By Paul E. Forte and Roger D. Loomis

Today, consumers, regulators, and even insurers have questioned whether a level premium approach makes sense for LTCI. However, current regulations require that tax-qualified LTCI plans use level premium pricing. Genworth has suggested a step-rated approach that would allow for small premium increases each year. This would result in modest, predictable adjustments.[3] Such an approach mitigates the unpleasant surprises associated with very large single-event increases, but does little to ensure the correct alignment of premiums and benefits over the life of the policy.

But what if, instead of attempting to fine-tune the LTCI premium after the fact, we were to keep the premiums level while allowing the benefit to float from the outset, such that its value would track and reflect emerging experience over time? Despite the difficulties that level premiums have caused the LTCI industry, many consumers, especially those in retirement living on fixed incomes, like them. Varying the lifetime maximum LTC insurance benefit payout—perhaps with a minimum floor (more on this later)—would allow the insurer to guarantee the premium for periods of time, if not indefinitely. Variable benefit payouts have regained popularity in life insurance and annuity sales, following the setbacks from the financial crisis of 2008–2009.[4] There is no reason that a variable benefit could not work for LTCI.[5]

In this article, we make the case for a variable LTC insurance product (hereafter referred to as Variable LTCI). The idea of a varying payout would have been hard to imagine just a decade ago, when more than 100 carriers still offered standalone LTCI policies and the full extent of difficulties were not yet known. Today things look different. Variable LTCI offers a way to both address this issue and incorporate the hard lessons of the past few decades, while offering levels of stability and transparency not yet achieved in conventional LTCI.

I. LTCI as Participating Policy

Section 10 of the LTCI Model Regulation requires that when an LTCI policy is issued the pricing assumptions must forecast experience over the life of the policy, typically 40-plus years into the future. What will morbidity rates look like over this time? Mortality rates? Lapse rates? Investment yields? Until very recently we have had little historical experience with an insured population at the advanced ages when most claims happen. Even today, not enough time has passed for truly credible and reliable LTCI experience to emerge. And the experience we see may not remain applicable over the lifetimes of policies currently being issued. For example, positive changes in morbidity and increased emphasis on wellness and nutrition could have an effect.

Currently, insurers set premiums based upon their best estimates plus a margin. They then sell policies and monitor the experience that evolves—both on their own block and for the industry as a whole. On an ongoing basis, the adequacy of the reserves and premiums are evaluated based on a formula such as this one:

Reserves + PV(Premium) ≥ PV(Claims + Expenses)

If the actuary determines the inequality in this formula is not true—if the reserves plus the present value of future expected premiums are insufficient to pay the future expected claims and expenses—the reserves must be increased so that the formula becomes true. Depending upon the company’s assets, an adjustment may be needed to achieve solvency. And the factor to be adjusted has always been premium.

Adjusting premium makes sense for many lines of insurance, especially where the benefit is based on a replacement value, such as income, as in disability or life insurance, or the market value of a residence, as in property insurance. But is this the best approach with LTC insurance, for which no such objective amount can be stated? In our view, an LTCI policy should be based on the insurable loss, which is the full cost of care for as long as that care might be needed. However, most people cannot afford a policy with a high maximum daily benefit, robust inflation protection, and lifetime benefits, so they end up buying as much coverage as they can afford and then fill in any gaps in care however they can. If premium affordability is what primarily drives the choice of plan, for some consumers it may make more sense to adjust the benefit level rather than premiums.

But does adjusting benefits rather than premiums make sense from an actuarial perspective? The key point to keep in mind is that more than any other insurance product, LTCI is a prefunded liability. For the first several years of a policy, the vast majority of the net premiums are intended to be saved to accumulate with interest and policy survivorship to fund claim costs that will eventually rise steeply. Consequently, if a projected shortfall emerges after the policy has been issued, adjusting the benefits provides more leverage than adjusting the premium: By the time adverse experience has emerged and the need for a rate increase becomes manifest, most of the claims are still in the future, but most of the premiums are already in the past.

