By Allan W. Ryan

What is a profession? The Oxford Dictionary defines the word in part as “a paid occupation, especially one that involves prolonged training and a formal qualification.” The attributes of a profession, as broadly recognized in the United States, often include the following: (1) a formal educational system; (2) a national association; (3) a code of professional ethics; (4) public respect and trust; (5) licensing; and (6) the ability to discipline members.

The actuarial profession in the United States meets the definition above and has all the attributes of a profession with one exception: licensing. Note that “actuarial profession” is intended here to include those individuals who are members of at least one of the five U.S.-based actuarial organizations which have adopted the Code of Professional Conduct (the “Code”) effective January 1, 2001. Those organizations are the American Academy of Actuaries, the Society of Actuaries, the Casualty Actuarial Society, the Conference of Consulting Actuaries, and the ASPPA College of Pension Actuaries. Henceforth in this article the term Actuary (with “A” capitalized) shall mean a member of one of the five organizations (consistent with its use in the Code).

So possibly unique among professions, and in contrast to say, the legal, medical, or accounting professions, Actuaries in the United States are, in general, not subject to licensing by federal or state government (with the exception of enrolled actuaries, licensed by the federal government to perform specific services related to qualified employee benefit plans under the Employee Retirement Income Security Act of 1974 [ERISA]). It should be noted that enrolled actuaries may or may not be members of one or more of the five U.S.-based actuarial organizations noted above.

Although Actuaries are not in general licensed, they are widely recognized as professionals by various government entities. State insurance department law and regulations identify membership in the American Academy of Actuaries as meeting the definition of “Qualified Actuary” for purposes of signing actuarial opinions (including the Actuarial Opinion and Memorandum required for statutory reserves, policy form filings, and other services). The NAIC Valuation Manual, adopted by the states, gives recognition to Qualified Actuaries performing specific actuarial services under principle-based reserves.

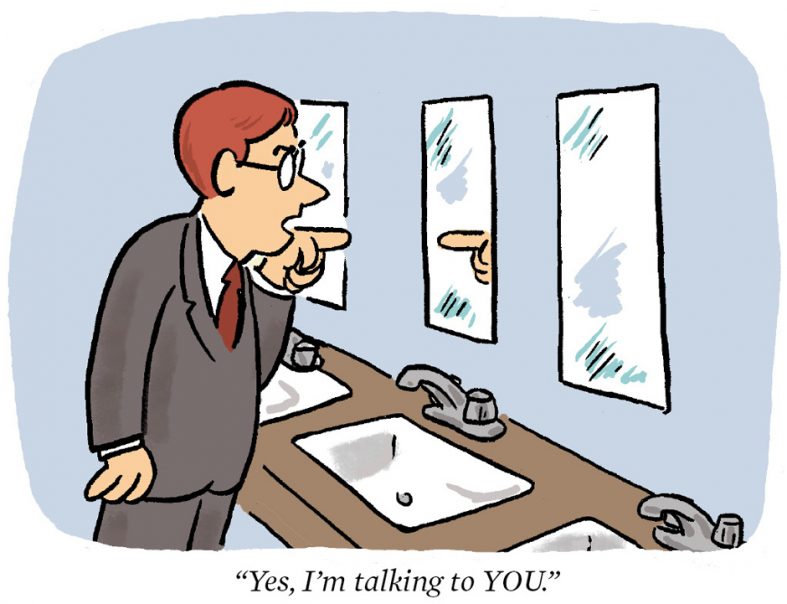

Whereas practicing medicine, law, or acting as a certified public accountant without being licensed will land you in trouble, an individual who is not a member of any of the recognized U.S. organizations can call himself or herself an actuary and provide “actuarial” services, without necessarily violating any law. Because of this, it is essential that our credentials be recognized as making a difference in the services we provide. I believe that our profession has built trust with our clients and the public, and we have accomplished this trust and confidence with our self-credentialing and self-regulating approach. In order to continue to maintain that trust, we must provide actuarial services that meet our high standards, so that our clients, including the government entities for whom we perform services, and the public in general, can have confidence in the quality of the work we perform.

The five U.S.-based organizations each individually adopted an identical Code of Professional Conduct in 1994. Following that, a number of differences, some significant, developed between versions of the 1994 adopted by the U.S.-based organizations. “After significant restructuring and revision, the [Academy’s Joint Committee on the Code] developed a single Code of Professional Conduct”[1] that was individually adopted by each of the five U.S.-based organizations and effective January 1, 2001. Members of any of the five U.S.-based actuarial organizations are bound by this Code. Our standards in turn rely on the Code provisions for their applicability to members of those five actuarial organizations.

