By Jason Alvarez and Mark Troutman

Health care insurance programs require capital to support the risk assumed by the health plan. Those that require capital include policyholders, rating agencies, and regulators. The focus of this article is on the regulators’ risk-based capital (or “RBC”) standards applicable to health plans.

Health reform has brought many health plans opportunities for growth. As a result, many health plans have legitimate concerns about meeting RBC requirements. This article explains how we believe captives and reinsurance can help health plans with growth opportunities meet RBC requirements and other company enterprise risk management needs.

With many health systems and Accountable Care Organizations (ACOs) forming or acquiring their own health plans, assuming more population health management risk from payers via ACO contracts, and even directly contracting with employers in a narrow network strategy, population health management and protection from catastrophic medical claims become imperative for operational and financial success. If a health plan or hospital has an affiliated captive insurance company, it has an effective risk management tool at hand.

Key Drivers of the Increased Use of Health Captives

The following industry trends have contributed to an increase in health captives with insurance or reinsurance protection:

- A growing number of health care entrants (e.g., providers, property and casualty insurance carriers, and venture capital investors);

- An abundance of low-cost capital making reinsurance a cost-effective option for capital planning and management and catastrophic risk protection;

- New health programs requiring protection in early years (e.g., Next Generation ACOs) and unlimited maximum risk;

- A desire to draft custom insurance policy or reinsurance treaty terms and conditions;

- A desire to better understand fundamental risks and exposures and to access strategic partners to help manage risk; and

- A desire for analytics to provide customers with insights and confidence to vary reinsurance buying patterns to mitigate and diversify risk.

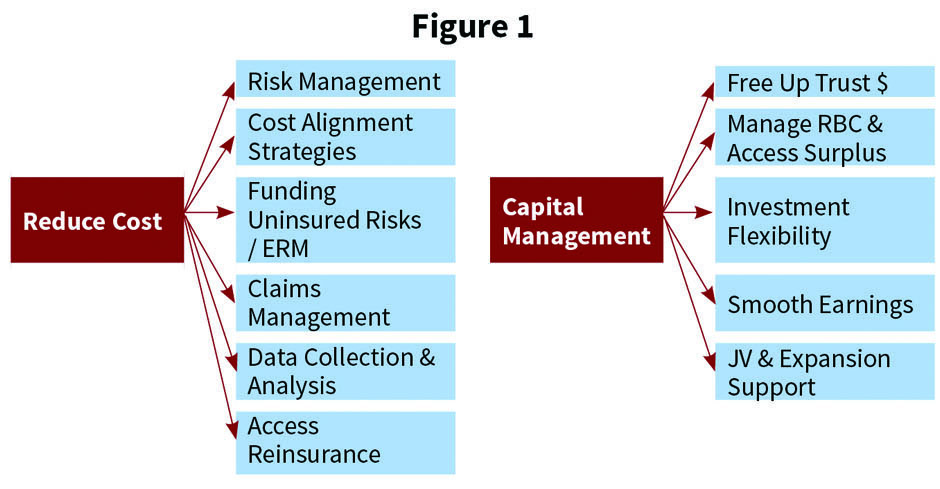

Captive utilization offers several ways to reduce costs and improve capital management. Enhanced captive strategies are shown in Figure 1.

There is increased utilization of cell captives in particular for several additional reasons:

- Additional cells can be added to the system’s captive if/when needed;

- Cell assets and liabilities are segregated;

- Each cell can make its own tax elections (e.g., Internal Revenue Code Section 953(d) election for U.S. taxpayers);

- Cells can be structured to fail the IRS tests as an insurer for tax-exempt entities to avoid unrelated business taxable income and federal excise tax; and

- Cells can have separate governance.

Although an existing health plan or provider captive may have been formed to accept medical malpractice or professional liability or other property and casualty coverages, it may have excess capital or access to capital that would allow it to assume additional types of risk. The captive insurance company may be well-suited to accommodate various levels of medical excess, provider excess, and/or employer stop-loss risk. Utilizing a captive to expand risk protection has numerous potential advantages and disadvantages to consider.

Potential advantages:

- Less risk and profits charges are ceded to an external organization.

- There is potential for lower expense and risk charges for the layer of risk retained in the captive as well.

- There is ability to buy higher-deductible reinsurance while providing appropriate volatility protection in line with risk tolerance and enterprise risk management objectives.

- This is more flexibility on how to handle “lasers” placed by an insurer or reinsurer.

- Risk portfolio diversification within the captive lowers overall capital requirements due to covariance adjustments.

- There is ability to customize services provided.

Potential disadvantages:

- Additional risk is assumed.

- Additional captive accounting is required.

- There are limited markets that can handle the administration for the captive. The captive may contract with a managing underwriter to handle various services.

- Additional insurance/reinsurance agreements are needed if such coverage is purchased.