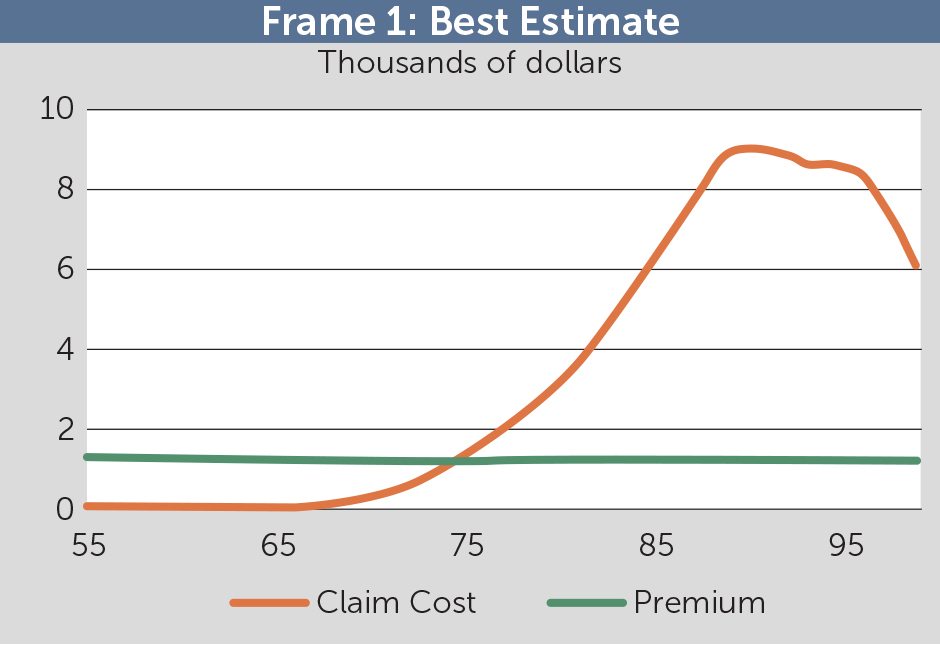

Consider the net premium and claim cost[6] pattern illustrated in the first frame of Figure 1. In this example, a 55-year-old purchases a policy with a $1,200 per year net premium. This premium funds a claim cost pattern that begins very low but grows exponentially and approaches $9,000 a year the time she is 90.

