By Jay Vadiveloo

I recently attended a seminar on artificial intelligence (AI) by Ajay Agrawal, Ph.D. I think Agrawal’s book, Prediction Machines: The Simple Economics of Artificial Intelligence (Harvard Business Review Press, 2018), is a must-read for any actuary who would like to get some understanding of the emerging world of artificial intelligence and how it can impact the work we do as actuaries.

A Working Definition of AI

Agrawal provides a very basic and working definition of AI as the sum total of all the tools, techniques, and algorithms that are being developed to improve prediction. Using this definition, I would like to regard AI as the overarching umbrella that encompasses various data analytics tools like generalized linear models, machine learning, neural networks, decision trees, etc. Also, because the primary purpose of AI is to improve prediction, then the reverse holds—any technique that improves actuarial prediction can be viewed as an AI form of application in actuarial science.

A New Way of Thinking About Actuarial Modeling

To understand how AI can be used to improve prediction in actuarial science, it is important to recognize some of the unique aspects of actuarial modeling and how it is different from traditional statistical modeling. My work over the past 11 years in applied actuarial research, using the available technological tools and techniques available in computer programming language like R, has uncovered new and innovative techniques that I am unaware are being used elsewhere. This work does not conform to the “building block” approach whereby one starts with existing established statistical modeling techniques and then adapts these techniques to solve the problem at hand. Using this approach to actuarial modeling, some of these techniques and algorithms can be viewed as a form of application of AI.

AI Application to Model Healthy Life Expectancy

Let me illustrate with an example. Over the past few years, I’ve worked with a team that has come up with a model to measure Healthy Life Expectancy (HLE). As a corollary, the model also measures Unhealthy Life Expectancy (ULE) and Life Expectancy (LE), where LE = HLE + ULE. Unlike traditional statistical modeling, the HLE model was not developed from a single data source. As is typical in most actuarial modeling, we focus on the underlying actuarial assumptions and search for the most suitable data sources to estimate these actuarial assumptions.

In the HLE model, the main actuarial assumptions we needed were healthy mortality rates, incidence of disability, and disabled mortality rates. For healthy mortality rates, we used first-year select mortality rates from the Society of Actuaries (SOA) Valuation Basic Tables, incidence of disability from Long Term Care rates published by the SOA, and disabled mortality rates from the SOA RP 2014 disabled mortality rates. These actuarial assumptions formed the base rates that were used to develop the HLE model. The AI technique was adopted to adjust HLE to reflect individual lifestyle characteristics, health, and diet.

The adjustment factors to HLE required an independent literature review of different data sources. For example, if research showed that individuals who followed a healthy diet lived 20% longer than individuals who did not, that 20% figure was translated into adjustment factors applied to the underlying base actuarial assumption. The adjustment factors were simply multiplied together to create an overall adjustment factor for the individual.

This HLE modeling technique can be viewed as an actuarial application of AI—the model uses varied sources of data and an algorithm to better predict an individual’s HLE. Can this AI technique be improved or refined? Absolutely, if we had better information on the impact of the interaction of various lifestyle habits. For example, an individual who exercises regularly and follows a healthy diet may have an overall adjustment factor effect that is greater than the product of the individual adjustment factors. But based on the information available, it would have been unreasonable to estimate the impact of interactions between various adjustment factors, so the model had to use the multiplicative approach.

A schematic of the AI application to model HLE is shown in Figure 1.

