By Bob Beuerlein

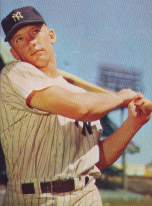

When I was growing up, my hero was Mickey Mantle, a star baseball player for the New York Yankees. When we played baseball in the field across the street, I would try to do everything just like No. 7 (Mickey). Later, when I realized that I did not have the skills to become a professional baseball player, my new role model was Arnold Palmer, the best professional golfer in the world at that time.

While I had wonderful role models in my parents and teachers at school, my goal in life was to be exactly like Arnold. Then, when I realized that I did not have the talent to be a professional golfer, my new role model became a top amateur golfer in Kansas who, it turns out, was also an actuary. The rest is history—I became an actuary but am only an aver- age golfer. Throughout my career, I have learned many things from people that I have worked with, but some of the best learnings came from people who did not know that they were teaching me.

As actuaries, we all have the opportunity to be this type of teacher or role model to other actuaries. Sociologists tell us that people compare themselves with each breathe life into the words that make up the Code through our words and actions. Specifically, U.S. actuaries must “adhere to the high standards of conduct, practice, and qualifications of the actuarial profession” and comply with the “professional and ethical standards” set out in the Code. Each actuary agrees to do so “to fulfill the Actuary’s responsibility to the public and to the actuarial profession.” By following the Code, U.S. actuaries are committing themselves to an action-oriented plan of ethical professional behavior that will be sufficiently visible to the public to earn its trust. We need to personally commit to model professionalism every day of our careers.

I use the words “modeling professionalism” intentionally because, as actuaries, we recognize that we are not in this profession alone. Principals, other actuaries, regulators, the press, and a vast array of other stakeholders see our actions and judge us every day. And the public trust that we so proudly enjoy as individuals who occupy a role to which they themselves aspire. And I believe that the role to which actuaries should aspire is that of a professional actuary.

The Code of Professional Conduct is the foundation of actuarial professionalism, and it is vital that it not become “just a document.” Each of us who is a member of one of the U.S.-based actuarial organizations is obligated, as a condition of membership, to comply with the Code. I hope we can a profession is the product of the sum of those individual judgments. It is also a direct result of the high professional standards of the actuarial profession. And those high standards are essential. Take a moment to think about what is at stake when actuaries don’t put professionalism into action: People’s lives, health, property, retirement, or other critical interests may be harmed. As an actuary, your practice of professionalism can contribute to others’ well-being … or the opposite.

The Code of Professional Conduct is the foundation of actuarial professionalism, and it is vital that it not become “just a document.” Each of us who is a member of one of the U.S.-based actuarial organizations is obligated, as a condition of membership, to comply with the Code. I hope we can a profession is the product of the sum of those individual judgments. It is also a direct result of the high professional standards of the actuarial profession. And those high standards are essential. Take a moment to think about what is at stake when actuaries don’t put professionalism into action: People’s lives, health, property, retirement, or other critical interests may be harmed. As an actuary, your practice of professionalism can contribute to others’ well-being … or the opposite.

It is clear that it is important for every actuary to put professionalism into action in their everyday work, but why is modeling good behavior so important? Research[1] in the area of business ethics—arising from the ashes of a vast number of well-known corporate scandals over the past several decades—suggests that ethical culture has to be reinforced through behavior that matches the expectations found in a code of conduct. The determinants of ethical behavior include the following:

- Tone at the top. Employees who believe that top management acts ethically are much less likely to engage in unethical behavior than employees who believe that top management talks about ethics but does not act accordingly.

- Behavior of peers. Professionals who see their peers behaving ethically are more likely to act ethically than those who observe their peers engaging in unethical behavior.

- Profession-wide ethical practices. Employees view the day-to-day ethical practices they experience as “normal.” When employees work in a profession where unethical actions are regarded as “standard,” they are more likely to engage in unethical practices than employees who work in a profession where ethical conduct is the norm.

These research results, which underscore the importance of modeling professionalism, depict a cautionary tale for us as actuaries. As we all know, the U.S. Qualification Standards require an actuary to gain experience, usually “under the review of a qualified actuary.” As another example, Precept 3 of the Code requires an actuary to ensure that actuarial services performed by the actuary directly or “under the Actuary’s supervision” comply with the standards of practice. If senior actuaries treat the Code, and the professional and ethical standards it embodies, as meaningless—if they model poor professionalism—the damage they do will be multiplied by the number of less-experienced actuaries they may influence. In fact, some research[2] suggests that having a written code of conduct without abiding by it causes more harm to the ethical culture of a workplace than not having a code at all—because employees, once convinced that the words in a code are meaningless in practice, will no longer engage in the moral analysis required to sort through complex ethical situations. The bottom line: Each generation of actuaries must practice with integrity and in compliance with professional standards for such a norm to be passed to the next generation.

So what can you do?

I am fond of saying that an actuary must act as an ethical “thermostat,” not a “thermometer.” The Code of Conduct does not ask us to merely record the ethical climate, but to establish it. We have to make the Code a living, breathing part of our everyday professional lives and demonstrate to each other—and all who depend on the work we do—that we continue to deserve the public’s trust. Here are some ways you can demonstrate your commitment to the Code, to not only set an example, but also to encourage other actuaries to follow in your footsteps.

- Perform a professionalism self-assessment. Every actuary—especially seasoned actuaries—should start with a professionalism self-assessment. Take steps to strengthen your professionalism efforts in any weak areas.

- Walk the walk. Articulate your commitment to ethical behavior and high integrity and follow it up with action. As discussed above, studies show that words and action set the right tone at the top and among peers, but that words alone do not suffice. If you supervise other actuaries—at any level[3]—it is vital that you lead by example.

- Discuss professionalism and ethics. Frequent discussion of professionalism and ethical issues reinforces ethical awareness, hones critical thinking skills in this area, and helps create an atmosphere in which employees are not afraid to raise such issues. This includes talking to your principals and regulators, when appropriate, about the professional standards by which you are bound and why they do not allow you to cut corners.

- Don’t be afraid to ask for advice. Other actuaries can be a good source of advice, as you may find a peer who has already worked through the predicament you are facing. If the issue is confidential, or you are not comfortable discussing it with colleagues, confidential guidance from the Actuarial Board for Counseling and Discipline is just a phone call or email away. Set a good example by seeking help when you need it, and encourage teammates and juniors to do the same. Actuaries today practice in increasingly complex work situations and may face challenges arising from new technology; new areas of practice; changing laws; and pressure from clients, regulators, and the public. Even an actuary who was on top of his or her game a few years ago needs to stay up to speed in our ever-changing work environment. Failure to do so risks violating the Code of Conduct and undermining the public’s trust in our profession.

Going back to where we started, think of the actuaries who have impacted your career by how they performed services as actuaries. You also have the opportunity, maybe unknowingly, to demonstrate pro- fessionalism to other actuaries. The Code of Professional Conduct is an important document. We must bring it to life by making it the cornerstone of our everyday work—not just in words, but in action.

References

[1] Research compiled by the Association of Certified Fraud Examiners, “Tone at the Top: How Management Can Prevent Fraud in the Workplace.”[2] Id.

[3] Hanson, Kirk. “Ethics and the Middle Manager: ‘Tone in the Middle’”; Markkula Center for Applied Ethics, Santa Clara University, 2008.