdrop, it has been interesting to observe the growth of these “combination products” that couple life insurance or annuities with living benefits for LTC or chronic illness. Conning reports the total lives in-force on these plans at 1.4 million. New policy sales, which were primarily structured on a single premium basis 10 years ago, were about $500 million across the industry at that time. Figure 1 shows the sales trends from 2012 to 2016 as reported by LIMRA. For all combination products, 2016 sales were over $4 billion.

LIMRA also reported some recent highlights from 2017 sales for life combination plans:

- 2017 marked the third year in a row that polices and premiums grew for individual life combination products. Industry growth was driven by the introduction of new products by multiple companies and the increased agent awareness of combination products.

- Seventeen of the 24 participating companies experienced an increase in both policy and premium sales over last year.

- Combination products increased their market share of total new individual life insurance premium by 3 percentage points to put them at 25 percent of the overall market, while annualized premium share increased to 16 percent.

- Combination products generated over $4.1 billion in premium, and over 260,000 policies sold in 2017.

LIMRA also reported that in the first half of 2018 new premiums on life combination plans grew another 5 percent. By count, products with chronic illness riders remained the highest-selling of the three products (life/LTC ADB-only plans, life-linked benefit plans, and chronic illness plans), representing slightly less than half of all combination products sold. However, only 21 percent of chronic illness riders require additional premium at issue. By premium, plans with chronic illness riders account for 16 percent of new life combination plan premium. Chronic illness riders that do not require additional premium almost always use a discounted death benefit approach, where the actual payments received by policyholders at the time of rider claim are equal to the requested accelerated death benefits, reduced by discount factors developed by the company. Under that design, the policyholder essentially “pays” for the coverage at the time of claim.

Combination annuity sales have lagged life combination sales due to fewer companies selling combination annuities, and in part due to distribution issues and low interest rates.

Producer Interviews

In order to gain some insight into what is driving sales of these products, we conducted interviews with six successful producers working in the LTC insurance field for their views on what combination plan features appeal to clients and drive sales. The discussions centered on linked benefit products, as these distributors were focused on ways to address the LTC insurance needs of consumers beyond plans that cap LTC benefits at life face amount levels. A number of recurring themes from most of these distributors were heard, such as:

Leverage: Consumers like the leverage of securing large potential LTC benefits that not only exceed the premium going into the coverage, but also may be a multiple of the death benefit. Leverage generally is defined as the amount of benefits relative to the premium paid.

Leverage: Consumers like the leverage of securing large potential LTC benefits that not only exceed the premium going into the coverage, but also may be a multiple of the death benefit. Leverage generally is defined as the amount of benefits relative to the premium paid.- Sales motivation: Sales are often driven by emotional issues triggered by personal experiences with family members or fear of becoming a burden on children and other family members.

- Life insurance values versus LTC benefits: For combination life products, the relative importance of death benefits, surrender values, and LTC insurance protection varies depending on the product. Many life with ADB-only sales still have the primary purpose of providing life insurance protection, with the rider offering a living benefit that is fairly low-cost and consumer-friendly. In contrast, linked benefit plans, which include EOB provisions, are sold primarily to meet the LTC insurance need.

- Asset repositioning: The offering of death benefits or surrender benefits at levels close to the premium paid or higher is viewed as a nice safety net as assets are repositioned into these products. This is often presented as a way to avoid the “use-it-or-lose-it” characteristic of stand-alone LTC insurance. A common theme in the sale of linked benefit products until the last few years was an insured’s ability to surrender the policy at any time for a return of full premium. That focus has shifted as the return of premium (ROP) benefits on many of these plans have been reduced to 80 percent of premium, either grading up over time or staying level. Further, clients buying these products are focused on the LTC benefits, and have no intent to surrender their coverage. The death benefits are still of some interest to insureds in the event that they never use the LTC benefits or do not fully accelerate the death benefit.

- Guaranteed values: Most linked benefit plans are sold on a noncancelable basis, meaning that premiums cannot be increased by the insurance company. These guarantees are particularly important in today’s environment in light of the significant rate increase experience seen on the vast majority of stand-alone LTC insurance policies. The rate increases have received negative press and turned off many consumers to LTC insurance. On the other hand, insurers are taking some risks with these guarantees; it will be interesting to see whether the additional reserves imposed on many of these policies featuring those guarantees will translate to higher prices after December 31, 2019, when principle-based reserving will be required.