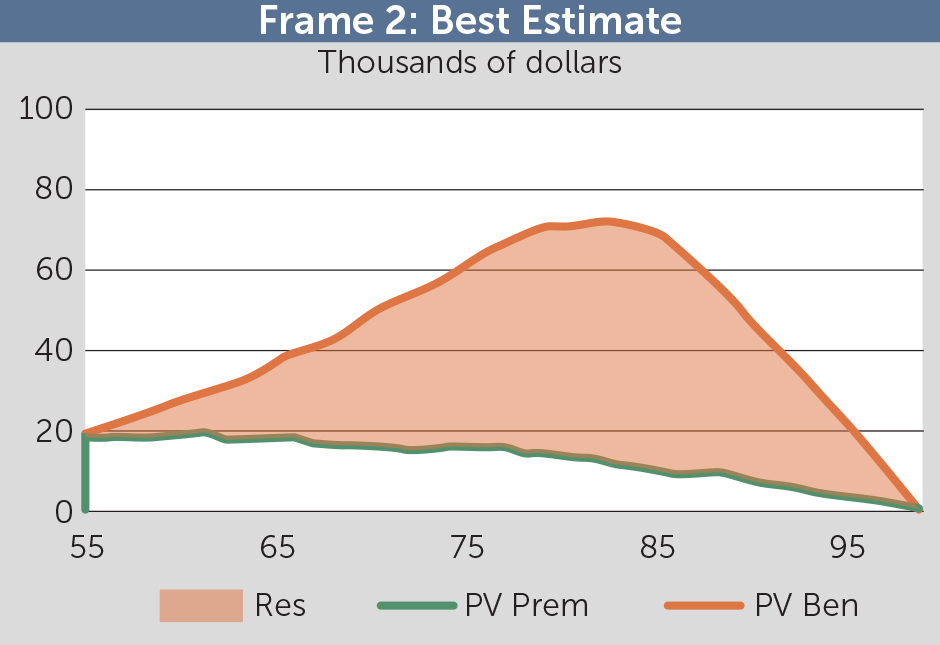

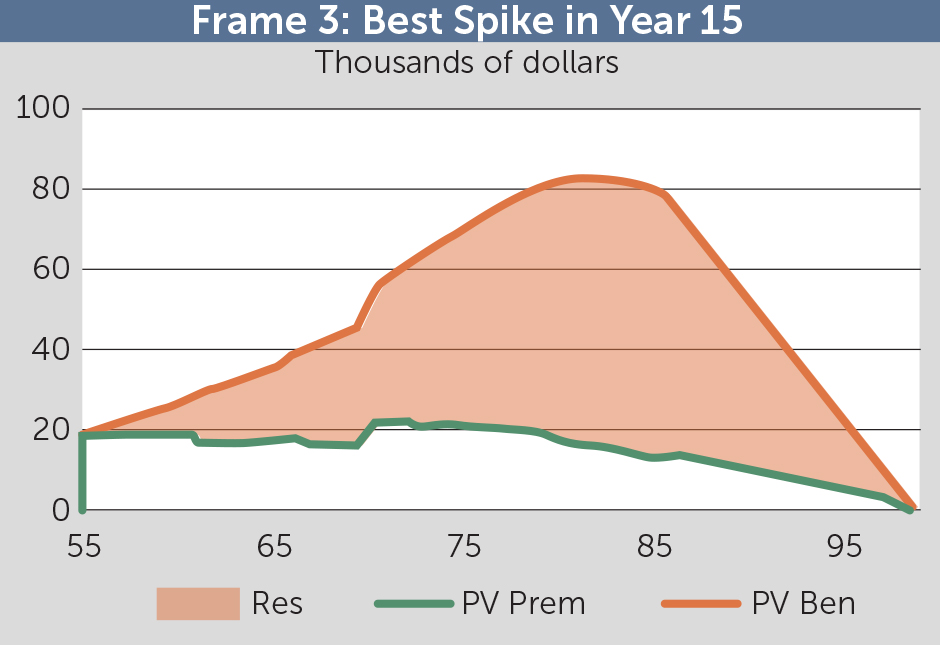

The second frame of Figure 1 shows a projection of the present value of future benefits and the present value of future net premiums. The orange area between these two lines is the reserve. As the graph shows, on a present-value basis the premiums are heavily weighted toward the beginning of the policy and benefits toward the later years.

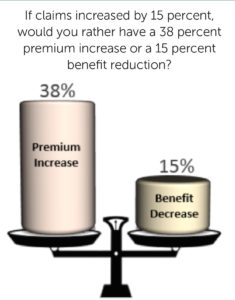

Is raising premiums the best way to address adverse experience, or is there an alternative? Let’s suppose that based upon new industry data that becomes available in policy year 15, we now expect that for all future years, claims will be 15 percent higher than previously forecasted. Thus, the present value of future claim costs increases by 15 percent in the year the shift in the projection occurs.

Figure 1: Frame 1 shows the premiums and claim cost forecast for a representative policy issued to a 55-year-old showing how a level premium funds an increasing benefit. Frame 2 shows the present value (PV) of these amounts—the green line is the PV of future premiums, the orange line is the PV of future benefits, and the shaded area is the reserve. Notice that starting at issue, the PV of benefits sharply increase while the present value of claims decrease so that for most of the policy, future benefits are primarily financed by past premiums, not future premiums. Frame 3 shows what happens when the forecast of the future claims increases by 15 percent in year 15. Since the reserves are already higher than the PV of premiums, a 15 percent increase in claims necessitates a 38 percent premium rate increase.

If we could go back to the date of policy issue, a 15 percent premium increase could fund the difference. But of course the only premiums that can be increased are those going forward. To account for the revised forecast in year 15, the premiums need to be increased by 38 percent (see Figure 1, Frame 3).[7]

With Variable LTCI, on the other hand, rather than imposing a 38 percent premium increase, the nominal benefit level for future years would simply be reduced by 15 percent to counteract the underlying 15 percent morbidity increase. For the policyholder who purchased an LTCI policy based on affordability, this may be a preferable adjustment.

II. Mechanics

Here is a starting point for how adjustments to a variable LTCI policy might be handled in a way that is fair and transparent. First, every variable LTCI policy would have an associated account, similar to a universal life (UL) policy. Premiums would be paid into the account, cost of insurance (COI) charges to fund claim payments and expenses would be assessed against it, and the account would grow with interest. However, the policy would have no surrender value. Whenever a policyholder dies or lapses, the money in the fund would be transferred to the other policyholders in the pool, and accounts would be credited proportionately. In this way, the policies still get the insurance leverage provided by lapses and mortality. The COI portion would then be used by the insurance company to pay incurred claims, expenses, commissions, and as a source of profit.

The actual benefit level to which each policy is entitled at the time of claim is the nominal benefit level of the policy, multiplied by an adjustment factor. The adjustment factor would be updated periodically so that the account value plus the present value of future premiums is sufficient to pay for the present value of the adjusted COI charges:

Account Value + PV(Future Premium) = adj Factor × PV(COI Charges)

The PV factors and COI charges would be “locked in” at issue. Thus, updating the adjustment factor would be a routine and objective calculation based on the actual performance of the plan.

In this concept, the insurer would still take on some morbidity risk because the COI charges collected every year might not be sufficient to pay for that year’s claims. However, even that risk could be shared with policyholders by giving the insurer the right to change the COI schedule if there is poor experience or allowing true-up credits and debits to be made to policyholder accounts so that the adjusted COI charges equal the actual claims paid plus expenses. If the account value were to increase more than what was anticipated in pricing due to a combination of favorable interest returns, lapses, and mortality, the favorable experience would automatically cause the benefits to increase. Likewise, unfavorable experience would cause the benefits to decrease.

To ensure that variable LTCI benefits remain meaningful, a benefit “floor” would be established for the policies, below which the adjustment factor (and the corresponding Maximum Lifetime Benefit [MLB] or target benefit) could not fall. The more margin built into the COI charges, the higher the floor. Higher margins may be necessary if there is concern that the floor not be too far below the target payout. If the policyholder is willing to accept more risk—say a minimum floor of only 25 to 30 percent of the original target benefit—the margin could be lower.