Precept 1 of the Code states: “An Actuary shall act honestly, with integrity and competence, and in a manner to fulfill the profession’s responsibility to the public and to uphold the reputation of the actuarial profession.” This principle, which seems like—and should be—common sense, guides our behavior as actuaries. Precept 2 states: “An Actuary shall perform Actuarial Services only when the Actuary is qualified to do so on the basis of basic and continuing education and experience, and only when the Actuary satisfies applicable qualification standards.” This Precept is what requires U.S actuaries to abide by the USQS. Precept 3 states: “An Actuary shall ensure that Actuarial Services performed by or under the direction of the Actuary satisfy applicable standards of practice.” This Precept is what requires U.S. actuaries to follow the actuarial standards of practice (ASOPs).

The Code has 14 precepts, but I have highlighted Precepts 2 and 3, along with Precept 1, because the Code, along with the U.S. Qualification Standards and the ASOPs, constitute our profession’s binding guidance. What is important with respect to this binding guidance is the need to exercise professional judgment: for example, in determining whether one is qualified to provide a particular actuarial service, or in the application of an actuarial standard of practice to a specific assignment. Note that ASOP No. 1, Introductory Actuarial Standard of Practice, states in section 3.1.4:

“The ASOPs are principles-based and do not attempt to dictate every step and decision in an actuarial assignment. Generally, ASOPs are not narrowly prescriptive and neither dictate a single approach nor mandate a particular outcome. Rather, ASOPs provide the actuary with an analytical framework for exercising professional judgment, and identify factors that the actuary typically should consider when rendering a particular type of actuarial service. The ASOPs allow for the actuary to use professional judgment when selecting methods and assumptions, conducting an analysis, and reaching a conclusion, and recognize that actuaries can reasonably reach different conclusions when faced with the same facts.”

Within this framework of guidance requiring the exercise of professional judgment, the Actuarial Board for Counseling and Discipline (ABCD) has several roles, delegated to it by the U.S.-based actuarial organizations noted above, all intended to ensure that we regulate ourselves in a manner to uphold the public trust. I will start by mentioning that the full title of the ABCD is a bit of a misnomer, in that it is incomplete—the missing word being “guidance.” A more appropriate title would be the “Actuarial Board for Guidance, Counseling, and Discipline.” Putting aside the “guidance” role for a moment, it will be helpful to describe briefly the “C” and “D” roles. The “D” role, or discipline, should be viewed as a last resort, as it is only used when a material, unresolved violation of the Code is serious enough to warrant such a recommendation by the ABCD (note that the ABCD only recommends discipline to an Actuary’s member organizations; the final decision rests with those organizations). The “C” role, “counseling,” consists of formal advice provided to an Actuary, by one or more ABCD members, where a complaint has come before the ABCD, but the Actuary’s conduct or practice is not considered by the ABCD to merit a recommendation of discipline. While not considered discipline, confidential records of counseling are maintained by the ABCD, so that if a new complaint is subsequently brought to the attention of the ABCD, the counseling record may be taken into account.

Finally, the “guidance” role, which I want to emphasize here, is important because guidance is intended to assist Actuaries in interpreting or understanding our standards, and to avoid later potential violations of the Code. A “Request for Guidance” (RFG) consists of asking the ABCD for help in a particular situation. When an RFG is received, an ABCD member is chosen to speak with the requestor and discuss the issue. In an RFG discussion, the intent is to assist the requestor in thinking through the situation and using professional judgment, and to make clear that often there is no single “right” or “wrong” answer. The results of an RFG are treated as confidential by the ABCD and documented and circulated among the ABCD members and ABCD counsel.

To submit an RFG, all one needs to do is go to the website of the American Academy of Actuaries and click on the ABCD icon at the top of the page. This takes you to the ABCD page, where at the bottom you will find an icon, “Ask for Guidance.”

It is worth noting that the discipline process is concerned with “material, unresolved” violations of the Code, and that of all complaints received by the ABCD, the majority are dismissed, and of those not dismissed, counseling is more likely than discipline. Furthermore, RFGs are far more numerous than complaints!

When you have questions, discussion with peers can often, but not always, provide a solution. There are various reasons—such as confidentiality, working as a sole practitioner, or possibly dealing with a new area of practice—where this discussion is not practical. The ABCD is here to help in such situations through the RFG process.

ALLAN W. RYAN, MAAA, FSA, is a member of the Actuarial Board for Counseling and Discipline.

Reference

[1] Structural Framework of U.S. Actuarial Professionalism; American Academy of Actuaries; October 2004.