- Illustrations: Illustrations of policy values and benefits were not particularly important to many of the distributors. However, several companies have developed comprehensive illustrations to show those values. They include year-by-year premiums, cash values, death benefits, and maximum LTC insurance benefits. Several also illustrate the internal rate of return (IRR) to the policyholder on the premium paid when an insured event occurs, such as a maximum LTC insurance claim. While some may find these detailed illustrations with IRRs insightful, several distributors felt they were of limited value to the average consumer. As one producer commented, “Statistics kill LTC sales, while personal experiences and stories sell the coverage.”

- Lower coverage levels: Average premium per case is fairly steady for some producers, but they are selling less extensive coverage levels. There was some acknowledgment that producers may have sold over-insured plans in the past, as producers typically sold to the cost of nursing home care. As more care is being provided through home health care (HHC) services and assisted living facilities, which typically cost less than traditional nursing homes, producer emphasis has shifted and they are selling lower average monthly benefits than in the past. Also, while 5 percent compound inflation protection is required to be offered on LTC riders, over the past several years LTC cost inflation has been significantly lower than 5 percent. One producer commented that “showing rates for a 5 percent compound inflation feature is suicide. … It is just too expensive.” Thus 5 percent compound inflation protection is being sold less frequently, while 3 percent compound is the most common inflation benefit structure being marketed. The idea is that it is better to sell the consumer some coverage than show an expensive product that over-insures and is not purchased.

- Simplicity: As they see it, the more the industry can reduce the number of choices and decisions for the insured, the better. Several producers commented, as one example, that it is positive that linked benefit products tend to offer only one elimination period. In addition, they indicated that selling a longer coverage period was much more important than selling first-day coverage with no elimination period. The simplicity of the new business process, including underwriting, is also very important to the producers.

- 1035 exchanges: Some producers are selling a fair amount of 1035 exchanges, both for life and annuity combination products. It should be noted that annuity combination plans are the only vehicle that allow for otherwise taxable gains in an annuity to be paid out as tax-free LTC benefits. So 1035 exchanges from stand-alone annuities to combination annuities feature tax leverage and benefit leverage. Producers note that higher interest rates would fuel more usage of annuity combination plans. Also, the sources of funds drive combination product choices (notably, annuities cannot be 1035-exchanged into life combination plans).

- Producer comfort: Producers are generally getting more and more comfortable selling combination products. Often force of habit and familiarity with a product drive sales, but combination products are starting to make their way into more producers’ tool kits.

- Financial strength: The relative financial strength of the insurance carrier is very important. Producers want to be confident that the company they are recommending will be around years down the road when their clients need them most.

- Combination plan deficiencies: We asked producers what they feel are the primary deficiencies of combination products.

- Several mentioned the lack of annual premium plans for linked benefit products, as almost all of that business is single pay or limited pay for up to 15 to 20 years.

- For limited pay plans, some plans still require the insured to continue to pay premium while the insured is on claim.

- If interest rates increase, there is likely to be little or no change in policy values under most combination plans, which may become an issue, particularly if the policy values are a large portion of assets.

- There is somewhat limited availability of designs providing shared benefits between a couple, compared to these options in the stand-alone market.

- Some linked benefit plans in the worksite market cap HHC benefits at 50 percent.

- Coverage for international care is limited.

- There is a lack of marital discounts available.

Product Comparison

There are now many different insurance options for consumers to meet their LTC insurance needs. It can be very difficult for average consumers to determine exactly which solution is right for them. We heard the same frustration from the producers we interviewed as well. Comparing similar products, such as stand-alone LTC from two different companies, is complicated in and of itself. It can be difficult to align risk classes from one company to the next, as well as matching up policy benefits. Comparisons become even harder when trying to compare stand-alone LTC insurance to combination life and annuity contracts.

