By Benjamin Slutsker, Kevin Piotrowski, and Linda Lankowski

Principle-based reserving (PBR) is a new statutory reserve regulation that combines company-specific assumptions with prescribed rule-based requirements. For the majority of states, the new regulation is mandatory for new business policies sold in 2020 and later, though companies may also elect to start implementing as early as 2017. As companies enter into the world of PBR, they face the challenges of modeling complications, regulatory guardrails, and actuarial ambiguity.

While the feature titled “How to Survive—and Thrive—Amid Regulatory Change” in this issue of Contingencies provides an overview of possible implementation approaches in light of new regulation including PBR, this article is intended to provide our thoughts on technical details to consider when implementing PBR. Many of these technical details may be new to U.S. companies and may generate actuarial challenges that have not been previously encountered. To understand the technical details within PBR, we briefly review the PBR calculations. The final PBR reserve equals the maximum of the Net Premium Reserve (NPR), Deterministic Reserve (DR), and Stochastic Reserve (SR):[1]

■ The NPR serves as a formula-based floor, which equals the present value of premiums less the present value of future benefits, using prescribed mortality, lapse, and interest assumptions. For term policies and universal life policies with secondary guarantees, this calculation is different than the current Commissioner’s Reserve Valuation Method (CRVM) but similar in that it is still rules-based. For other products (such as whole life and universal life accumulation products), the NPR is identical to the current CRVM requirement.

■ The DR, similar to a gross premium reserve (GPV) calculation, equals the present value of future benefits and expenses less the present value of future premiums, using company-specific assumptions plus margins with some regulatory guardrails (such as prescribed margins) specific to VM-20.

■ The SR is similar to the DR but equals the average of the worst 30 percent (CTE 70) of the greatest present value of accumulated deficiencies across prescribed interest rate and equity scenarios. Because company-specific assumptions are used for the DR and SR components of the final PBR reserve, the associated requirements can cascade through several aspects of company operations. There are PBR considerations for experience studies, assumption-setting, modeling, and governance. In addition, because PBR is a statutory reserve calculation, it is required in the actuarial functions related to valuation, product development, and business forecasting. The following describes some of the primary challenges and considerations companies may face when implementing PBR.

Product Development

Product development is one of the most important company operations affected by PBR. Along with PBR, companies must update the 2001 Commissioner’s Standard Ordinary (CSO) Mortality Table to the 2017 CSO Mortality Table in accordance with minimum non-forfeiture standards and 7702/7702A requirements. PBR requirements and the CSO mortality table update may put companies in a position to reprice all individual life products by 2020.[2] In order to accomplish this, actuaries will collaborate with product management, marketing, and systems teams to redesign, reprice, and refile products within the required timeframe. Companies might stagger the introduction of repriced products to the marketplace to manage the additional workflow. Resources within state insurance departments and the interstate compact may possibly become strained near the end of the three-year transition as companies rush to refile products before the 2017 CSO mortality table becomes mandatory. Companies may wish to consider getting a head start on filing new products to avoid the risk of costly filing delays. The actual choices made in the design of new products will be affected by PBR. For example, companies may want to consider how selecting the level period structure for term would result in a set of prescribed assumptions that would impact the NPR reserve pattern. Another example of a choice to consider is how the structure of secondary guarantees may impact reserve levels and the status of PBR exclusion tests.[3] With the PBR requirements of VM-20, companies might reassess whether to offer products that produce a small sales volume and carry a heavy burden of PBR implementation. This could apply not only for term products and universal life products with secondary guarantees, but also for riders that must be valued as part of the base contract that could have PBR complexities, such as embedded secondary guarantees and chronic care benefit features.

Modeling

When it comes to modeling PBR reserve calculations, one of the first questions to consider likely is, “Does a company have a model readily available to add PBR functionality?” For cases where companies are already undergoing system conversions, the timing of PBR implementation may be coordinated with the construction of new models, while still complying with the regulatory deadline. For cases in which a company’s current valuation platform is unable to handle the technical requirements in the NPR calculation and DR / SR projection requirements, the adoption of a new modeling vendor or system may be needed.