- Solvency requirements may increase and would need to be evaluated if the captive retains quota share or excess of loss risk. However, various forms of capital substitutes may be employed (e.g., letter of credit).

- There may be premium tax and federal excise tax depending on where the captive is domiciled.

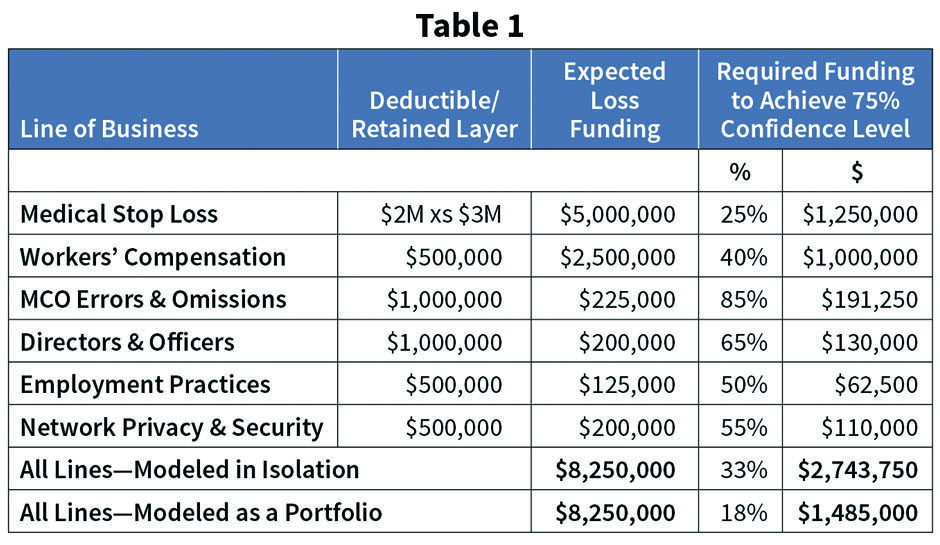

Financing multiple lines results in an RBC diversification discount due to risk covariance credits. Table 1 illustrates an example with RBC savings of $1,258,750 (46% of total) when the risks are modeled as a portfolio versus on a stand-alone basis.

Quota share reinsurance in particular is a capital management tool. Although it does not provide actual capital (i.e., increase the numerator in an RBC calculation), it does reduce the required capital (i.e., decrease the denominator in an RBC calculation). Quota share benefits to a health plan are many:

- Reduce the plan’s required capital and/or improve its RBC ratio through a transaction that can be executed quickly;

- Provide a temporary funding of risk capital during a period of premium growth without a dilution of the equity in the company;

- Reduce financial exposure to adverse claim fluctuations resulting in underwriting losses;

- Continue to participate in underwriting gains, although such gains will be diluted based upon the reinsurance terms; and

- Access to outside expertise via underwriting, actuarial analysis, claims, and care management services.

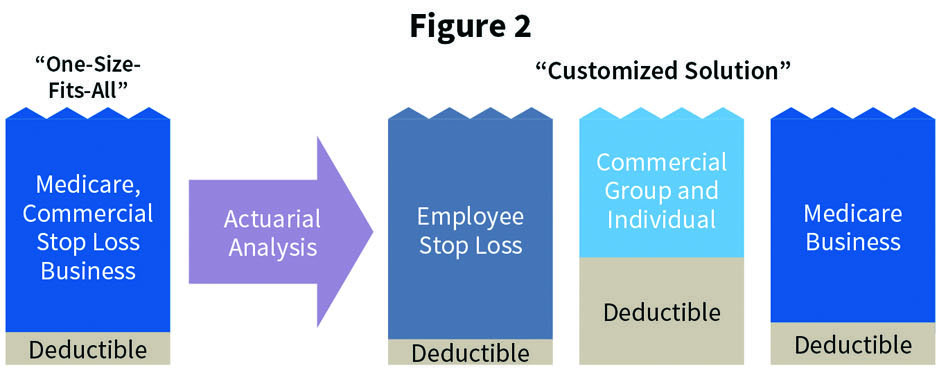

Excess-of-loss reinsurance is less effective as a capital management tool (versus a moderate to large quota share percentage) because the typical excess-of-loss premium is only 5% to 10% of total premium. A health plan must cede more premium to receive more RBC relief (e.g., a 50% quota share would provide close to 50% RBC relief). Excess-of-loss protection is still important to cover catastrophic claims even when a quota share reinsurance treaty also exists. An excess-of-loss reinsurance treaty provides protection to the variability of the quota share reinsurance treaty results. A captive provides maximum flexibility to offer alternative reinsurance structures protecting against claim volatility. Many health plans utilize a “one-size-fits-all” strategy in developing their reinsurance programs. For example, they may have the same deductible across all blocks of business, in spite of the varying claims profile of each line, simply due to historical decreases customized solutions hedge health plans against the unique volatility of each block of business they write. (See Figure 2).