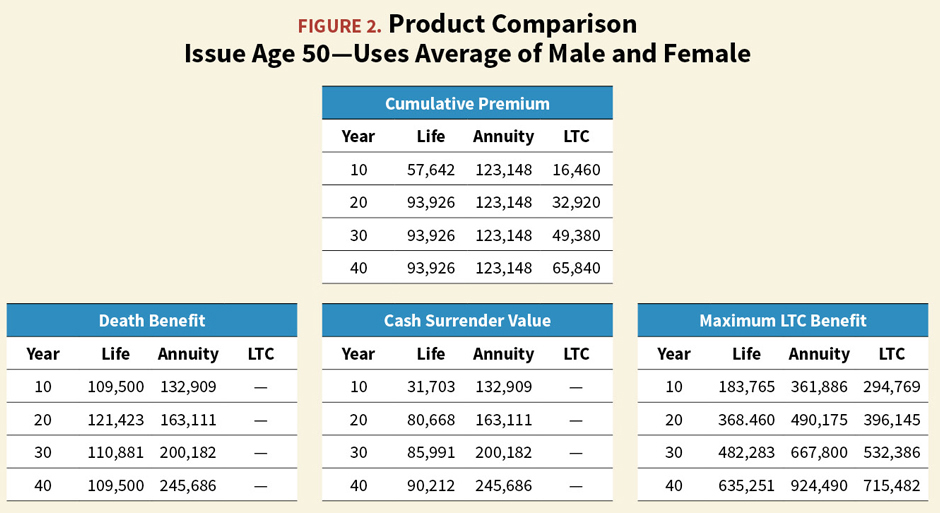

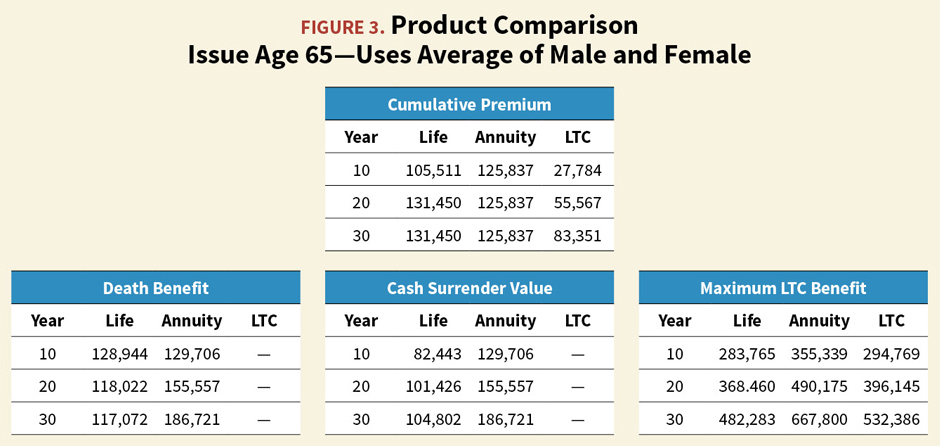

Figures 2 and 3 compare coverage under combination life insurance plans, combination annuity plans, and stand-alone LTC insurance for issue ages 50 and 65, respectively. The values come from an average of several life and annuity combination plan illustrations and average premiums for several companies selling stand-alone LTC insurance. In order to get as close of a comparison as possible, we tried to align the LTC benefits across plans. We targeted four years of LTC coverage at $4,500 a month with 3 percent compound inflation protection. The combination life contracts used were based on a two-year base acceleration and two years of extension of benefits. Also, the combination life contracts reflect a mix of reimbursement styles, with some products reimbursing actual LTC expenses while others pay out fixed cash benefits once chronic illness triggers have been met. The annuity designs also have an extension of benefits provision, but the account value grows at the credited rate. Not all companies offered those exact benefits. For example, on some combination plans, the inflation benefit only applies during the extension of benefit period, resulting in lower total LTC benefits over time.

Combination annuity/LTC plans are written on a single premium basis. Virtually all stand-alone LTC business is level premium, so that was used here. For the life combination plans, the comparisons used limited pay structures ranging from 10-pay to 20-pay designs. Also note that rates for the stand-alone LTC products are not guaranteed, while the life combination plan premiums are usually fully guaranteed and LTC charges on the annuity combination plans are usually guaranteed.