Separate models may also be needed for different actuarial purposes. For example, a valuation may need precise reserve calculation functionality for point-in-time reserves, and a pricing model may need less precise reserve calculation functionality for projecting reserves. A model that can produce several shorter or quicker runs may be better suited for pricing purposes, and a model that can produce fewer, more calculation-intensive runs may be better suited for valuation purposes.

Separate models may also be needed for different actuarial purposes. For example, a valuation may need precise reserve calculation functionality for point-in-time reserves, and a pricing model may need less precise reserve calculation functionality for projecting reserves. A model that can produce several shorter or quicker runs may be better suited for pricing purposes, and a model that can produce fewer, more calculation-intensive runs may be better suited for valuation purposes.

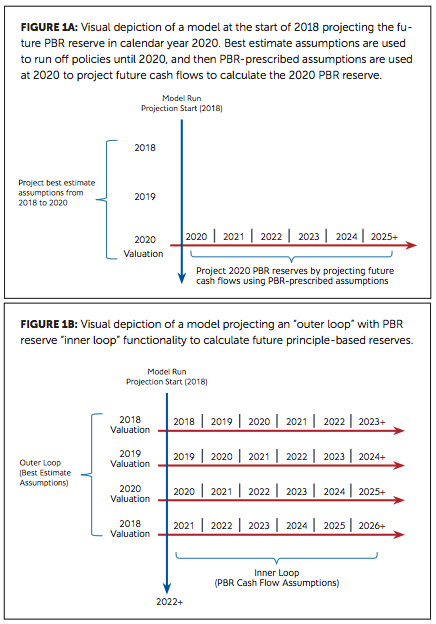

One challenge of using multiple models is making the methodology and assumptions consistent. Assumption grids, model documentation, and model centralization are all methods to examine whether PBR calculations for pricing, forecasting, and valuation are all on a consistent basis. One challenge for modeling PBR, in particular, is projecting the DR and SR reserves at future points in time. Because PBR-specific assumptions (which include margins) are not equal to best estimate assumptions, companies may need to project cash flows and policy decrements up to the future PBR valuation date using best estimate assumptions, and then calculate cash flows for the PBR reserve using PBRspecific assumptions prospectively from the PBR valuation date. This is sometimes referred to as the outer and inner loop calculations.

For example, let us say that at the beginning of 2018, a company wants to project the PBR reserves in calendar year 2020. First, this would require the company to use its best estimate assumptions to project the policy runoff from 2018 to 2020. This projection is represented by the left blue line in Figure 1a. Then, depending on the amount of inforce business remaining at 2020, the 2020 PBR reserve can be calculated by projecting future cash flows for years 2020 and later. The 2020 PBR reserve future cash flows are represented by the red line in Figure 1a. This approach results in an “outer loop” (blue line) to project company best estimate assumptions until the start of each PBR valuation date and an “inner loop” (red line) for projecting PBR reserves from each future point in time using PBR-specific assumptions. See Figure 1b, which depicts this modeling technique over multiple projection years.

This inner loop versus outer loop projection capability is important for projecting mortality improvement until the valuation date for each future reserve calculation,[4] estimating the future prescribed scenarios and asset assumptions, and including margins in the assumptions used to calculate future PBR reserves.

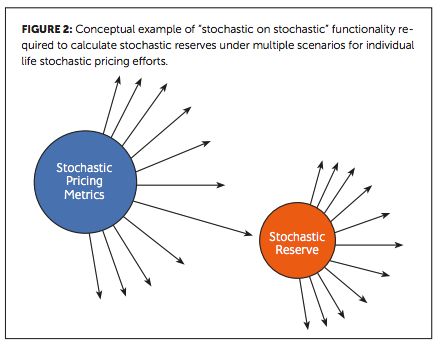

At each valuation date, the SR itself requires projecting reserves across a distribution of up to 10,000 different prescribed equity and interest rate scenarios.[5] For pricing purposes, companies that need to calculate multiple iterations of each cell may consider modeling simplifications, such as projecting the SR for only certain projection years (e.g., every fifth or 10th year) and then interpolating the SR for years between the full projections. Even more computing power would be needed to model a stochastic distribution for pricing purposes, with each scenario requiring a stochastic reserve. Figure 2 illustrates this “stochastic on stochastic” calculation.