Customized Service

A captive can also subcontract for various risk management services. Unbundled risk management services for captives include the following:

- Providing fronting services that allow a risk-bearing entity to cede risk to the captive via insurance policy or reinsurance treaty;

- Appropriately pricing and underwriting stop-loss coverage on medical risks placed into the captive;

- Evaluating the actuarial adequacy of pricing of stop-loss coverage provided through ACO contracts;

- Providing medical case management support for excess medical risk on large claims inside or that leak outside a health plan’s contracted provider network;

- Calculating premiums and executing billing function for various lines of business;

- Adjudicating claims; and

- Obtaining quota share and/or excess of loss insurance or reinsurance for non-retained risk.

Give (Reinsurance) Credit Where Credit Is Due

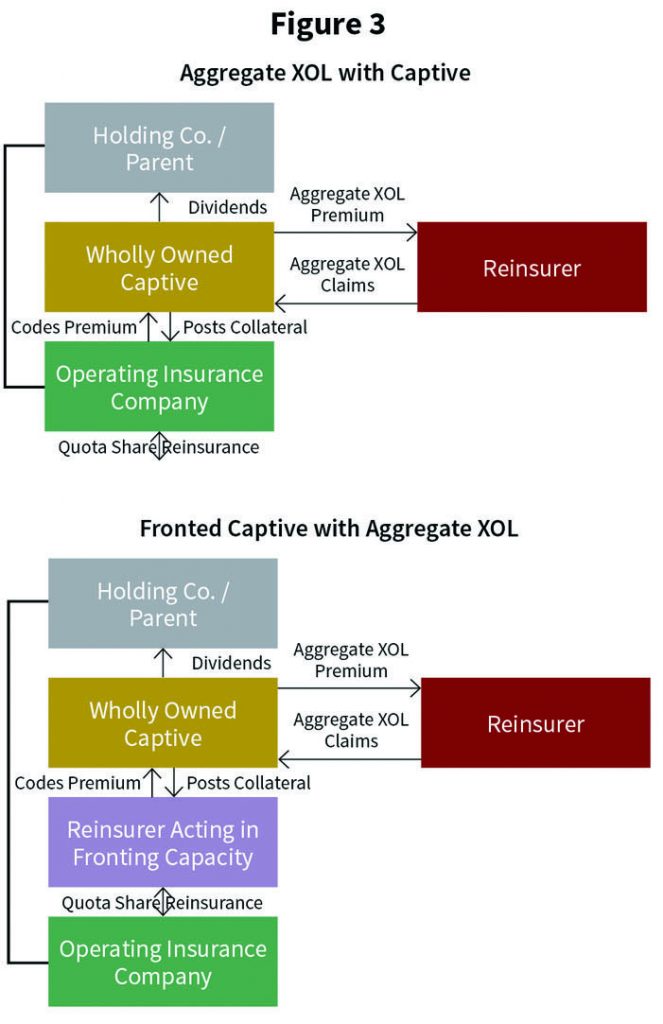

There are two primary options for captive reinsurance, with and without a “front” company (See Figure 3).

A cedant will need to obtain some form of security for the reserve credit and credit risk it takes when it cedes risk to a captive reinsurer. There are several ways to accomplish this:

- Funds withheld—Cede the premium and reserves to the reinsurer in the form of an account receivable. Because cedant retains the funds, they are secured.

- Assets in trust—Cede the premium and reserves to the reinsurer, which puts them in a trust with cedant as beneficiary. Assets are not commingled in the general funds of the reinsurer. It is like an escrow account.

- Licensed and approved reinsurer—Cede the risk to a “domestic” reinsurer licensed and approved to do business in cedant domiciliary state (i.e., not an unauthorized or alien reinsurer). The state regulates them as well, so the cedant is allowed to take proper reserve credit. This reinsurer will then “front” the business to the captive.

- Letter of credit for alien or unauthorized reinsurer—Cede to an alien or unauthorized reinsurer, which uses a letter of credit to guarantee its reserve credit obligations to the cedant. The letter is evergreen (drawable at any time) on a qualified bank so it is as good as cash to the cedant.

- Parental guaranty—As a form of general security, but not necessarily reserve credit, the captive reinsurer’s parent provides a guarantee to the cedant to pay claims that the captive reinsurer fails to pay. Alternatively, it agrees to maintain a specified capital level ($ or %) as surplus in the captive.

Conclusion

The authors believe that a captive utilizing reinsurance tools and related services can play an important role in successfully managing risks assumed by health plans and providers as risk contractors and as employers in their own self-funded employee benefits program.

JASON ALVAREZ is leader-health plan practice at Willis Towers Watson.

MARK TROUTMAN is president of Summit Reinsurance Services, Inc.