By Matthew Sonduck

Policy Director

Have you ever been in a meeting or had a conversation when a word, phrase, or acronym was used, and you felt lost? We’ve all been there: Someone says something that doesn’t quite make sense and there aren’t enough context clues to help you understand. In the public policy sphere, it happens often. Terminology can be vague or ambiguous. Acronyms are typically worse and used constantly. Conversations seem exclusionary. Sometimes it gets so bad that you wonder whether the other person is even speaking the same language.

About a month ago, a seemingly universally understood public policy term was used in conversation with key volunteers and I realized that not everyone really knew what was meant. So instead of continuing to perpetuate confusion, today’s mission is to define the term “external stakeholder” and its relevance for the Academy and our members.

To accomplish this mission, let’s focus on three key questions:

- What is an external stakeholder?

- Why is an external stakeholder important for the Academy’s mission?

- Who are some key external stakeholders for the Academy?

What is an external stakeholder?

It is often best to answer a question with a question.

Q: In the

modern world, when someone wants to find out what something means, where do

they go?

A: The internet.

Browsing both Bing (with ChatGPT) and Google, a common definition can be found. For a business, a stakeholder is commonly defined as a “person or a group who has an interest in an enterprise.” We can take that further to mean a person or group who can affect or be affected by the business. So, to us, an external stakeholder is someone or something outside of the Academy’s staff and volunteers.

This could be nonspecific, such as the media or Congress, or it could be as specific as the leadership of the National Association of Insurance Commissioners (NAIC), a specific elected official, or the Actuarial and Risk Management Department of Towson University. The basic idea is two-way engagement, meaning seeking to influence or engage with an entity outside of the Academy or vice versa. When the Academy creates work products like issue briefs, Contingencies articles, or blogs, one of the key questions is, “Who is the audience?” The audience is our external stakeholder.

Why is an external stakeholder important for the Academy’s mission?

The first question to answer is: What is the Academy’s mission? As listed on the Academy’s website, “The American Academy of Actuaries’ mission is to serve the public and the United States actuarial profession.” The mission statement identifies the Academy’s primary external stakeholder—the public.

Now, for the broader question. Public policy discourse and decisions made by certain external stakeholders have impacts for the Academy’s primary external stakeholder, the public. The Academy leverages its membership, who are the preeminent experts in risk and financial security, to provide unbiased thought leadership to external stakeholders to inform public policy decisions. To effectively inform decisions, the Academy must engage in strategic relationship-building with external stakeholders from across the public policy sphere.

Who are some key external stakeholders for the Academy?

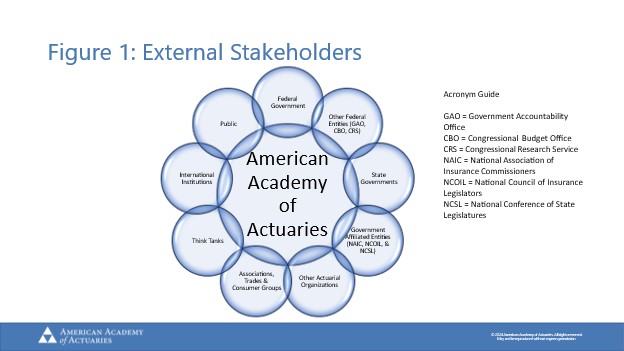

As with most things public

policy, the question of “who” depends on the topic or practice area. Figure 1

broadly conceptualizes key Academy external stakeholders. Different practice

areas—property/casualty, health, life, retirement, or financial reporting and

risk management—are likely to see some overlap and some differences when they

ask “who” to focus on.

Beyond the previously identified “public,” from the proverbial 30,000-foot perspective, key external stakeholders for the Academy includes the government, other trade or membership associations (such as AARP, ACLI, or the Chamber of Commerce), and the media.

Consider this: Social Security and Medicare are public programs benefitting millions of Americans. They are programs in which actuaries play a key role when considering program risk and financial security. Social Security provides financial protection, whereas Medicare provides health insurance primarily for older Americans.

Both programs are overseen by the federal government, specifically by federal agencies that are directed by the executive and congressional branches. Congress, which created the programs, broadly considers reform options. Which is why the Academy’s Health and Retirement practice councils work with elected officials, key committees of jurisdiction, and professional staff to share information, offer actuarial perspective, and regularly facilitate communication between our senior fellows, our volunteers, and our leadership teams.

At the same time, different federal agencies fall under the purview of the executive branch, namely the Social Security Administration and the Centers for Medicare and Medicaid Services, which are charged with administering the programs. To inform the discourse and potential public policy decisions impacting these important programs, the Academy fosters relationships with these external stakeholders as well.

Each practice area continues to identify and maintain a contact list for these identified key stakeholders … and it remains a work in progress to identify who we should be including in our broader list of external audiences.