An additional simplification method to facilitate stochastic calculations is to predict the SR against another benchmark, such as the DR. Therefore, if the benchmark is known, then the SR can be approximated without conducting the full calculation.

For pricing and forecasting, companies may use simplified assumptions regarding the relationships among NPR, DR, and SR. For instance, analysis may show that DR “wins” in the first 10 policy durations, then SR is higher for 10 durations, and DR dominates after that. An actuary will use professional judgment to determine how to use that relationship in his or her projections and possibly decide that stochastic projections are not necessary for all purposes.

PBR requires Asset Liability Modeling (ALM) functionality. ALM requires functionality for projecting both liability cash flows (i.e., policyholder benefits and expenses) and asset cash flows. The projection of portfolio asset reinvestments and divestments depends on the projected timing of meeting policyholder obligations. VM-20 has specific requirements for these asset assumptions, but much of the choice of methodology is left to the actuary as long as the model follows actual company investment practices.

For the calculation of point-in-time reserves for valuation purposes, the simplifications used for projecting reserves for pricing and forecasting purposes may not always be appropriate. But even for valuation purposes, VM-20 provides flexibility for calculation simplifications, as long as reserves are not materially understated.[6] Examples include using a reduced stochastic scenario subset, policyholder model grouping, and other valuation modeling limitations.

Because there are several complicated modeling aspects of PBR, the earlier companies start building the models, the greater the chance of their being able to implement needed changes prior to both management and regulatory deadlines.

Net Premium Reserve Methodology

Although the DR and SR requirements have some ambiguity, the new prescribed methodologies for the NPR can also raise potential challenges for implementation. For products other than term and universal life with secondary guarantees,[7] the NPR is the same as the reserve under CRVM, which requires no additional work for implementation. However, VM-20 introduces new calculations for term policies and universal life policies with secondary guarantees.

For term policies, the prescribed NPR methodology is a net level premium (NLP) reserve methodology, in which the benefits and survivorship are projected out to solve for a net premium at issue. There is additional work to solve for separate net premiums during the level period and after the level period if the projected profits in the post-level premium period exceed a specified threshold.[8]

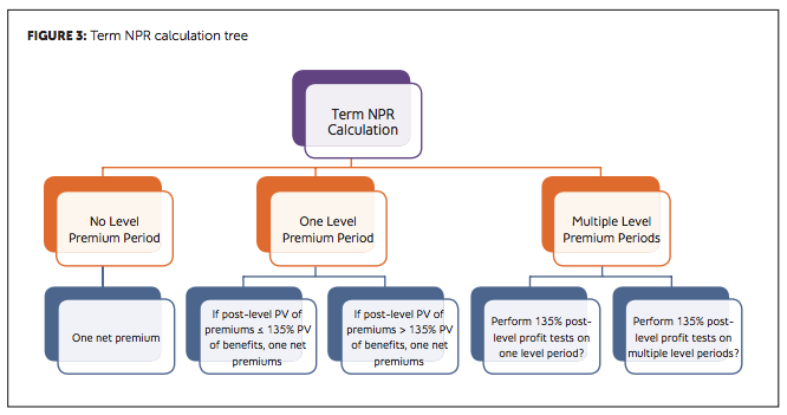

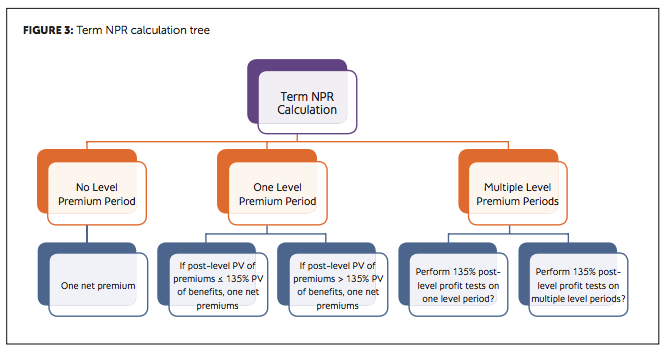

VM-20 is not explicit on how to calculate the NPR for term policies with multiple level premium periods under this new requirement. Figure 3 illustrates possible paths for calculating the NPR on these types of policies.

