By Mike Hughes, Ian Sterling, and Raju Saxena

Insurers are embracing innovation and advanced technology like never before as they seek to drive growth, preserve profitability, and manage risk. Insurance leaders in finance, risk, and the actuarial field in particular are under pressure to modernize and transform their operations, toolsets, and workforces to better serve the business.

These transformation and modernization initiatives can take many forms—from major systems upgrades and more sophisticated data management and analytics capabilities, to new operating models with increased offshoring and outsourcing. Such programs will have a profound impact on the future of actuarial work. That future is taking shape now.

Robotic process automation (RPA) has emerged as a key technology enabler of increased automation, more efficient and integrated processes, and higher organizational productivity across the insurance enterprise. RPA is accelerating actuarial innovation, both as part of broad-based and “industrial-strength” transformation to targeted improvements and in specific processes or work streams.

What Is Robotic Process Automation?

The Institute for Robotic Process Automation & Artificial Intelligence defines RPA as “the application of technology that allows employees in a company to configure computer software or a ‘robot’ to capture and interpret existing applications for processing a transaction, manipulating data, triggering responses and communicating with other digital systems.”[3]

Essentially, RPA is the use of software robots to replicate the actions of human beings in performing specific tasks and interacting with other systems. In this sense, robots are virtual co-workers adept at handling recurring tasks, enabling human workers to focus on higher-value and analytical activities. Robots have their own security profiles (identification, passwords, and credentials) to access company or external resources and execute functions in the same way employees do; work is performed in compliance with business requirements and security policies.

Robots in the Workforce

Given their evolving role in organizations, robots will affect talent management and sourcing strategies. Insurers seeking the optimal workforce model will need to factor RPA into their decisions. In many cases, robotics is emerging as an attractive alternative to offshoring or as a lever to further optimize costs for those processes already offshored (see Figure 1).

A History of Rapid Evolution

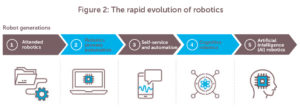

Robotics capabilities have advanced rapidly in recent years and continue to evolve at an impressive rate. Processing speeds and self-learning capabilities have improved considerably (see Figure 2). The various generations are:

- First generation—focuses on desktop automation (e.g., call center representatives triggering searches for customer account information across multiple systems);

The various generations are:

- Second generation—uses robots as virtual employees, executing repetitive processes across multiple systems, based on higher processing speed and falling costs;

- Third generation—enables straight-through processing with no human intervention (e.g., the fulfillment of user requests via self-service portals and delivery of status updates to customers);

- Fourth generation—adds cognitive robotics based on machine learning, improved analytics, and stronger decision engines, which add an element of judgment, extending automation opportunities and strengthening the business case; and

- Fifth generation—extends robots with artificial intelligence (AI), where decisions and actions are continuously optimized based on machine learning and statistical modeling.

Early generations of robots have achieved widespread deployment in many industries. While the later generations have received much recent media attention, many of these applications remain in development or piloting phases.

Business Case and Benefits of RPA

The rapid adoption of RPA is no surprise, considering the significant value it can deliver, including:

- Increased efficiency and productivity;

- Accelerated cycle times for key processes, such as policy issue, claims processing, and the financial reporting statement close;

- New and improved sales and customer service interactions and delivery models;

- Improved quality, consistency, transparency, and controls; and

- Enhanced employee engagement and value contribution resulting from a reduction in time spent on administrative activities and an increase in focus on higher-value activities.

Robotics can increase profitability and enhance the customer experience by improving responsiveness and communication while lowering resource costs. For example, in property and casualty (P&C) insurance claims processing, the speed of settlement is directly related to both the cost of the claim and customer satisfaction.

Part of the appeal of RPA is its noninvasive nature. Typically, robots can be overlaid on existing systems environments and interact with and across all of the same internal and external systems as humans. This ease of integration contributes to a compelling business case for RPA in comparison to some transformation and modernization initiatives because:

- Upfront investments are relatively modest;

- Payback periods are relatively quick;

- Return on investment is attractive; and

- Implementations can be achieved with modest demands on key IT resources.

The bottom line: RPA offers value whether deployed as part of a full modernization program or as an incremental step in automating and streamlining specific recurring processes, subprocesses, and tasks.

The Rise of Robots

Because the benefits and business case align with the goals and objectives of many insurers, it is easy to see why robotics is quickly gaining traction in the industry—with forecasts calling for much broader adoption in the coming years.

A landmark 2013 study by Oxford University[4] found that a number of insurance jobs—including those in underwriting, claims settlement, and policy processing—were among the most likely to be handled by robots, or via “computerization,” with a probability of at least 98 percent. While specific finance, actuarial, and tax-related roles were not included in the study, EY’s experience confirms that insurers also have an appetite for automating these activities. Indeed, these changes are already taking place.

It’s not just the insurance sector that is automating work through robotics. According to Gartner[5], about one-third of all customer service interactions are now handled without any human interaction. By 2020, that number could reach 85 percent. As for costs, EY’s research has shown that RPA can reduce the cost of manual operations by 25 to 40 percent.[6]

RPA in Insurance

Due to the compelling value proposition, many insurance companies have begun using robotics to automate standardized processes, including those in claims processing, policy administration, underwriting, accounting and finance, actuarial, and tax.

Most insurers present a “target-rich environment” for RPA thanks to their:

- Complex web of legacy systems and inefficient manual processes;

- Need to enhance the customer experience to succeed in digital channels; and

- Need for increased efficiency to remain competitive and fund innovation and growth initiatives in a time of thin profit margins.