Actuarial effort will be required to determine the appropriate floor; ideally it would be set high enough that benefits remain useful in covering LTC expense risk, but far enough below target to ensure that the plan does not guarantee too high a benefit. This is to avoid a situation similar to that which occurred with variable annuities during and after the investment banking crisis of 2008–2009, when the requirement to make guaranteed minimum payments above the market value of assets resulted in steep losses for insurers. Ideally, the variable LTCI floor will ensure an adequate LTC benefit at a price that is stable without the insurer having to add in high margins. As with universal life, a “no-lapse guarantee” would be in place so that significant decreases in the account value do not trigger a lapse.

This approach provides a transparent and objective mechanism to adjust benefits. Because the premiums, COI rates, and actuarial assumptions are known at policy issue, insurers could provide policyholders with a table illustrating the present value of future premiums and present value of future COI charges. With this information, policyholders could calculate their changing benefit adjustments based on actual account values, and could compare account growth to what was shown in these illustrations.

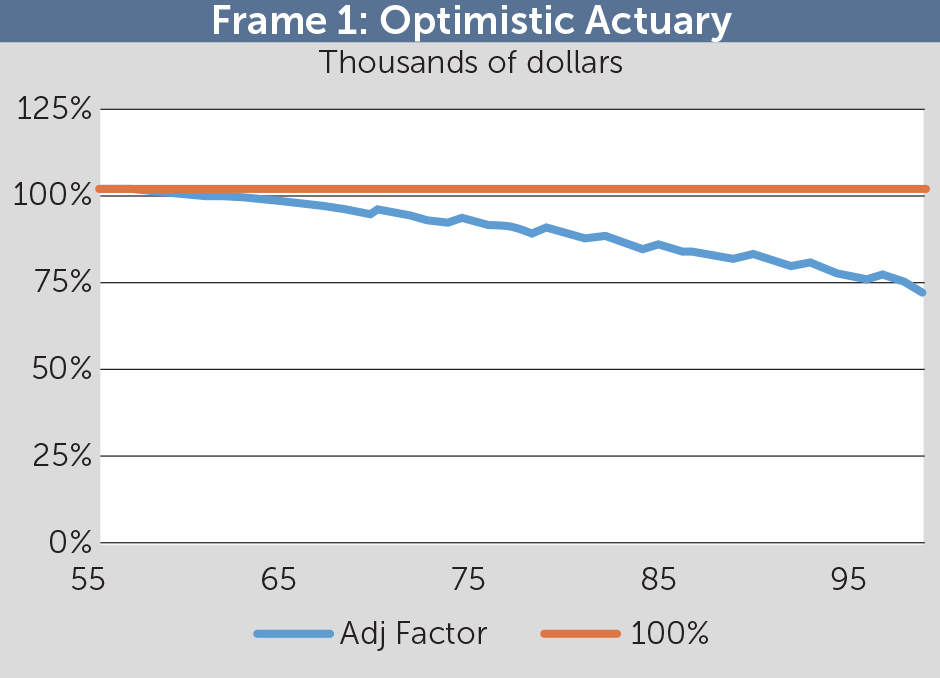

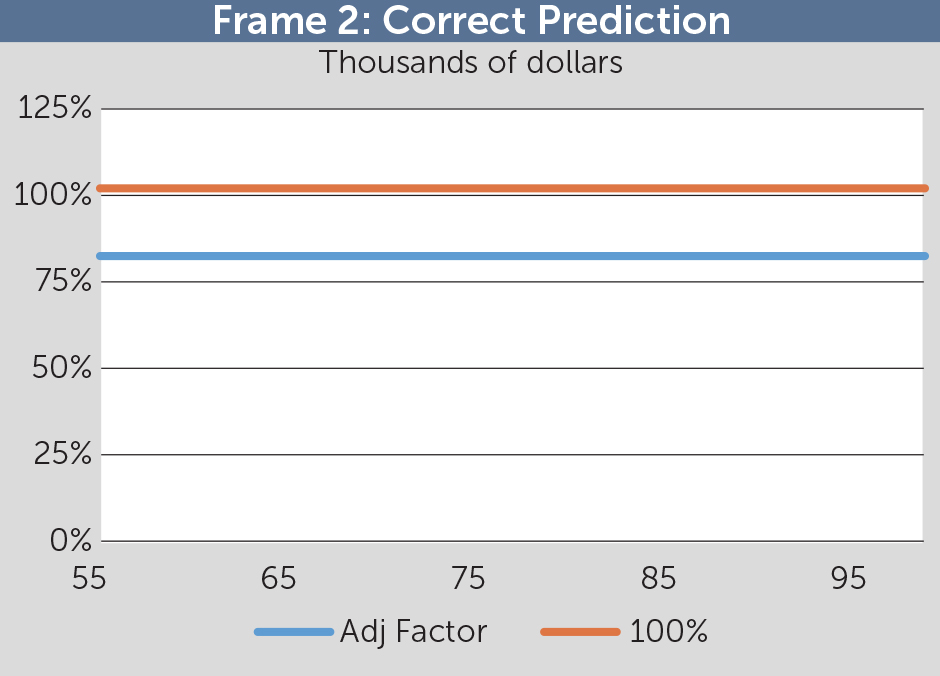

Such a design does raise questions of equity if systemic changes in assumptions occur. For example, say the policy illustrated in Figure 1 was a variable policy. If all of the various pricing assumptions exactly matched the best estimates and there were no margin, the benefit would be identical to what was illustrated. In contrast, what if best estimates anticipate 5 percent interest yields for all policy years, but immediately after issue the interest return drops to 4 percent and stays there? Because the adjustment factor would gradually and automatically decrease from 100 to 72 percent over the life of the policy (See Figure 2, Frame 1), a problem of intergenerational equity arises, as policyholders who go into claim at younger ages could get higher benefits.