Stand-alone LTC plans are currently written on a sex-distinct basis, while there are a variety of practices under combination plans. The comparisons removed the effects of these differences here by using an average of male and female rates and values.

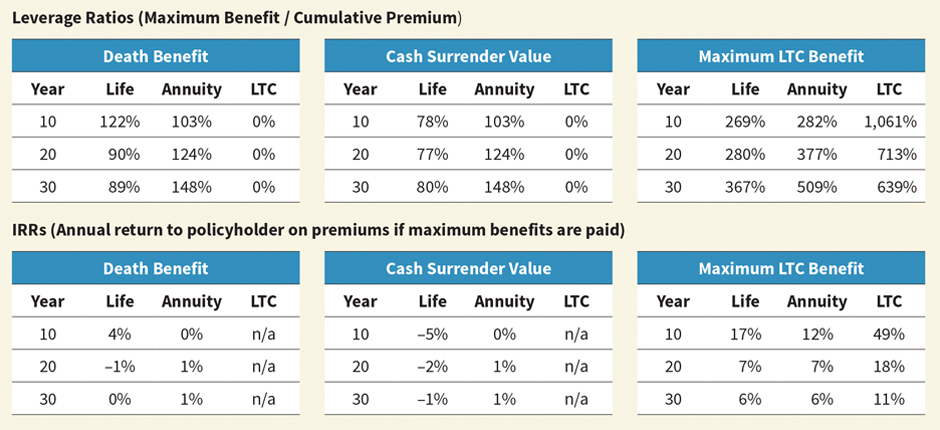

In our discussions with producers, several mentioned the importance of the level of maximum benefits compared to the cumulative premium paid into the policy at various points in time. This information, referred to as the leverage ratio, is shown for a number of policy durations for scenarios involving a maximum LTC benefit payout, a payout of the full death benefit of the policy (with no prior LTC claim), or a payout of the surrender value of the policy with no prior LTC event.

Although the leverage ratios are interesting, they ignore the effects of the different timing of premium payments among the various plans. One useful measure that overcomes that shortcoming is to calculate the internal rate of return (IRR) that the policyholder would realize on the premium if maximum benefits are paid out. As noted earlier, many combination plan illustrations provide the IRR on premium that would be realized if maximum LTC benefits are paid. Similar calculations can be performed if the only benefits payable are death benefits or surrender benefits.

In reality, there are many other scenarios that involve payouts of portions of maximum LTC benefits, with potentially subsequent payouts of reduced death benefits or surrender values. The overall “actuarial value” of these policies could be calculated reflecting a weighted average of all of these scenarios, but that is beyond the scope of this article. Further, the importance of many insurance coverages is not how much they pay on average, but rather the degree to which they provide coverage against a catastrophic event.

As expected, stand-alone LTC policies generally provide the highest leverage ratios and IRRs on maximum LTC benefits, because they do not provide surrender benefits or death benefits, in contrast to the combination products. The annuity combination plans actually show higher leverage ratios than for stand-alone LTC plans for issue age 65 in the very high attained ages, but that fails to account for the difference in premium patterns between these products, as the combination annuity plans require a substantial upfront premium compared to the level premium structure of stand-alone LTC.

When comparing life versus annuity combination plans, there are several items we thought worth noting:

- Annuity account values grow more than life cash values, as the cost of the life insurance has the effect of eroding the growth in account values under the life policy compared to annuity account value growth. The advantage of the annuity combinations would be even larger were it not for the inflation benefit feature on these annuity plans, which requires an additional single premium to fund LTC inflation benefits with no associated cash value on that extra premium.

- Life combination plans have higher early-duration death benefits than annuity combinations, because there is a required minimum ratio of death benefits to cash values prescribed by tax law for life insurance policies, while annuity death benefits are generally equal to the cash value. However, eventually the annuity combination plans provide more death benefit than the life combination plans due to the account value growth. Although not reflected in the numbers in Figures 2 and 3, at the time of death the excess of the death benefit amount over cumulative premiums is taxable on annuities, and tax-free under life policies.

- The annuity combination plans generally have slightly higher leverage ratios for maximum LTC benefits than life plans, but results are mixed with respect to IRRs. At issue age 65, long-term annuity IRRs for maximum LTC claims are slightly higher than life, but for issue age 50 the life IRRs on maximum LTC claims are superior in all durations.