One question involving term policies with multiple level premium periods is whether the post-level profit constraint needs to be complied with at each level period. This is not settled. It is likely to be an area of continuing discussion among industry groups and regulators over time.

The NPR on universal life policies with secondary guarantees equals the maximum of two reserve components. The first reserve component is similar to the Universal Life Model Regulation Reserves (i.e., UL CRVM) calculation today;[9] the second reserve component solves for the level guaranteed premium to fund the secondary guarantee. This calculation may result in multiple goal seeking algorithms to determine the level valuation net premium from issue, which shows that calculation complexity can exist in the simplest part of the regulation.

Other possible considerations include prescribed lapses and valuation discount rates used in the NPR calculation. VM-20 contains a prescribed formula to determine a lapse rate for universal life policies with secondary guarantees, and specifies level premium lapse rates, shock lapse rates, and post-level lapse rates for term policies. The valuation interest rates required for the new term and universal life with secondary guarantee NPR calculations differ from the current statutory valuation rates for CRVM.[10] There are also reserve floors in the NPR, which are based on the policy average cost of insurance until the next policy anniversary and the cash surrender value.

Perhaps the most significant change from the current CRVM valuation method is that VM-20 indicates the possibility that the NPR mortality and lapse assumptions may be unlocked in the future for inforce policies.[11] Details of how to unlock the reserves are not yet worked out, nor is there a guarantee that retrospective unlocking would occur. Th e impact to tax reserves and standard non-forfeiture requirements for inforce policies would likely have to be considered.

Deterministic/Stochastic Reserve Assumptions

Determining the appropriate assumptions to use for the DR and SR components is one of the primary challenges of implementing PBR. PBR requires “prudent estimate assumptions.” Th is consists of anticipated experience assumptions[12] plus margins. So while best estimate assumptions can serve as a starting point for reserve calculations, there are also requirements for margins, prescribed assumptions, and guardrails within VM-20. Th is is the case for liability, asset, and reinsurance assumptions.

Mortality Assumptions

VM-20 has a number of requirements surrounding the PBR mortality assumption. Mortality is based on each company’s historical experience, with a prescribed margin based on credibility level,[13] or the amount of data present in the experience used to develop the mortality assumption. Margins are applied to both company experience and industry tables. Complying with experience study requirements for the development of the mortality assumption is a new statutory reserving concept. Whereas before companies would perform experience studies under internal standards, now the following are considerations:

■ Credibility calculated on mortality experience determines the prescribed margin that companies hold on their assumptions and the required point in the projection at which companies must grade to mapped industry assumptions.[14]

■ Companies that have less data supporting their mortality experience are required to hold higher margins due to greater uncertainty.

■ Underwriting standards for each risk class must be mapped to a relative risk factor based on industry tables (such as the Valuation Basic Table 2015).[15]

■ As of early 2017, there are no industry tables available for simplifi ed issue policies or those issued through accelerated underwriting techniques. An interesting question for the future is the level of comfort around the credibility of assumptions related to the advent of predictive modeling techniques, where in many cases, only “back-tested” mortality experience will be available.

■ With regards to accelerated underwriting, there are still open questions on whether to group experience from these policies with experience from previously issued fully underwritten business, in addition to the associated credibility method and margin to use in the reserve calculation.

■ Companies will consider at what level of aggregation to calculate credibility; such calculations must comply with VM-20 requirements.[16] Higher levels of aggregation can result in higher levels of credibility.

Other Liability Assumptions

Other liability assumptions include policyholder behavior and expenses. Similar to mortality, these assumptions include a company experience assumption plus a margin. Unlike the mortality assumption, though, margins for other liability assumptions are not prescribed. Therefore, companies will use their own experience and judgment to determine prudent estimates for determining lapses, surrenders, persistency, term conversions, and future maintenance expense assumptions.

Primary challenges of modeling these assumptions include:

■ VM-20 requires dynamic modeling for policyholder behavior, such as cases in which the likelihood of policyholders surrendering depends on the interest rate environment.