Clearly, the insurance carrier actuary would have to adjudicate. If there is a significant shift in interest rates, lapses, or mortality that causes a best-estimate forecast of the benefit level steadily to erode, this would trigger an event where the discount factors are updated. In this example, once the discount factors are updated, the adjustment formula would then drop the benefit to 83 percent immediately, with the projection that all future claims would remain at that level. (See Figure 2, Frame 2).

The optics here are important. Policyholders will be monitoring the amount in their accounts and will see it increasing due to premiums, interest, lapses, and mortality. They will understand that their ultimate benefit level is tied to the performance of this account. If adjustments to actuarial assumptions result in benefit reductions, we believe that it will be important for the policy communication to demonstrate that the change—really a pooling charge—will enhance and protect the value of everyone’s account so that the insurer will be able to pay more to future claims of older policyholders by ensuring that too much money is not being spent on younger claimants. Another point to keep in mind: When the insurer changes the benefit percentage, the adjustment is only theoretical until the time of claim, which lies in the future for most policyholders. With traditional standalone LTCI, rate increases are immediate and not likely to be reduced.

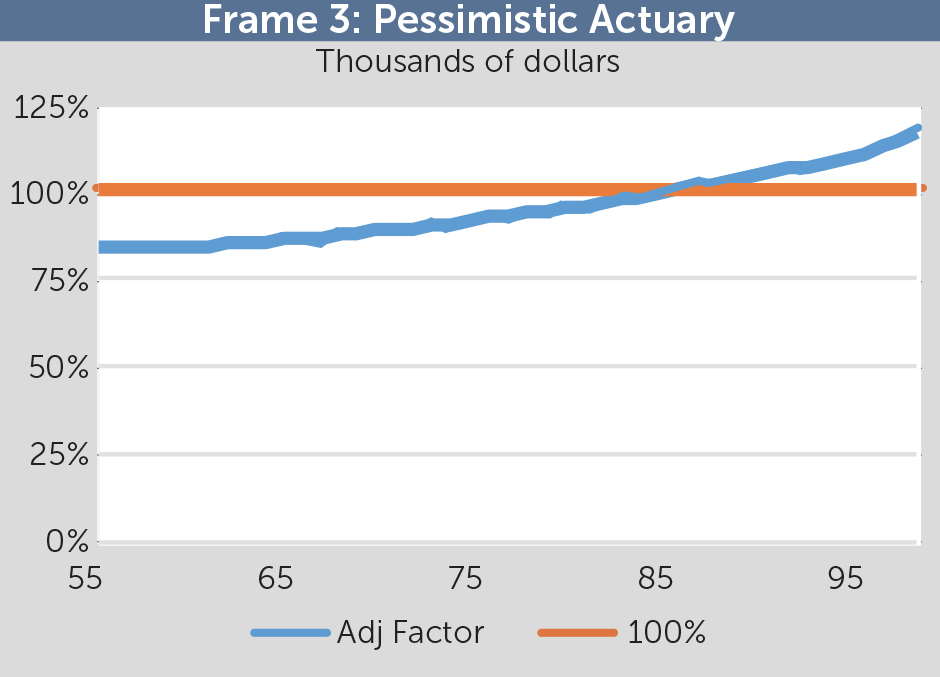

Variable LTCI dynamics are different. To continue with the prior example, say that the insurer updates the discounting factors resulting in an 83 percent benefit adjustment because it now believes interest rates will only be 4 percent, but the actual yields returned 5 percent. In this case, as the favorable experience emerged and accumulated in the account, the 83 percent adjustment factor would gradually and automatically increase to 100 percent by age 85 (when most claims are paid anyway) and could get as high as 116 percent by the end of the projection (See Figure 2, Frame 3).

In the formulas described above, everything was priced on a best-estimate basis. If this plan were implemented in the real world, a margin would be added to the premium. This margin would accrue to the accounts so that in the years it isn’t needed, the value of the accounts (and thus the benefit level) would increase. This would result in a pattern seen like in Figure 2, Frame 3, but with the adjustment increases beginning at 100 percent at issue rather than 83 percent at issue.