Companies are exploring opportunities for automation in key actuarial processes and tasks, including:

| Property and casualty, accident and health | Life and annuity |

|---|---|

|

|

Companies weighing RPA should consider the success stories of early adopters. One life insurer used RPA to automate some of the essential steps in its cash-flow testing process. When business units submit model results to corporate actuarial, a robot performs a series of validations on the submissions, aggregates the results, updates the status tracker, and sends email notifications as process milestones are achieved or issues arise.

Click to enlarge

The company has achieved a number of significant results, including:

- Actuaries can now focus on exceptions, reviewing model results identified by the robot as being outside of predefined tolerances.

- Cycle times are shorter because the robots operate on a 24/7 basis and submissions outside of business hours are immediately processed.

- Rework is minimized because each work step is consistently executed and automatically documented.

- Key review and decision points have been incorporated where human judgment is needed; in some instances, signoffs from the process owner are required before the robot will proceed to the next milestone.

RPA was similarly effective in performing quarterly analysis across 20 property and casualty reserve segments. Despite the use of reserving software, the reserving process was inefficient, with significant time spent on manual activities such as data preparation prior to the selection of assumptions.

To improve the efficiency and controls, RPA took on data preparation subprocess tasks, including:

- Copying and pasting prior-year data to current spreadsheets;

- Aggregating and copying current evaluation data to the latest diagonal;

- Uploading the triangles and other data into the reserving software;

- Setting initial assumptions based on the prior evaluation selections process; and

- Exporting initial results into data visualization and reporting software.

Just like a human, the robot worked across multiple platforms—including Excel (with macros), reserving software, and data visualization tools—providing additional information for better decision-making and allowing actuaries to focus on the selection of assumptions and interpretation of results.

In this situation, implementing RPA led to:

- 25 to 30 percent productivity gains and overall cycle time reductions;

- Improved controls; and

- Earlier and better insights into emerging trends and business implications.

Automation in Context:

Driving to Holistic Solutions

It’s important to recognize that RPA is one of a variety of technologies that can be leveraged to drive automation in finance, risk, and actuarial functions. Further, it’s only one element of broader modernization and transformation initiatives. Those programs may also involve:

- Rationalization of modeling, valuation, and analysis systems, and migration to next-generation platforms;

- Centralization of modeling, valuation, reserving, and other critical functions;

- Enhanced data management practices, including big data techniques, and the embedding of analytics throughout the value chain;

- New sourcing strategies, including using resources in lower-cost offshore locations and/or outsourcing to third-party providers;

- Adopting new or updated talent management strategies; and

- Applying business process management and other automation tools.

Companies seeking to boost their returns on transformation and automation investments and enhance the value that the actuarial segment can bring to the business should consider their options holistically and decide which tool, or combination of tools, is right for their unique circumstances and objectives.

RPA and the Future of Actuarial Work

RPA is one of several “megatrends” reshaping the economy and the nature of work itself.

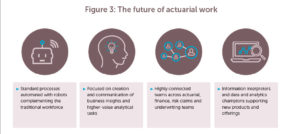

Thanks to the drive for more customer-centric offerings, transformation and modernization programs, and associated technology innovations, the future work of actuaries and others will be vastly different than their past work (see Figure 3).

Actuarial “customers” in the business want better, more timely, and efficient decision support. External customers and distributors want more personalized experiences, faster answers, and more digital interaction. These demands are accelerating innovation and disruption and requiring new levels of cross-functional collaboration. More and more tasks and activities will be automated.

Although increased straight-through processing will displace a significant number of jobs over time, the remaining workers will be realigned to higher-value analytical and decision support activities—with new roles and responsibilities yet to emerge.

Leaders will require new competencies to manage a workforce that is becoming leaner, yes, but also more skilled, diverse, remote, and contingent. Attracting and retaining high-performing workers will be more important—and more difficult—as employee expectations rise and the competition for talent intensifies. Executives will be evaluated on their ability to drive innovation and adopt data-driven, analytics-enabled decision-making as the new normal.

It is a challenging time for actuaries and the industry as a whole, but it is also an exciting era of unprecedented opportunity. Thriving in the new era will require:

- Strong and diverse leadership teams with the ability to align and integrate the finance, risk, and actuarial domains and to manage the “metrics that matter” related to growth, profitability and risk;

- A bold vision for how work will be performed and the future-state operating models needed to succeed (e.g., increased automation and skilled resources focused on higher-value tasks);

- A framework for making strategic choices—prioritizing investments based on their alignment to the company purpose and their ability to deliver both immediate returns and sustainable competitive advantage;

- Deep capabilities in talent development—recruiting, developing, retaining, and motivating high-potential staff; and

- A culture that inspires and enables innovation and teamwork—significant organizational change will be required to instill a “disrupter” culture capable of adapting to and proactively driving constant change, and leaders will need to inspire creativity and promote increased risk-taking and innovation.

While it’s difficult to predict exactly what the future will look like, it is clear that the actuarial functions of the future will be leaner, more data-driven, and more technology-enabled. Actuarial leaders who take bold action today will reap the benefits and provide more value to the business going forward.

About the authors

Mike Hughes, Ian Sterling, and Raju Saxena are part of Ernst & Young LLP’s Advisory Services practice.

|

The views expressed by the authors are their own, and not necessarily those of Ernst & Young LLP or other members of the global EY organization. |

References

[1] “What Is Robotic Process Automation?”; Institute for Robotic Process Automation & Artificial Intelligence; undated.

[2] The Future of Employment; Oxford Martine Programme on Technology and Employment; Sept. 17, 2013.

[3] Gartner Customer 360 Summit 2011; conference brochure; 2011.