The key takeaways from the comparison are as follows:

- Stand-alone LTC insurance offers the most LTC benefits for the premium outlay. However, there are no death benefits or cash surrender values. It should also be noted that the premiums are not guaranteed and could be increased.

- Combination life designs offer essentially the same LTC benefit, along with an option for consumers to get more than their premium back if they die without using any LTC insurance, but the premiums are higher than for stand-alone LTC. They also eventually allow the return of a substantial portion of the premium on surrender. The contract values are typically fully guaranteed.

- Combination annuity designs also offer a similar level or more of LTC benefits, but require a large initial single premium. A common design grows the single premium at a credited rate less a charge for the LTC coverage. The LTC insurance charges are often guaranteed. After the surrender charge period is over, consumers can get access to the account value if they surrender or die without using any LTC insurance. As seen in Figure 2 above, the account value grows to be significantly larger than the initial premium over time.

Early Experience Results on Combination Plans

All the theory in the world won’t help if the products aren’t meeting the needs of all involved—industry and consumer alike. So what does the actual experience show us about this nascent niche market?

In June 2017, 11 companies participated in a study[1] on experience of combination products that incorporate life or annuity with long-term care (LTC) or chronic illness (CI) riders. The primary focus of the study was on incidence rates, lapse/surrender rates, and mortality rates. The study includes data from 10 companies using life insurance-based plans and one using an annuity chassis.

In June 2017, 11 companies participated in a study[1] on experience of combination products that incorporate life or annuity with long-term care (LTC) or chronic illness (CI) riders. The primary focus of the study was on incidence rates, lapse/surrender rates, and mortality rates. The study includes data from 10 companies using life insurance-based plans and one using an annuity chassis.

The study generally included data through the end of 2016, with the vast majority of experience from 2010 to 2016. Policies with LTC ADB riders and no EOB riders comprised about 60 percent of the exposures, policies with CI ADB riders represented about 25 percent (none of which used the discounted death benefit approach), and the rest of the policies included both ADB and EOB LTC riders. All the policies in the study accelerated the death benefit on a dollar-for-dollar basis.

The following are the key findings and observations:

Incidence

- Overall, incidence is significantly better than expected. The actual-to-expected (A:E) is very low when measured against stand-alone LTC plan assumptions.

- Plans with extension of benefits have higher incidence than acceleration of death benefit-only plans, but results are still favorable when compared against stand-alone LTC plan assumptions.

Mortality

- Mortality results were somewhat lower than industry experience on stand-alone fully underwritten life products, despite the less extensive underwriting done on some of these combination products.

Lapse

- Lapse rates by count and amount were generally between 2 to 3 percent for ADB-only policies. Policies with ADB and EOB coverage had slightly lower lapse rates, but still higher than seen in the stand-alone LTC market.

- Another major factor affecting lapses overall is the type of base plan. Some differences between universal life, whole life, indexed universal life, and variable universal life may be partly explained by equity market performance during the exposure period.

To date, early experience on combination plans is very positive. It will be important to monitor emerging developments on this front in the upcoming years.

Opportunities and Takeaways

The options available to consumers to address LTC needs are growing. A comparison of the options necessitates analysis of many different facets of these diverse approaches. Producers are homing in on what is important to their clients, and it is clear it is not a one-size-fits-all environment. As a result, combination product sales continue to increase.

Early experience on these products is positive from an industry perspective. Further, companies are recognizing that there are some important pricing synergies in combination products that limit the risks compared to stand-alone LTC insurance.

It is expected that LTC insurance products and markets will continue to evolve to help address the LTC insurance needs of consumers. An expanded menu of products, with more premium payment options, can enhance the growth opportunities for combination plans. Higher interest rates would further enhance sales, in particular for annuity combination plans, and in general for 1035 exchanges. In summary, the outlook appears to be very positive for these LTC solutions.

Carl Friedrich, MAAA, FSA, Dan Nitz, MAAA, FSA, Al Schmitz, MAAA, FSA, and Deyu Zhou, MAAA, FSA are consulting actuaries with Milliman.