Figure 2:

Frame 1 shows how the Variable LTC adjustment factor would systematically drop from 100% to 73% if the plan was priced at 5%, only received a 4% yield every year, and no actuarial adjustments were made to the PV tables. Frame 2 shows that if the actuaries adjusted the PV tables there would be an 83% adjustment in all policy years. Frame 3 shows that if the actuaries made the adjustment to 4% but a 5% yield was actually achieved, the 83% adjustment would increase to 100% by age 85 (when most claims are paid anyway), and would get as high as 116% by the end of the projection.

Perhaps the key point is that with variable LTCI, the balance between the present value of future premiums and the present value of COI charges can be made without the necessity of recovering the margins that emerging experience reveals should have been present in the past. Variable LTCI allows for smoother, less wrenching adjustments.

It could be argued that having the option to pay a premium increase or reduce one’s benefit, which is available in conventional LTCI, is preferable to the automatic reduction that variable LTCI imposes because the former allows choice. But such choice comes with a cost. Conventional fixed-benefit plan rate increases are driven by actuarial projections of future experience—i.e., what will happen with morbidity, mortality, lapse, expense, and interest. In contrast, the variable plan is primarily based on actual experience as it emerges. Because the insureds are participating in the emerging experience and the benefit level is adjusted accordingly, high margins are no longer needed. If the accumulated premium plus gains from interest, lapses, and mortality are insufficient to pay for projected claims, the value of claims or benefits is simply lowered across the board so that they do become sufficient. If experience later improves, the variable benefit is adjusted upward. Additionally, policyholders could be allowed to replenish their target benefit after a benefit reduction by purchasing additional coverage and would be in a better position to do so thanks to the lower premium cost enjoyed to date, which reflects lower initial margins.

In the end, variable LTCI gives policyholders confidence that they are truly pooling their risk with other policyholders and that any better-than-expected experience will benefit the policyholder pool. If the pooled risk turns out to be higher or lower than the actuaries originally thought at issue, the good and bad experience automatically flows to the policyholders.

While policyholders will not know at the time of issue exactly or even roughly what the future benefit level will be (apart from the benefit floor), they will know they are getting a fair value for the premiums paid and paying less to the insurer in margins. This is because any increases or decreases in benefit payouts will be visible via policyholders’ individual variable LTCI accounts. Policyholders will have the assurance that they are participating in more of the actual experience of the insurer. This perceived partnership could even lead to a wiser use of benefits. If enough policyholders see their nominal value growing above 100 percent of the original benefit, they might mentally project that good experience into the future and delay going on claim in order to receive a larger benefit down the road, as with Social Security, pensions, and other forms of protection. Additionally, this design lowers the risks of the insurers and facilitates smoother and more predictable earnings.

III. More or Less Certainty?

It may be objected that variability introduces another kind of uncertainty on top of the existing uncertainty of whether premiums will increase. This is true, if you assume that the buyer of a conventional LTCI policy can depend on receiving down the road what he or she is buying for a benefit upfront. But in reality, that benefit may be subject to periodic rate increases, which could be substantial—and benefit reductions are often the de facto result. The real issue is not whether the total benefit payout is certain, but whether buyers can predict the amount that the benefit they bought might change and whether they can easily adjust financially.

In other words, unless conventional LTCI buyers plan on paying significant increases at time of purchase, or purchase sufficiently generous protection at issue to weather future benefit reductions, significant uncertainty already exists. With variable LTCI, uncertainty is a given and the process is transparent. Buyers are educated upfront that fluctuations in total benefit payment are to be expected and must be planned for and are invited to monitor the status of their benefits throughout their policy’s life. Thus, the process mirrors what is expected in most other areas of long-range finance.

As we envision it, variable LTCI plan design would follow that of standard standalone comprehensive LTCI, with policyholders choosing a maximum daily benefit (MDB), a maximum lifetime benefit (MLB), and an appropriate means of adjusting for inflation. With so many elements of the benefit, how would adjustments be made in a variable policy? The simplest way would be to multiply both the MDB and the MLB by the adjustment factor. However, instead of this approach, some consumers might prefer a larger reduction in the MLB and no reduction in the MDB.

Another possible approach would be for the MLB and MDB to be adjusted in tandem, but with an optional rider that allows the policyholder to exceed the MDB on a coinsurance basis—for example, if he or she has the rider and pays 20 percent of the actual charges out of pocket, the plan will pay the remaining 80 percent of charges, even if that exceeds the MDB.

When building personal variable LTCI plans, buyers can be encouraged to consider how many moving parts they are willing to monitor, as well as their personal tolerance for deviations from the target or expected levels/policy duration.