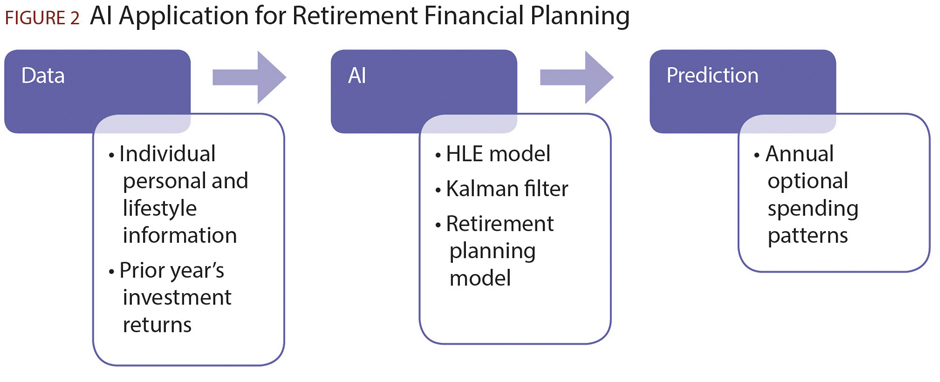

AI Application for Retirement Financial Planning

From the above example, one can see that applying AI to improve actuarial prediction is not as straightforward as it might be in non-actuarial applications. Most actuarial modeling is built on estimation of actuarial assumptions, and any use of AI to improve prediction would require applying AI techniques to the underlying actuarial assumptions. In our previous HLE example, HLE was measured by adjusting baseline actuarial assumptions of healthy mortality, incidence of disability, and disabled mortality rates. A traditional statistical approach would start off with a database of healthy lives, model these lives until death, and fit a survival model to measure HLE. While the actuarial approach may not satisfy some of the fundamental principles in statistical inference and parameter estimation, it has the advantage of being far more flexible and adaptable to capture various individual lifestyle characteristics.

Another application of AI can be demonstrated in individual retirement financial planning. Sophisticated retirement financial planning models have been developed using a combination of Monte Carlo techniques to project investment returns and Markov chain algorithms to project realizations of mortality and morbidity assumptions. Using this MC-MC technique, we can predict the optimal level of spending for a retiree so she does not run out of money before death with a high degree of certainty. Can we use AI to improve the spending level prediction? Two modifications present themselves:

- Apply the adjustment factors used to calculate HLE to vary spending patterns while the retiree is healthy and while the retiree is unhealthy.

- Use an annual recalibration technique called Kalman filter to adjust projected investment returns based on the prior year’s actual returns.

Using both these approaches, the predicted optimal spending levels are recalculated each year to reflect any changes in health status of the retiree and the model’s recalibration of projected investment returns. Both approaches are examples of a unique application of AI to improve the model prediction of retirement planning—a very important application in actuarial science.

A schematic of the AI application for retirement financial planning is shown in Figure 2.

General Rule for Applying AI in Actuarial Science

While these are specific examples of applications of AI in actuarial science, I would like to generalize to a broader range of actuarial issues in which use of AI could provide a better solution. While this is not exhaustive, I believe one of the most effective uses of AI in actuarial science is to better understand and predict “outlier” events. While outlier events in statistics generally refer to outcomes falling outside a certain number of standard deviations from the mean (also termed tail events in actuarial science), I would like to create my own definition for purposes of applying AI. My definition of outlier events refers to unusual events with significant financial consequences that don’t necessarily follow the usual progression of actuarial probabilities. It is an anomaly, and having better insights into what causes anomalies could improve our prediction of these events and their financial consequences.

Let me illustrate with a couple of examples.

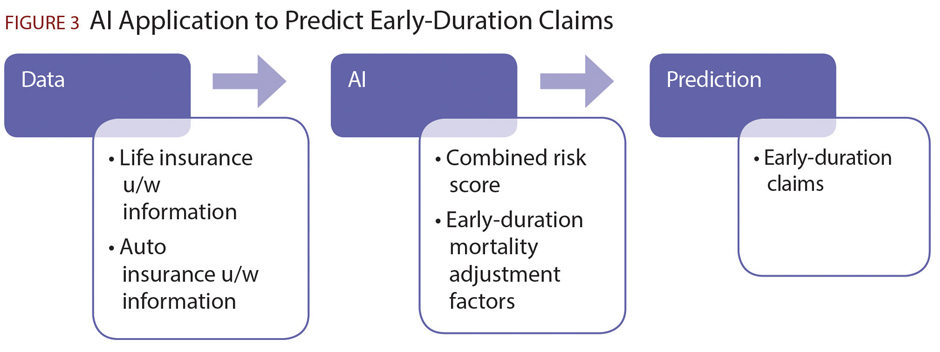

AI Application to Predict Early-Duration Life Insurance Claims

The first is early-duration life insurance claims (e.g., claims within five years of issue) that were fully underwritten. It is certainly unusual for an individual who was deemed healthy at issue to die within five years. It is a total violation of the extremely low select mortality rates we assume for newly underwritten lives, and these early-duration claims can run into millions of dollars. This is a life insurer’s worst nightmare, because insufficient premiums would have been collected to cover claims and acquisition costs. So how can AI be applied to better understand and predict these early-duration claims?