■ There are prescribed sensitivities on premium funding patterns for flexible premium products.

■ Projected cash flows must include any known future nonrecurring expenses in reserve projections.

■ PBR requires margin development, the stated rationale for selecting margins/ assumptions, and the associated documentation of such.

■ Companies will decide whether to make PBR experience assumptions and margins consistent with those used for asset adequacy testing, U.S. generally accepted accounting principles (GAAP), and international financial reporting standards (IFRS) accounting methods.

■ The VM-31 PBR Actuarial Report requires disclosure of liability assumptions, including the credibility methodology used to develop policyholder behavior assumptions,[17] and inconsistencies with assumptions used in the company’s overall risk management process.

Asset Assumptions

VM-20 designates the Net Asset Earned Rate (NAER) as the valuation discount rate for the DR. The NAER is based on projected portfolio rates using PBR interest rates, equities, fund mapping, spreads, defaults, investment expenses, and reinvestment strategy. Below are some of the challenges a company may face when projecting asset cash flows to determine the NAER:

■ Companies may decide either to reflect PBR assets as a portion of existing assets in the investment portfolio or to develop a new portfolio for future issued business falling under PBR valuation requirements.

■ If market values for various assets are not able to be updated in a timely manner, companies may choose to lag assets (i.e., use assets from a prior reporting date) or use proxy assets. This must be documented in the VM-31 PBR Actuarial Report.

■ For defaults, VM-20 requires three components: base default calculation, grading to long-term economic expectations,[18] and an asset quality guardrail.[19]

■ Prescribed current spreads must be graded into prescribed long-term spreads over four years.

■ Companies can use their own starting asset mix and reinvestment strategy, except that the reinvestment strategy must reflect a floor of 50 percent A-rated/50 percent AA-rated non-callable public bonds for fixed income assets.

■ The starting assets to develop the NAER must be within 2 percent of the final reserve, which may require multiple model iterations to comply with this collar (i.e., “Method A”). An alternative approach (i.e. the “Direct Iteration Approach” or “Method B”) is to solve for the starting assets that result in the liquidation of all projected future benefits and expenses by the end of the projection horizon.[20]

For the SR, the discount rate required to calculate the greatest present value of accumulated deficiencies in each scenario is 105 percent of the one-year U.S. Treasury interest rates. These rates are provided in the PBR prescribed scenarios.

Reinsurance

Reinsurance cash flows must be included in the projections for the DR and SR. This is the case for both ceding companies and reinsurers. For coinsurance and Modco arrangements, reinsurance cash flows include arrangement fees and ceded cash flows. For yearly renewable term (YRT) arrangements, reinsurance cash flows include reinsurance premiums to the reinsurer and reinsurance death claim recoveries paid to the ceding company.

VM-20 requires that companies take into account potential risks surrounding reinsurance arrangements. For instance, if there is probable risk that the counterparty may become insolvent, then this risk must be reflected. Similarly, if the reinsurer is expected to increase YRT premiums or the ceding company is expected to recapture, then these actions will need to be considered in the projections. For example, ceding companies may consider the following methods to account for possible future YRT premium rate increases when calculating reserves:

■ Modeling future YRT premium rate increases or ceding company actions to recapture at a specific point in the projection.

■ Projecting convergence or capping of the YRT premium rates at the company experience mortality assumption.

■ Adding the mortality margin to the YRT premium rates.

■ Zeroing out any YRT net benefits that result in lowering the final reserves.

Note that these types of assumptions set a new precedent in how to model reinsurance for calculating reserves. VM-20 has an explicit recognition that ceding companies and reinsurers may have different assumptions used to calculate PBR reserves.

For the DR and SR, the reserve reinsurance credit calculated by ceding companies for YRT arrangements equals the difference between the post-reinsurance reserves (i.e., include reinsurance cash flows) and the pre-reinsurance reserves (i.e., exclude reinsurance cash flows). This calculation represents a major change from the prior calculation of YRT reinsurance reserve credit. Previously, a ceding company would only reduce statutory reserves due to applying the YRT reserve credit, whereas now ceding companies could potentially increase statutory reserves when applying the YRT reserve credit. When assessing whether to reflect a positive or negative reserve, ceding companies should keep in mind that reinsurers are intending to price for profitability at issue.