In sum, variable LTCI requires policyholders to pay more attention to the plan’s performance as well as to factors affecting costs in the health sector, such as longevity, and in the general economy, such as interest rates. The upside is a design that generates better value through the long term for those willing to do so.

IV. Administration

Administering a variable product would likely involve additional challenges. Certain values like MDBs or MLBs that are only affected today by claims payments would now be subject to experience adjustments. Buy-ups or benefit reductions would become more complex, as would periodic inflation adjustments. Policy benefits statements would be harder to produce, and online or telephone self-service functions would be necessary to avoid inundating the call centers with routine questions. Of particular importance to work out would be tracking the account values and the mechanics for how gains from lapses and mortality would be credited to surviving policyholders.

In our view, actuaries would need to monitor morbidity and offer a professional opinion on whether future COI charges would be sufficient to pay claims and expenses. They would also need to monitor whether the locked-in formulas to discount COI charges and premiums were still applicable and were fair to policyholders of different cohorts. The actuaries would then be responsible for making any required adjustments.

As indicated above, a trigger would have to be devised for this purpose. The easiest one to administer might be a test in which the actuary forecasts the adjustment factor using current best-estimate assumptions. If the adjustment factor is forecast to fall below a predefined threshold—say 90 percent—that would trigger an adjustment. In such an instance, we suggest that the discounting rates and COI rates be recalculated to produce a level or gradually increasing forecast of the adjustment factor.

Whatever is decided, it would be important to determine a standard process for accurately reporting changing account values. Because conventional LTCI payouts are fixed, this change will require systems work. Some LTCI insurers have developed their own proprietary systems; others have purchased off-the-shelf software; still others have modified off-the-shelf software over time such that it resembles the operations of no other insurer. In each case, new requirements would necessitate software development lifecycle efforts and extensive testing.

Moreover, the new, more-sophisticated variable LTCI products would have to pass muster with state insurance departments. And the trigger mechanism for adjustments to benefits would have to be explained and approved. Hopefully, the process would be similar to how rate increases are approved now because adjusting benefits and premiums are corresponding and complementary actions. The National Association of Insurance Commissioners Interstate Compact, which has streamlined and expedited the approval process, could be of help.

There is, of course, the matter of compliance with current tax law under the Health Insurance Portability and Accountability Act of 1996 (HIPAA) and state income tax laws. One issue with variable LTCI concerns the provision of guaranteed renewability, which is required by HIPAA, Section 7702B (b)(1)(C), for tax-preferred treatment of LTCI premiums and benefits. The nature of a variable lifetime benefit payout involves a different (although tighter) relation between premium and benefit, which might raise questions about the policy being renewable on identical terms. However, variable LTCI stipulates a guaranteed floor below which the MLB cannot drop. This floor constitutes a consistent, guaranteed renewable relation between premium and benefit. The floor would not be subject to change unless the policyholder elects to make such a change under a conversion. It will be necessary to approach the U.S. Treasury for a ruling on compliance of variable LTCI with current tax law. That will take time and effort.

All of this might seem like a tall order, but it is relatively simple when compared with the administrative requirements of most investment products. And, variable LTCI would not at first involve the selection of any securities by the individual policyholder. As noted above, all investment decisions would be made at the group or portfolio level by insurer managers. Finally, it must be remembered that the administrative demands of variable LTCI would be offset by the avoidance of the need to file for and implement frequent rate increases and corresponding landing spot offers. As LTCI insurers know, such efforts necessitate a huge amount of administrative work, planning, and expense.

V. Marketing Considerations

Most consumers are able to live with insurance premium increases. They see increases in their health, homeowner’s, and other insurance policies. They understand that the cost of services goes up, that actual might exceed expected claims, and that insurers must make adjustments. What is important to the consumer is that premium adjustments be predictable, which has not been the case for many private LTC insurance policyholders. Hopefully, prospective variable LTCI buyers or converts from existing standalone policies can be made to understand these risks and the challenges of generating an adequate LTCI benefit decades in advance. We believe a more manageable relationship between premiums and benefits should supersede concerns about the potential shrinkage of the variable benefit itself. The lower total cost of variable LTCI over the long term due to the elimination of large margins required by conventional LTCI will bring satisfaction.

However, for variable LTCI to succeed, the importance of education cannot be overstated. Understanding and accepting the variability of LTC benefit payouts will require the policyholder to understand, first, the many factors that can affect LTC insurance benefit outcomes; second, that insurers set higher margins when they cannot anticipate every contingency affecting risk; and third, that guarantees, however desirable in themselves, carry additional costs that may not result in good purchase value. Variable LTCI accords well with the notion that insurance serves consumers best not where every last dollar of claim is paid but where major risks are covered at the best possible price. That philosophy, held by money-smart consumers of other insurance products, must be encouraged among LTCI consumers so that they purchase coverage adequate to their needs and are not over-insured.