Barring anti-selection, the only reason for this unusual occurrence is that these are accidental deaths. Typically, life underwriting does not underwrite for the potential of an accidental death that auto insurers routinely do. My team is developing an enhanced early-duration claim model that incorporates both life and auto insurance underwriting information to adjust early-duration select mortality rates based on the combined risk score (life plus auto underwriting) of policyholders at time of issue. Following Agrawal’s definition of AI as any technique or algorithm that improves prediction, this enhanced early-duration claim model is an example of an AI application. The combined risk score model can be adjusted by detailed examination of the characteristics of actual early-duration claims to see whether certain patterns emerge that are associated with accidental deaths. This enhanced screening of life insurance policyholders to detect the onset of an early-duration claim could have significant financial implications for a life insurer.

A schematic of the AI application to predict early-duration claims is shown in Figure 3.

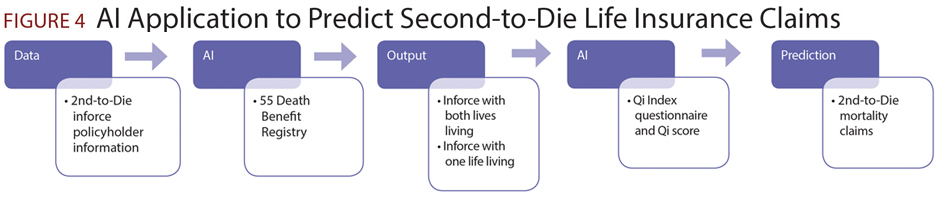

AI Application to Predict Second-to-Die Claims

A second example of an AI application is to predict second-to-die life insurance claims. These second-to-die policies are characterized by the following features:

- Large face amounts

- Both policyholders are older, with the underwriting requirement that at least one life is insurable

- The second-to-die policyholder is not required to inform the insurer when the first death occurs, so claim reserves and claim predictions use the conditional probability that a claim will be incurred given at least one life is living

One of the problems with predicting second-to-die claims when you don’t know whether only one life or both lives are living is that you cannot distinguish between individual mortality when both lives are living and individual mortality when a spouse has passed away. Even if an insurer is aware that exactly one life is living, the estimation of the individual mortality could be contingent on various factors like the age of the surviving insured, how long they were married before the spouse passed away, surviving children living at home or nearby, etc. Here is where AI can be effective. To determine the inforce second-to-die policies where only one life is living, an insurer can do a sweep of the Social Security Death Registry. Then for the surviving spouse, the insurer can conduct an online survey to gauge the impact of the death of the first life on the survivor. The survey questions have been designed to assess the emotional impact of the first death on the survivor and will be condensed into an Index on emotional well-being ranging from 0 to 100. Call this the Qi Index—the higher the Qi Index, the more well-adjusted the survivor after the death of the spouse. The Qi Index is then used to adjust the future mortality of the surviving spouse to better predict claims from second-to-die policyholders.

The prediction of the mortality of a surviving spouse is the outlier event; developing the Qi Index to adjust future mortality rates of the survivor is the AI application to improve our prediction. If this approach is implemented by an insurer, it can be combined with a benefits package that provides counseling and related services by the insurer to the surviving spouse to help them cope with their loss. Besides distinguishing the insurer from its competitors, it could extend the longevity of the surviving spouse and allow an insurer to create an ongoing relationship with the surviving policyholder.

A schematic of the AI application to predict second-to-die life insurance claims is shown in Figure 4.

Concluding Remarks

We now operate in a new world of data analytics and decision-making using vast sources of information. For the actuarial profession, any application of AI to improve prediction has to be done within the framework of actuarial modeling, which is typically long term in nature and focuses on estimation of actuarial assumptions.

Using the broad definition of AI as the incorporation of all analytical tools and modeling techniques to improve prediction, I believe the best applications of AI in actuarial science arise from “outlier” or unusual events that are difficult to predict using standard actuarial assumptions. This article provides several examples of AI applications in actuarial science; I hope this will stimulate readers to come up with their own applications based on the work they are doing.

I believe actuaries are the only professionals who have the business and risk management knowledge to apply data analytics and AI techniques effectively to improve the decision-making process in the insurance and financial services industry. However, applying AI in actuarial science is not as straightforward as other disciplines, and I hope this article will stimulate other actuaries to realize how well-positioned they are to move our profession forward into the world of technology and AI.

JAY VADIVELOO, MAAA, FSA, is the director of the Janet & Mark L. Goldenson Center for Actuarial Research at the University of Connecticut.