Assumptions for Different Purposes

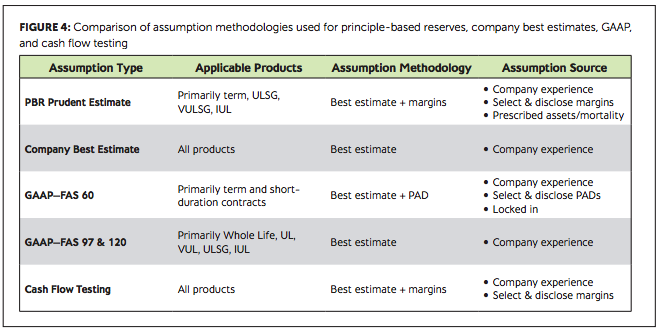

Companies will have different types of assumptions for best estimate, GAAP, PBR, and cash flow testing purposes. Figure 4 shows a table comparison among the various assumption types for life insurance actuarial functions. Note that cash flow testing employs the use of margins for assumption-setting, similar to PBR. However, cash flow testing and PBR assumptions may still vary assumptions due to prescribed components within the PBR calculation and differing levels of calculation granularity. In addition, FAS 60 Provisions for Adverse Deviation (PADs) may also differ from PBR margins set on term products.

Financial Reporting

In today’s fast-paced and automated environment, many companies are familiar with the stresses and urgency brought on by the financial reporting cycle. Therefore, life insurance companies will plan strategically and deliberately to meet the new challenges that PBR introduces into an ecosystem already saturated with deadlines and dependencies.

As a first step, companies may find it helpful to start diagramming the reporting process in a PBR future state. Such planning will not only illustrate the modeling activities, but also system inputs, journal entries, and the final arrival to the company ledger, as well as the eventual impact on statutory net gain and surplus. This practice can help provide a sense of process flow, time dependencies, and potential bottlenecks in the valuation process. This process includes the need to address the VM-G requirements of informing the Qualified Actuary, senior management, and the executive board.

In addition, the process will likely include the time and documentation necessary to develop the VM-31 PBR Actuarial Report, which will be hundreds of pages for most companies. More description of VM-31 and VM-G are provided in the feature titled “How to Survive—and Thrive—Amid Regulatory Change” in this issue of Contingencies.

As companies have experienced through the Statement of Financial Accounting Standards (FAS) No. 97 and FAS No. 120 GAAP deferred acquisition cost, unlocking is critical in understanding the story behind earnings. Under PBR, unlocking will now also be used as a statutory reserving concept. The DR and SR will include unlocking impacts due to updates for the mortality assumptions, lapse assumptions, expense assumption, investment assumptions, and other assumptions.

Unlocking not only matters from a profitability analysis perspective, but also from an accounting and governance perspective. Whereas prior statutory reserves could typically be broken down through a reserve rollforward closed-formula, this method remains more applicable for the NPR component of PBR reserves.

In order to capture all of the unlocking impacts, the DR and SR require a waterfall analysis or a step-by-step impact analysis, in which each assumption is updated one at a time to quantify the associated impact. This type of analysis will not only provide insight for understanding current period earnings, but also for understanding product profitability for pricing products. These methods may be similar to what some companies currently use for cash flow testing analysis today but may require additional time for multiple model runs at each interim step.

With respect to the change in the stochastic reserve excess over deterministic reserves, more analysis can used to understand which scenario types are driving the worst 30 percent of scenarios. In addition, an attribution can be performed to determine how movement over time in the stochastic reserves are driven by changes in prescribed scenarios versus unlocking prudent estimate assumptions. One method to understand the scenarios driving the stochastic reserve is to graph scenario interest and equity returns at various durations against the GPVAD for each scenario.

Conclusion

Companies are able to think creatively when exploring analysis techniques for life insurance stochastic reserves under PBR. Detailed implementation plans and supportive analysis techniques can only aid companies as they face a new frontier shrouded in technical complexity and actuarial soundness.