Once the principles of variable LTCI are established, serious explanations of plan designs, benefits, and triggers that can reduce benefits and other subjects can be introduced to prospective buyers. If there is a financial adviser or agent, close consultation would alleviate misgivings or incorrect conclusions. If the policy is sold direct or via a group sponsorship, it will be necessary to harness the full resources of internet technology, including online modeling tools, webinars, video programs, graphs, and other aids, as well as well-trained customer service representatives. An introductory education and awareness campaign would probably take up to six months and involve post-enrollment support and reinforcement. We believe periodic communications to policyholders would be required to report the status (current value) of benefits and any changes, as well as voluntary buy-ups in the event of benefit reductions. Only if these conditions are met can variable LTCI become both comprehensible and attractive.

Clearly, variable LTCI is not a perfect solution for everyone. As acknowledged, it introduces an element of uncertainty not found, or least expected, in conventional LTCI. For some consumers, being unable to rely on a certain fixed amount of benefit could affect their overall sense of financial security. But at the same time, uncertainty exists today around the total benefit payout for traditional standalone LTC insurance due to rate increases and the benefit reductions many policyholders make when faced with them. With variable LTCI all of the terms are on the table in advance, requiring far less in the way of ad hoc planning and communications support.

For insurers, variable LTCI may be better able to align short-term cash flows with long-dated liabilities by reducing the amount of projected capital risk. As such, variable LTCI could become a welcome addition to an insurer’s product portfolio. Like solar energy and the electric car, variable LTCI seems impractical … until it is recognized as advantageous and even necessary. It is indeed an idea whose time has come.

PAUL E. FORTE, Ph.D., is chief executive officer of Long Term Care Partners, LLC. ROGER D. LOOMIS, MAAA, FSA, is a principal at Actuarial Resources Corporation.

The opinions and positions voiced in this paper are our own and do not represent Long Term Care Partners or its parent company, John Hancock Life Insurance Company (U.S.A.) and subsidiaries; Actuarial Resources Corporation; or any governmental or regulatory agency. We alone are responsible for any errors or misjudgments this paper may contain.

References

[1] A number of articles detail developments in the LTCI market. For a recent consumer perspective, see Howard Gleckman, “Where Is the Long-Term Care Insurance Industry Headed?”; Forbes, March 21, 2016; and Leslie Scism, “Collapse of Long Term Care Insurer Reflects Deep Industry Woes”; Wall Street Journal; Dec. 5, 2016. For a general overview of how the current crisis developed and possible fixes, see Richard Frank, Marc Cohen, and Neale Mahoney, “Making Progress: Expanding Risk Protection for Long-Term Services and Supports through Private Long-Term Care Insurance”; SCAN Foundation; March 2013. For a timeline of key private LTCI market developments, see Paul Forte, “Private Long-Term Care Insurance, Past, Present, and Future”; Contingencies; May/June 2015; p. 18–27.

[2] State insurance departments compounded the problem by insisting that initially LTCI margins be relatively thin, with the lion’s share of premium going into paying claims. Such slender margins were not adequate to withstand changes in actuarial assumptions necessitated when emerging experience brought lower-than-expected lapse rates, lower-than-expected interest rates, and improving mortality. The introduction of the National Association of Insurance Commissioners (NAIC) Model Act and Regulation in 2000 stipulated the use of stabilizing margins for “moderately adverse” experience in new policy issues, but by then it had become apparent that premiums for early-issued policies had been understated. Meanwhile, consumers began to plan their budgets around that initial level premium. Indeed, many had the impression that premiums were locked in for the duration of their life.

[3] This design would require a change in regulations. See Howard Gleckman, “Genworth Stays in Long-Term Care Insurance, But Seeks a New Premium Design”; Forbes; Dec. 4, 2013.

[4] See, for example, Allison Bell, “5 Reasons Variable Annuities Look Prettier”; ThinkAdvisor; Nov. 7, 2017; which postulates that a better understanding of risk, new product design, and U.S. stock price improvements may have helped to boost sales in today’s investment market.

[5] It should be noted that by “variable” we do not mean that policyholders would be able to choose the nature of the investment backing their policies, as with variable life and annuities. That could come later, once the concept is well understood and tested, but it is not something we recommend upon introduction. Here we define variable as having solely to do with the varying amount of minimum daily benefit, maximum lifetime benefit, or both.

[6] “Claim costs” can be thought of as a schedule of net premiums for an annually renewable term policy. To say, for example, that claim costs increase from $5 a year to $9,000 a year from attained age 55 to age 90 means that in theory this policy could be offered without any prefunding for premiums in those amounts (plus margin, expenses, commission, and profit).

[7] As insurers know, it generally takes years for a premium increase to be approved (assuming it is approved) and implemented. By this time, the deficit may grow due to compounding.

[8] The only divergence is when adjustments are made to promote intergenerational equity as discussed in Figure 2; even then, the adjustments naturally reverse themselves if they prove to be too conservative.